As George Soros as soon as mentioned: “When a long-term development loses its momentum, short-term volatility tends to rise. It’s straightforward to see why that needs to be so: the trend-following crowd is disoriented.” And proper now, that’s precisely the place world markets are, between narrative and noise, squinting at earnings and central financial institution alerts for path.

Gold’s glow-up

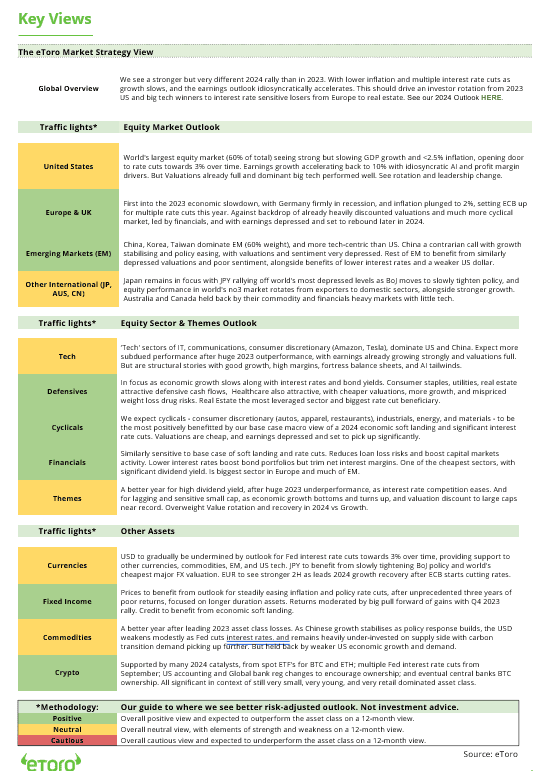

Gold pushed previous $3,350/oz supported by world uncertainty, a weaker USD, and powerful central financial institution demand. It’s additionally being seen as a hedge towards sticky inflation, with Fed charge cuts doubtless pushed additional out. Investor takeaway: Gold’s rally displays a shift in positioning, not panic. It’s a reminder that diversification, into commodities or short-duration bonds, can assist handle volatility.

China’s GDP “beat” isn’t the complete story

Sure, China’s financial system grew 5.4% in Q1, beating expectations, however markets barely flinched. Why? As a result of export frontloading forward of US tariffs juiced the numbers, whereas buyers are ready for extra concrete indicators of home demand energy or coverage stimulus (assume: charge cuts, infrastructure money). Investor takeaway: Chinese language equities like Alibaba and BYD noticed modest good points, however broad upside could depend upon upcoming fiscal or financial help (or a yuan coverage shift). Any stimulus announcement may very well be a near-term catalyst. Conversely, if commerce tensions escalate with new rounds of tit-for-tat tariffs, markets might react with one other risk-off bout, making China’s subsequent strikes all of the extra essential.

UK: Inflation cools, however possibly not for lengthy

Inflation got here in softer at 2.6%, under expectations, and merchants jumped on hopes that the BoE may reduce charges in Might. FTSE 100 shares in housing and retail (assume: Taylor Wimpey, Tesco) appreciated that information, and the pound held regular. Decrease charges might help home shares and ease borrowing prices however be careful: April vitality value hikes might push CPI again up. Investor takeaway: Should you’re in FTSE 100 ETFs, near-term upside could hinge on affirmation of a charge reduce. A reduce might increase small caps too, that are nonetheless lagging giant caps. Look ahead to BOE messaging in early Might.

Large Tech: Excessive expectations, cautious setup

Netflix delivered a strong beat (earnings up 25%, gross sales up 13%, working margin 31.7%) , however upcoming earnings from Alphabet, Microsoft, Amazon and others are being watched carefully. Analysts have trimmed forecasts barely, reflecting concern over margin compression and cautious company steering. Investor takeaway: Valuations stay elevated in tech. If steering underwhelms, there may very well be room for additional consolidation. Nonetheless, pullbacks could provide long-term entry factors into high quality names.

Japan’s inventory rally = commerce vibes + yen weak spot

The Nikkei 225 gained over 3%, lifted by a weaker yen and progress in US-Japan commerce talks, and exporters like Toyota and Sony outperformed. Inflation stays above goal, however the BOJ is anticipated to maintain coverage unchanged. Investor takeaway: Don’t sleep on Japan. It’s the best-performing main fairness market YTD and if the yen stays mushy, exporters nonetheless have room to run. Forex-sensitive sectors stay in focus.

Wave of earnings: Decrease expectations as a chance?

Within the midst of heightened market volatility, triggered by Trump’s tariff drama, buyers shouldn’t overlook the upcoming earnings studies within the U.S. The main banks have already reported, however this week the earnings season picks up velocity – together with corporations like Verizon, Boeing, IBM, PepsiCo, and Intel.

Tariffs threaten world stability greater than anticipated: Nonetheless, the U.S. financial system is way from a recession. At the very least that’s what the present earnings expectations for the S&P 500 counsel.

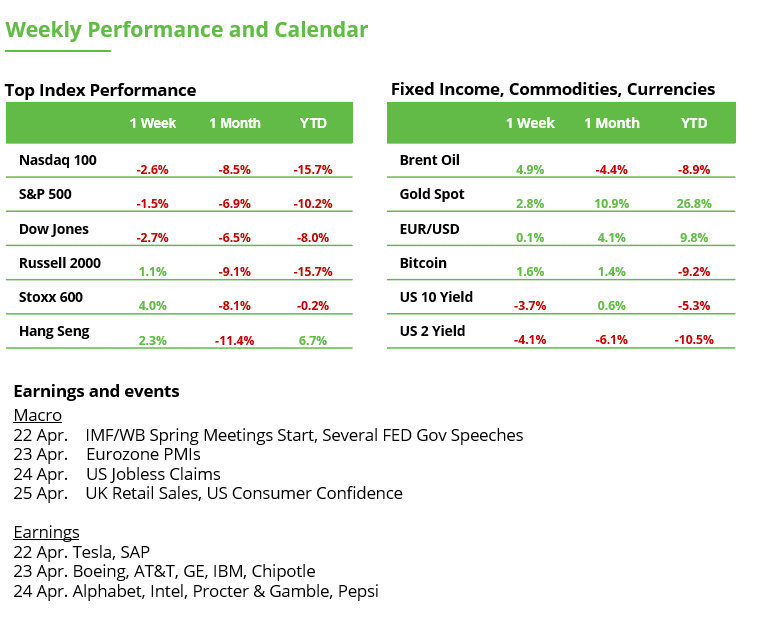

Momentum fading: Nonetheless, revenue progress is anticipated to have slowed considerably within the first quarter – from 18.2% to 7.2%. In response to forecasts (see chart), the sectors healthcare, expertise, and utilities are the principle progress drivers. On the destructive facet, shopper items, supplies, and vitality are weighing down outcomes.

Company income rise, inventory costs don’t: The scenario is complicated. 9 out of 11 sectors are in destructive territory year-to-date. Main the losses are shopper discretionary (-19.7%) and expertise (-18.3%). Client staples (+3.2%) and utilities (+1.9%) are the one sectors displaying optimistic efficiency, adopted carefully by healthcare and actual property.

Buyers are returning to defensive shares: These are much less depending on the financial cycle and provide extra stability in unsure markets. How rapidly the broader market can recuperate largely depends upon Trump. The world wants readability in commerce coverage. Each signal of easing reduces inflation expectations and creates room for rate of interest cuts. Buyers might then grow to be extra keen to tackle danger once more.

Financial injury onerous to measure: Previous macroeconomic knowledge has misplaced significance. What issues extra now’s how typically corporations deal with tariffs and recession dangers of their steering over the approaching weeks. That makes this earnings season extra necessary than ever.

Backside line: Earnings expectations have already been revised downward in latest months. The bar for this earnings season is due to this fact decrease. As well as, expectations have been exceeded in every of the previous eight quarters. That would present actual alternatives for optimistic market momentum.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.