Card Manufacturing facility ($CARD.L) is a well-liked model identified within the UK for high-quality presents at inexpensive costs. Regardless of its challenges, the corporate has potential for progress.

Key Highlights

Card Manufacturing facility is a resilient enterprise with a robust model consciousness within the UK

The outcomes of the Christmas interval would be the catalyst for its success

Card Manufacturing facility at present trades at a big low cost

The Enterprise and the Business

It’s obscure the greeting playing cards business outdoors of the UK, as this can be a quintessentially British phenomenon. Britons specific their love and affection by the alternate of playing cards, and interact on this custom at a fee 2-3 occasions larger per capita in comparison with the US. It’s then not a shock that the general UK greeting playing cards market has traditionally confirmed recession resilient, demonstrating constant progress even by downturns.

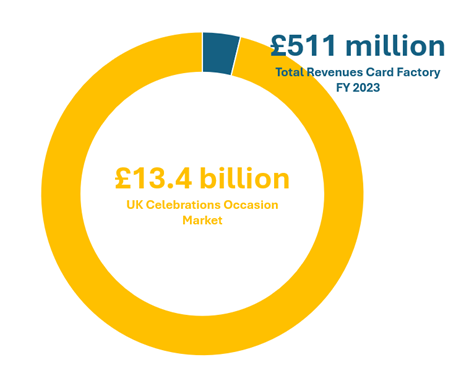

Knowledge from OC&C Technique Consultants – Visualization by the creator

Card Manufacturing facility was based in 1997 with the aim of delivering prime quality greeting playing cards at a low worth. To succeed, the corporate initiated a strategic transfer in the direction of vertical integration. Card Manufacturing facility began to design and manufacture its merchandise in-house, permitting superior price management and adaptableness to market tendencies. By specializing in high-quality merchandise at compelling worth factors the corporate gained a distinct segment within the finances sector of the market. Over time, Card Manufacturing facility stored rising, reaching over 1000 areas whereas specializing in non-card gadgets like celebration necessities and presents, however all the time sustaining its picture as a finances model.

An elevated aggressive surroundings mixed with the extreme blow of the COVID-19 pandemic meant the necessity for a brand new technique at Card Manufacturing facility. The corporate initiated a brand new funding cycle to enhance the net buyer expertise and broaden its product combine. The administration additionally modified the shop layouts, reducing the house for the greeting playing cards (solely 7% of the whole) and strategically putting them across the perimeter of the shop making room for celebration necessities and presents.

Now Card Manufacturing facility gives a one-stop procuring expertise to have fun life moments, effectively aligned with broader client tendencies. It transitioned from a store-led card retailer right into a market-leading, omnichannel retailer of playing cards, presents and celebration necessities. Buyer visitors and revenues have surpassed pre-pandemic ranges, displaying sturdy buyer loyalty, and non-card gadgets now account for roughly 51% of revenues.

Knowledge from Card Manufacturing facility Annual Report (FY 2024) – Visualization by the creator

Competitors

The principle rivals within the greeting card marketplace for the UK embody the specialty retailers (Clintons, Moonpig), grocery shops (ASDA, Tesco) and basic merchandise shops (Wilko, Dwelling Bargains).

Moonpig is the principle competitor within the specialty retailer house. The corporate is targeted on the net greeting playing cards house, the place it shortly gained a big market share. Anyway, regardless of its preliminary disruptive presence that eroded a part of the normal retail market channel, the corporate has now stopped rising. Specifically, its dependence on the postal providers turned out to be costly in opposition to in-store purchases, particularly for minor transactions.

ASDA emerged as Card Manufacturing facility’s principal competitor within the conventional greeting card enterprise. Leveraging its scale, ASDA was capable of negotiate extra favorable offers with suppliers, enabling the grocery chain to promote greeting playing cards at costs even decrease than Card Manufacturing facility. This aggressive stress turned the catalyst for Card Manufacturing facility’s strategic shift, reworking it right into a one-stop store for all life second celebrations.

Regardless of the challenges, Card Manufacturing facility can nonetheless depend on its aggressive benefit given by its vertically built-in brick-and-mortar greeting playing cards retailer mannequin. This gives a strong aggressive benefit, permitting complete management throughout all operations and fast adaptation to market tendencies. In a different way from basic shops counting on suppliers like Hallmark, Card Manufacturing facility can command better product selection with higher high quality.

Goal Market

Card Manufacturing facility controls roughly 30% of the UK greeting card market by quantity. The remaining is roughly evenly distributed between groceries and basic merchandise shops. The distinctive worth proposition of Card Manufacturing facility poses the corporate in an ideal place to revenue from the broad celebration events market.

Knowledge from Card Manufacturing facility Annual Report (FY 2024) Visualization by the creator

The focused market alternative for Card Manufacturing facility totals to £13.4 billion within the UK. This consists of the UK greeting playing cards market value £1.4 billion, the UK celebration necessities at £2 billion and the UK marketplace for (chosen) presents at £10 billion. The corporate additionally recognized a number of worldwide alternatives with an estimated £8 billion addressable marketplace for greeting playing cards that may enhance as much as £80 billion when celebration necessities and presents are included.

The celebration necessities and presents segments, way more engaging than the standalone greeting playing cards market, spotlight how Card Manufacturing facility’s strategic shift towards a extra numerous product combine might function a robust catalyst for future progress alternatives.

Alternatives

The market seems to be at Card Manufacturing facility as a stagnant and out of date enterprise. It is a false impression contemplating the strategic transfer that the enterprise has undergone within the afterwards of the pandemic. Certainly, regardless of the latest decline within the greeting playing cards phase, the corporate has leveraged its dominant place out there to supply further complementary merchandise.

In actual fact, the non-card segments provide the strongest progress potential for Card Manufacturing facility. At present, solely 17% of its clients buy presents alongside greeting playing cards, in comparison with the business common of round 70%. This hole presents a big alternative for Card Manufacturing facility to extend reward gross sales, which in flip might drive larger card gross sales, nonetheless essentially the most worthwhile a part of its product combine.

Dangers

There are a selection of dangers that jeopardize the chance for Card Manufacturing facility to ship these outcomes. As a finances model, Card Manufacturing facility is susceptible to inflationary pressures, because it has restricted flexibility to lift costs with out affecting its worth proposition. That’s what occurred over the past half yr, the place the rise within the Nationwide Residing wage squeezed the corporate’s gross margin. Anyway, the principle aggressive benefit of Card Manufacturing facility lies in its vertically built-in operations, that enable an intensive and extra dynamic price management.

One other danger is posed by potential financial downturns. Regardless of having the ability to develop identical retailer gross sales by 2008 and 2009, the numerous publicity to non-card gadgets now introduces a better vulnerability for Card Manufacturing facility. Equally, if client preferences had been to shift considerably away from conventional greeting playing cards, Card Manufacturing facility would possibly wrestle to adapt shortly. Nonetheless, the custom of sending and receiving greeting playing cards stays deeply ingrained in British tradition, and it continues to be in style even amongst youthful generations.

Card Manufacturing facility Valuation

However what’s the worth of Card Manufacturing facility?

I’ll use the Residual Earnings Mannequin to worth the enterprise, detailed in Accounting for Worth by Stephen Penman (Columbia Enterprise College Publishing, 2010). Some main advantages from utilizing this mannequin are the low variety of inputs, low quantity of hypothesis added and strict connection to the basics.

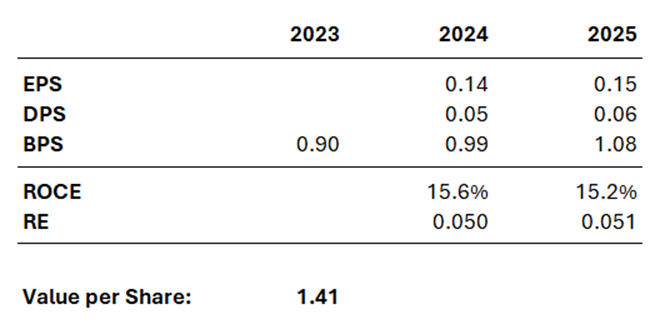

I’ll assume EPS of £0.14 and £0.15 for FY 2024 and FY 2025. These are essentially the most up to date estimates of the monetary analysts following the corporate. Plus, I’ll assume DPS (Dividend per Share) of £0.05 and £0.06, according to the corporate’s dedication. I’ll assume a ten% Value of Capital, that’s affordable contemplating the present risk-free rates of interest. I will even assume a 0% progress fee for the RE (Residual Earnings). This method has two key advantages: it considerably reduces the danger of overpaying for progress and aligns with market idea, which means that residual earnings are likely to diminish over time. Given a BPS (E book Worth per Share) in FY 2023 of £0.90, we are actually able to compute the worth per share of the corporate:

The BPS for FY 2024 and FY 2025 is computed including the EPS and subtracting DPS from earlier yr BPS. We compute ROCE (Return on Frequent Fairness) because the ratio of EPS and former yr BPS. The Residual Earnings are computed subtracting the Value of Capital from the ROCE, permitting us to deal with the Financial Income of the corporate. The result’s then multiplied by the earlier yr BPS. Lastly, we low cost future Residual Earnings with a ten% Value of Capital, assuming no progress for the longer term durations, and we add it to the bottom BPS.

As we will see the ensuing worth per share is £1.41, displaying roughly a 50% premium from the present worth of Card Manufacturing facility. This valuation is very conservatory, which means that it will be enough for the corporate to ship their commitments to see this appreciation mirrored within the inventory worth.

Conclusion

The market has lately punished Card Manufacturing facility too harshly for its disappointing HY 2024 outcomes. The corporate is considerably undervalued, because the market is underestimating its skill to navigate inflationary challenges within the UK and is displaying little curiosity in an business perceived as stagnant and out of date. Nonetheless, Card Manufacturing facility is evolving right into a one-stop store for celebrating life’s moments. This transformation opens thrilling new progress alternatives, leveraging its sturdy model recognition and dominant market place.

The upcoming Christmas interval, which accounts for roughly 70% of the corporate’s yearly outcomes, might function a key catalyst to evaluate its efficiency.

Moreover, the acquisition of Garven Holdings, LLC, introduced on December 5, 2024, underscores Card Manufacturing facility’s sturdy monetary place and highlights administration’s dedication to reaching its bold progress targets. On the identical time, the January buying and selling replace for the second half of 2024 revealed sturdy income progress (+6.2% year-on-year) and demonstrated administration’s skill to ship on its targets.

Lastly, there was notable insider exercise within the inventory. The Senior Impartial Director, Pam Powell, bought 5,109 shares on December 30, 2024. The CEO, Darcy Willson-Rymer, acquired 49,529 shares on December 11, 2024, and the CFO, Matthias Seeger, purchased 21,244 shares on December 5, 2024.

As Peter Lynch famously mentioned, “Insiders would possibly promote their shares for any variety of causes, however they purchase them for just one: they suppose the value will rise.”

Possibly it’s best to do the identical!

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.