Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

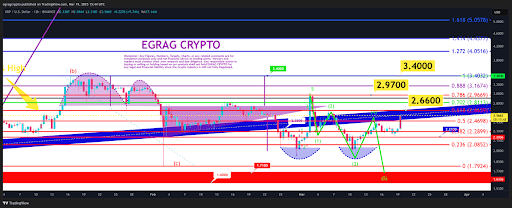

Crypto analyst Egrag Crypto has mentioned the potential of the XRP value witnessing one other corrective transfer. He revealed the worth stage that XRP wants to remain above to keep away from additional draw back stress and rally to the upside.

XRP Wants To Keep Above $2.66 To Keep away from Corrective Transfer

In an X publish, Egrag Crypto acknowledged that if XRP fails to shut above the $2.65 to $2.70 vary, it gained’t negate the wave 4 transfer and can probably lead XRP right down to the fifth wave. His accompanying chart confirmed that the altcoin may drop to as little as $1.7 on this corrective transfer, breaking the essential $2 help stage within the course of. The analyst had beforehand highlighted this $2.65 as being important for a bullish breakout.

Associated Studying

Egrag Crypto alluded to the truth that the US SEC was lastly dropping its long-running lawsuit in opposition to Ripple, which is often bullish for XRP. The analyst admitted that it was a major win for long-term adoption and utility, reinforcing the assumption within the altcoin’s use. Nonetheless, he added that the main target must be on the numbers and charts within the quick time period.

Consistent with this, he remarked {that a} shut above $2.66 could be signal, adopted by one other shut above $2.97 as a second bullish affirmation. He asserted that the final word affirmation for a bullish development could be a detailed above $3.40, which is XRP’s present all-time excessive (ATH). An in depth above $3.40 would result in the subsequent goal between $5 and $8.

Crypto analyst CasiTrades additionally echoed an identical sentiment, stating that XRP wants to interrupt above $3.40 to substantiate a brand new development. Till then, she remarked that market members should look ahead to indicators of affirmation, which is probably not apparent till wave 3 out there cycle. Prior to now, the analyst affirmed that the market is on the sting of a breakout, and this week may very well be a defining second, which already appears to be like to be the case with the Ripple SEC lawsuit.

A Rally To $5 Already In Play

Crypto analyst Darkish Defender advised that an XRP rally to $5 was already underway after the SEC determined to drop the Ripple lawsuit. His accompanying chart confirmed that XRP may witness a breakout to the $5 goal. The altcoin will first rally to round $4.4 on wave 3, then right to $3.7 on wave 4 earlier than the rally to $5.6 on wave 5.

Associated Studying

In the meantime, crypto analyst CrediBULL Crypto raised the potential of XRP dropping beneath $2 and reaching $1.7 earlier than any parabolic transfer to the upside begins. He predicts that the altcoin will rally to double digits no matter how the worth motion performs out within the quick time period.

On the time of writing, the XRP value is buying and selling at round $2.45, up over 7% within the final 24 hours, in keeping with information from CoinMarketCap.

Featured picture from Adobe Inventory, chart from Tradingview.com