The crypto market spent the higher a part of final week buying and selling persistently decrease.

Yearly profit-taking is a serious motive for worth declines as establishments shut positions for the yr, though the Fed’s hawkish stance on the Dec. 18 coverage assembly additionally performed a job.

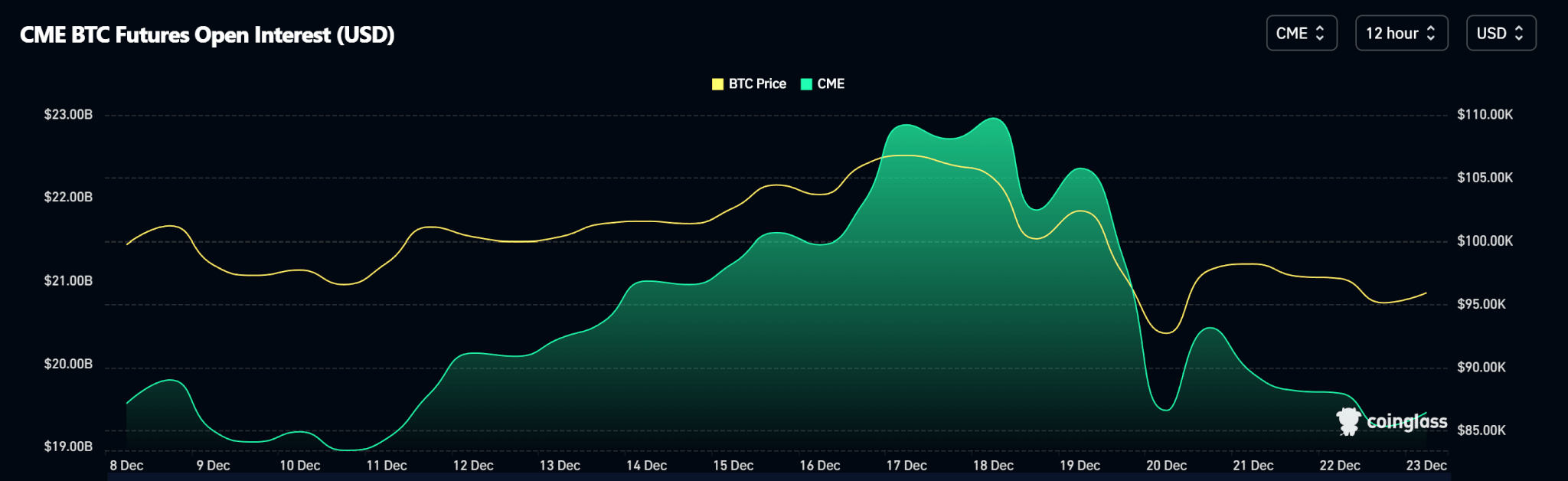

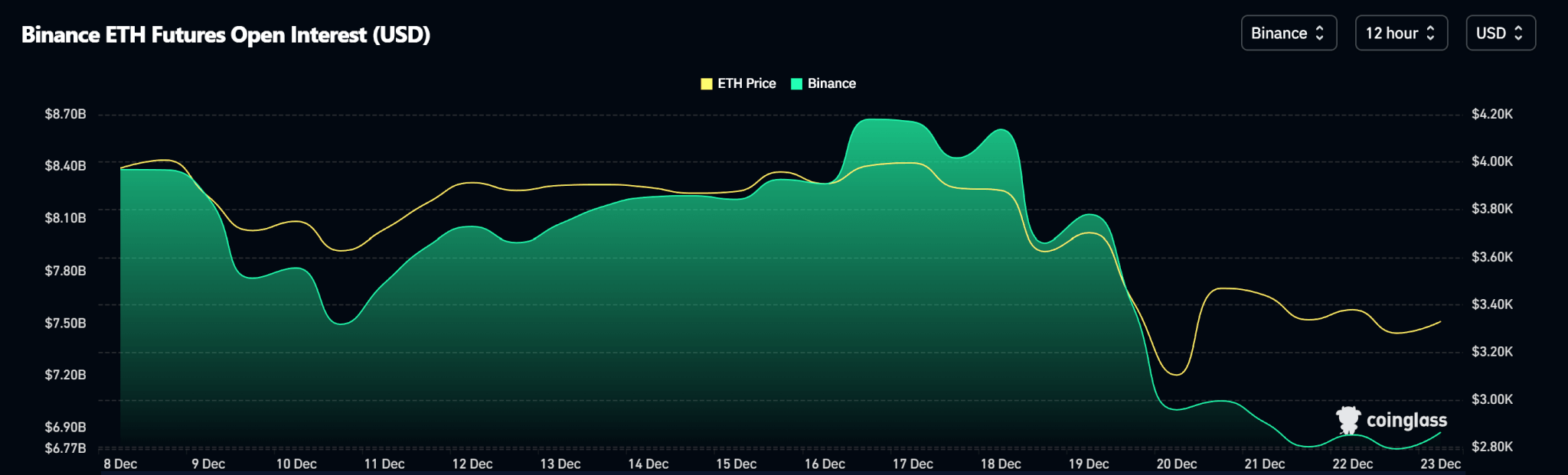

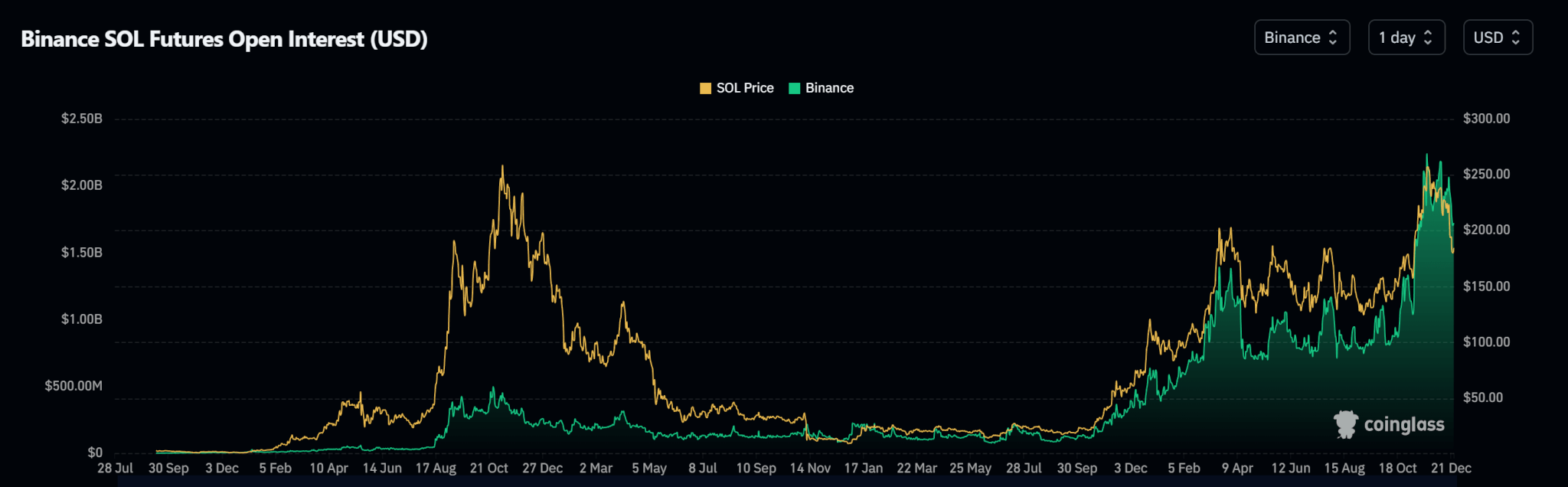

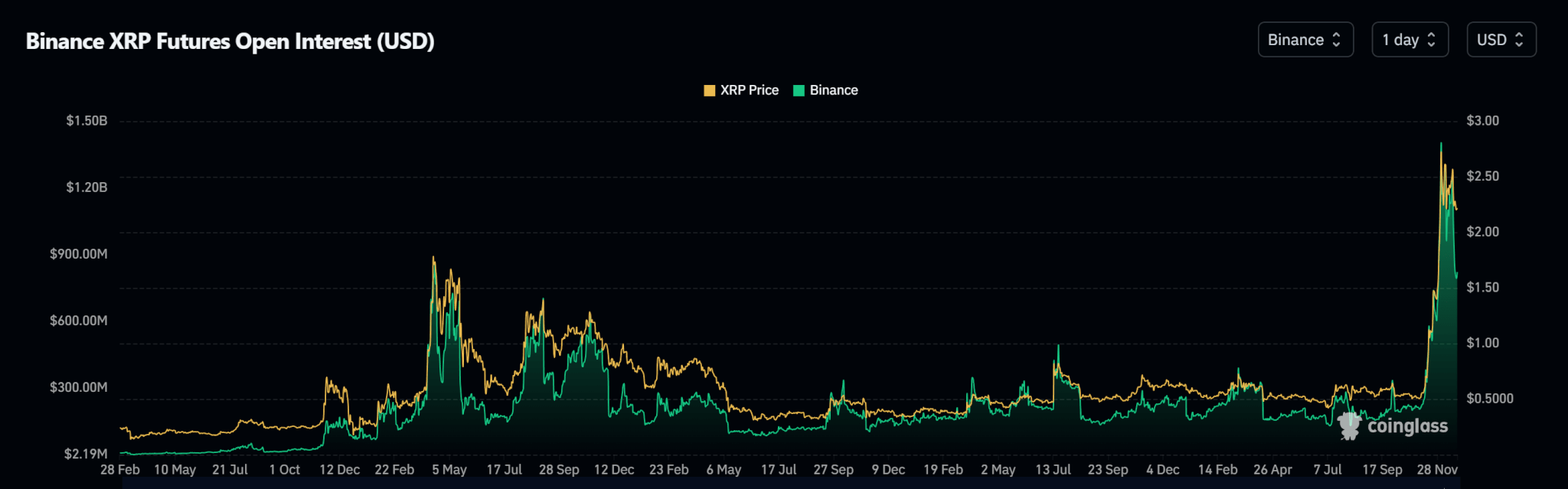

Open Curiosity in main cryptos confirmed weekly declines.

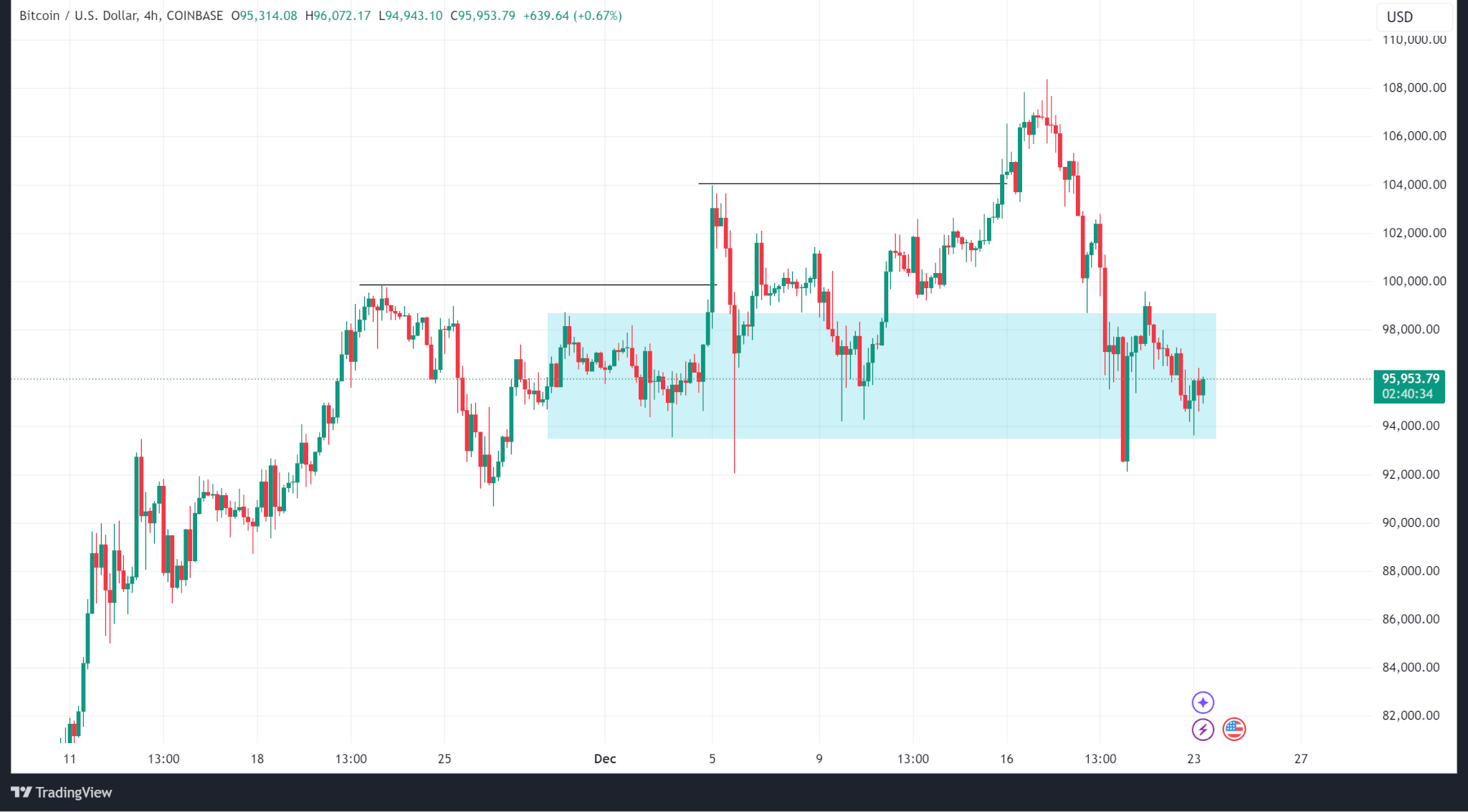

Bitcoin

Bitcoin’s worth fell from the weekly excessive of $108,372 on Dec. 17 to a low of $92,555 earlier than closing the week round $97,700. Nevertheless, regardless of the 9.7% drop, Bitcoin’s worth has not modified character to the draw back.

Open Curiosity knowledge reveals a discount in open contracts on the CME which correlates with worth declines.

The Fed’s coverage resolution on Dec. 18 favoured a 25bps slash. Nevertheless, Fed Chair Jerome Powell expressed hawkish sentiments regarding slashing plans subsequent yr, exacerbating selloffs.

In the meantime, Bitcoin spot ETF inflows knowledge reveals outflows on Dec. 19 and 20 totalling $948.90Mn. Internet inflows from Dec. 16 to Dec. 20 had been $447.00Mn.

Bitcoin trades at $95,700 as of publishing.

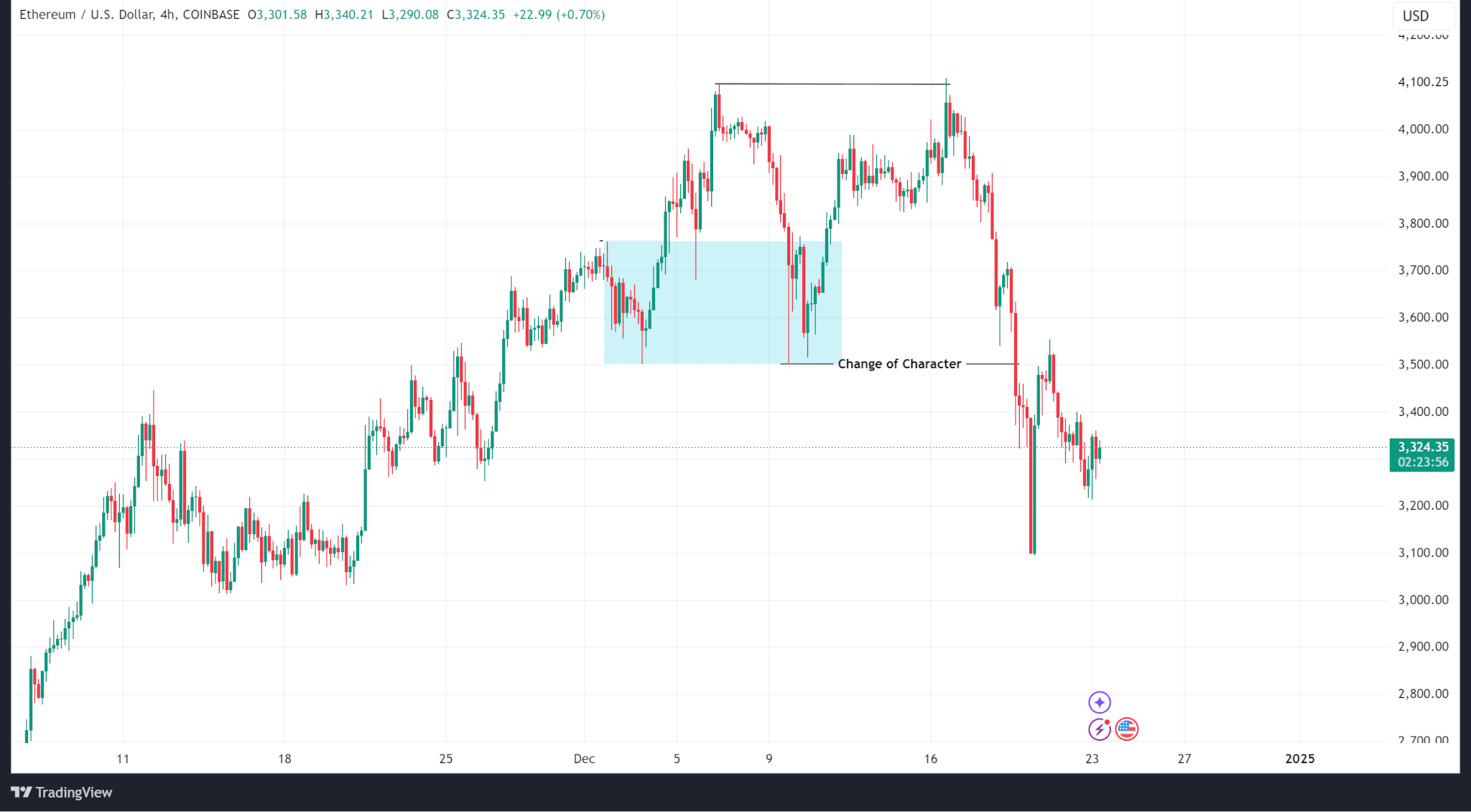

Ethereum

Not like Bitcoin which maintained its bullish construction, Ethereum’s worth modified character on the H4 timeframe to pattern decrease after testing (however failing to interrupt) the native excessive at $4,096.50.

Ethereum fell from a weekly excessive of $4,108.82 to a weekly low of $3,098.40 earlier than ultimately closing the week at $3,470.44 (a 15.51% drop).

Ethereum spot ETF inflows present the same sample with Bitcoin’s with outflows on the final two days of the week.

In the meantime, Ethereum’s open curiosity reveals a steep decline correlated with worth.

Ethereum trades at $3,330.78 as of publishing.

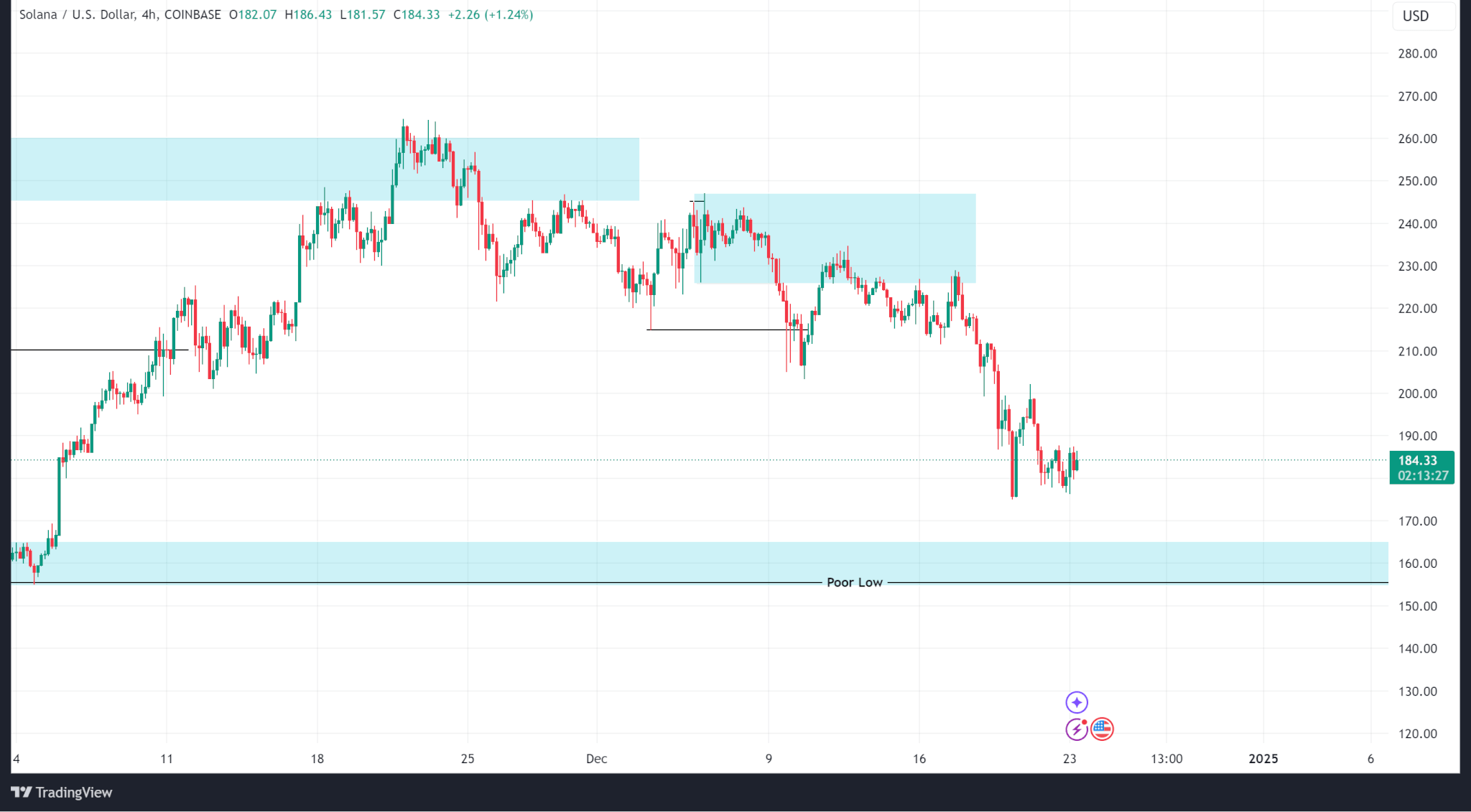

Solana

Solana’s worth motion continued a decline that started two weeks in the past after it failed to interrupt above the all-time excessive of $260.02.

Final week, worth motion traded into an inner provide zone round $227.71, continued promoting to a weekly low of $175.12 and ultimately closed at $194.44 (a 15.07% drop).

The demand zone round $160 (talked about final week) stays the primary logical assist zone as open curiosity continues to fall.

Solana trades at $184.82 as of publishing.

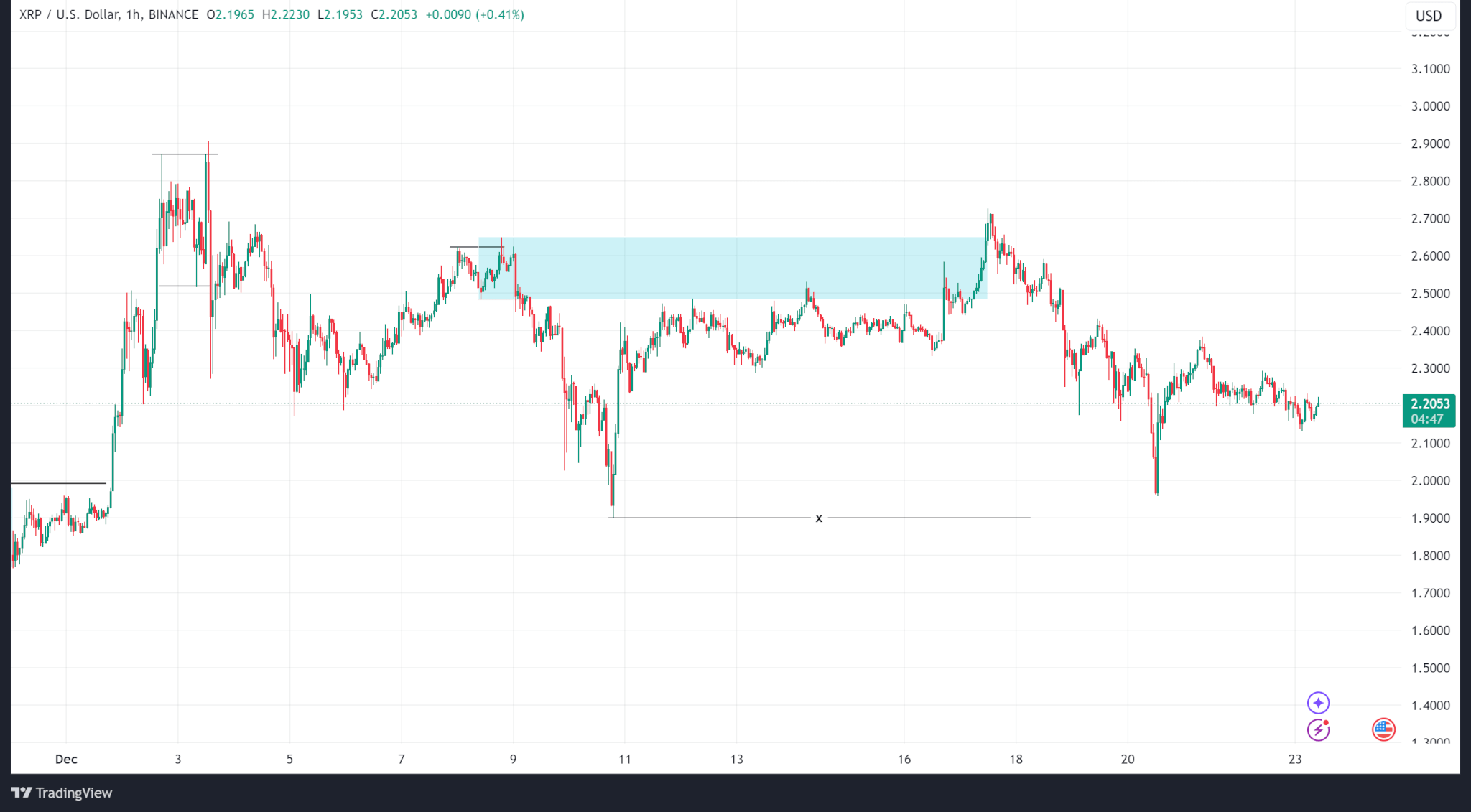

Ripple

Since breaking earlier all-time highs two weeks in the past, Ripple’s worth motion has largely ranged between $1.89 and $2.90. Nevertheless, inside this vary, the value has logged decrease lows.

Ripple’s worth traded into an inner provide zone and broke above it on Dec. 17 however melted to a weekly low of $1.95 earlier than ultimately closing at $2.27 (a 16.42% drop).

Ripple’s open curiosity knowledge reveals a decline in open contracts since Dec. 3.

Ripple trades at $2.21 as of publishing.