Cryptocurrencies are recognized for his or her volatility and might fluctuate quickly in worth. This makes it difficult to make use of them as a retailer of worth or a medium of alternate. Stablecoins have been created to unravel this downside by providing worth stability. They’re digital currencies which might be pegged to steady belongings like fiat currencies, valuable metals, or commodities. USDC and USDT stablecoins are the most well-liked representatives of such a digital belongings on the crypto market, however what precisely are they, and the way do they examine? The comparability between USDC vs USDT provides perception into their distinctive traits and the way they operate inside the crypto trade.

Key Takeaways

USDT has the next market capitalization and considerably bigger buying and selling quantity than USDC, making it the popular selection for merchants.

USDC is thought for its transparency: common audits and clear compliance with regulatory requirements just like the SEC and MiCA contribute to its fame.

USDT’s backing consists of numerous belongings like U.S. Treasury Payments, however the stablecoin has confronted criticism for historic opacity and regulatory challenges.

USDC advantages from a simple reserve construction, primarily backed by money and U.S. Treasuries, guaranteeing transparency.

USDT is extra battle-tested and extensively adopted, whereas USDC stands out for its stronger compliance and transparency.

What are Fiat-Backed Stablecoins?

Fiat-backed stablecoins are the most typical kind of stablecoins. They’re backed by fiat foreign money reserves held in a checking account. The quantity of underlying fiat foreign money held in reserves needs to be equal to the variety of stablecoins in circulation in order that the stablecoin is totally collateralized. If the stablecoin is pegged to the US greenback, then it’s known as a USD stablecoin.

Benefits of Stablecoins

Stablecoins supply a number of advantages, together with their regular worth, clear transparency, and excessive effectivity. All these cryptocurrency are versatile, serving as a dependable retailer of worth, an efficient medium of alternate, or a constant unit of account. They’re significantly helpful for cross-border funds, small-scale transactions, and remittances. Notably, USDT and USDC stablecoins stand out for facilitating low-cost, quick interactions and enabling customers to accrue curiosity by way of decentralized finance protocols.

Compared to conventional finance, stablecoins have a number of distinct benefits. Their decentralized framework permits for fast, low-fee world transfers, circumventing the necessity for typical monetary intermediaries like banks. This facet is particularly interesting because it aligns with the rising demand for stablecoins on main exchanges. Moreover, stablecoins supply enhanced safety as an funding possibility, due to their basis in blockchain expertise, which ensures tamper-proof transaction data and safeguards consumer funds. Moreover, many stablecoins adhere to regulatory compliance requirements and endure periodic audits, including an additional layer of belief and reliability for customers.

Why are there so many USD stablecoins?

The US greenback is the dominant world foreign money, and many individuals and companies all over the world use it for commerce and commerce. USD stablecoins enable individuals to transact in USD and not using a conventional checking account. Moreover, they supply an environment friendly method to transfer cash throughout borders, bypassing the charges and delays related to conventional remittance companies.

Stablecoins facilitate simple transfers and storage of worth for customers throughout cryptocurrency platforms, offering a secure possibility in comparison with the worth volatility of such digital belongings as Bitcoin and Ethereum.

What components make a stablecoin secure?

The protection of a stablecoin relies on a number of components, together with its reserve belongings, the extent of transparency supplied by the issuer, and the regulatory framework inside which it operates. A stablecoin backed by a big reserve of a trusted fiat foreign money and audited by a good third social gathering is taken into account safer than a stablecoin backed by an unknown asset or an unaudited reserve.

MiCA’s Affect on Stablecoin Security

The EU’s Markets in Crypto-Belongings (MiCA) regulation is designed to offer a complete framework for cryptocurrency and stablecoin regulation throughout Europe. It mandates stablecoin issuers to acquire e-money licenses and cling to transparency and reserve necessities. MiCA ensures that solely compliant stablecoins with audited reserves and correct authorization are granted the proper to function within the EU. This might profit USDC, which already follows strict regulatory protocols, whereas USDT may face better challenges on account of its historic lack of transparency.

What Is Tether (USDT)?

Tether (USDT) is the oldest and hottest USD stablecoin that was launched in 2014 with the purpose of making a bridge between cryptocurrencies and conventional fiat currencies. It’s pegged to the US greenback and backed by a reserve of fiat foreign money and different belongings. Tether is probably the most extensively used stablecoin, with a market capitalization of over $70 billion.

You’ll be able to be taught extra about Tether tokens on this article.

USDT Stability

In 2017, Tether was hacked, and 31 million USDT tokens have been misplaced. The challenge obtained criticized as many identified that as an alternative of taking accountability and demonstrating accountability, they initiated an “emergency onerous fork” to avoid wasting face.

In 2017, Tether was hacked, and 31 million USDT was misplaced. As an alternative of taking accountability and demonstrating accountability, they initiated an “emergency onerous fork” to avoid wasting face. This caught the eye of the New York Legal professional Common when it was found that Tether was lending out its money reserves with out having the ability to adequately again their tokens with USD. They tried to absolve themselves of accountability by antagonizing the Legal professional Common as an alternative of offering a rational protection.

USDT Quantity

In response to CoinMarketCap, the present market capitalization of USDT is round $111 billion, and it’s the most generally used stablecoin on this planet. This makes Tether the third crypto asset by market capitalization, solely surpassed by Bitcoin and Ethereum.

Recommended article: What’s quantity in cryptocurrency?

What Is a USD Coin (USDC)?

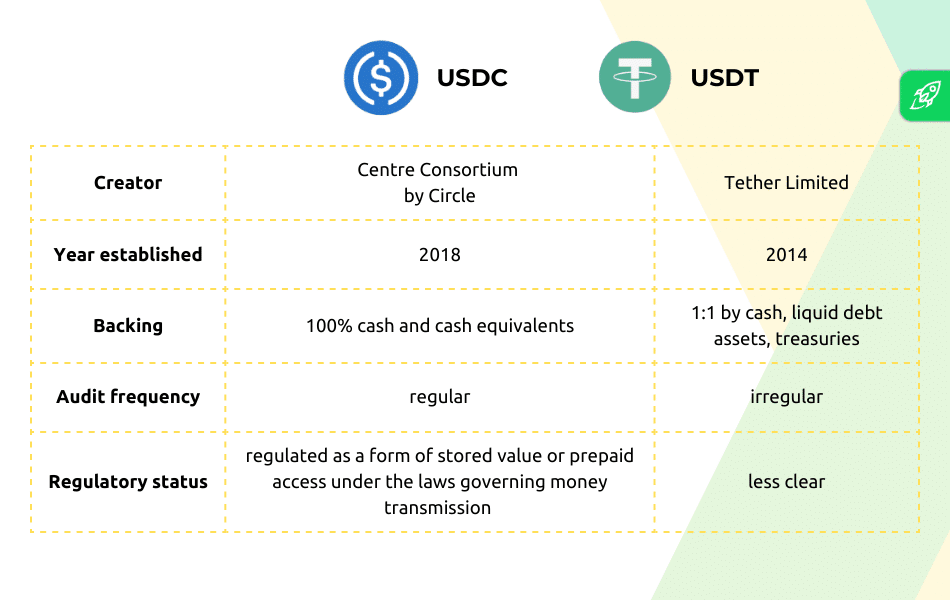

USDC, or USD Coin, takes second place within the checklist of the most well-liked stablecoins. It was launched in 2018 by Circle, a fintech firm primarily based in Boston.

The Centre consortium, which incorporates Circle and Coinbase, points and manages USDC. Centre is the one entity that may management USDC provide, just like the Federal Reserve controlling USD. Nevertheless, there’s a main distinction between USD and USDC — Circle has full authority over USDC, which isn’t the case with USD and the FR.

USDC Stability

USDC Stability is taken into account to be extra clear than USDT as a result of Circle gives month-to-month audits of its reserve belongings. Moreover, USDC is regulated by the US Securities and Trade Fee (SEC).

In March 2023, Circle reported that $3.3 billion of the money reserves backing USDC tokens remained in Silicon Valley Financial institution, inflicting it to depeg and drop in worth towards the greenback to 87 cents. As well as, comparable dollar-backed stablecoins comparable to DAI and USDD have been depegged from their authentic worth of $1. Nevertheless, it solely took USDC 2 days to return its peg.

USDC Market Capitalization

In response to CoinMarketCap, the present market capitalization of USDC is over $34 billion, and it’s the second most generally used stablecoin on this planet after USDT.

Tether vs USDC: Comparative Evaluation

An evaluation of the variations between Tether and USD Coin might be useful. Each are stablecoins, although they’ve some completely different key options and will every be examined earlier than investing. Let’s begin with the similarities they share.

They’re each stablecoins

USDC and Tether are nearly indistinguishable, differing in market cap. Each Tether and USD Coin are stablecoins, which means they’ve a set worth that’s pegged to the US greenback. This makes them much less risky than different different crypto belongings, to allow them to function a retailer of worth or a medium of alternate. Nevertheless, they can’t be handled as good substitutes for the US greenback because it’s not possible to deposit them right into a checking account or use them for funds.

One-to-one (1:1) worth ratio with USD

Each Tether and USD Coin keep a one-to-one (1:1) worth ratio with the US greenback. Which means that for each USDT or USDC token issued, there’s a corresponding US greenback held in reserves.

Blockchain variation

Each Tether and USDC stablecoin had operated solely on the Ethereum blockchain, however gained illustration on a number of blockchains since then, which permits for fast transferral and low transaction charges.

Blockchain transparency

Each Tether and USD Coin present transparency when it comes to their blockchain transactions. This permits customers to trace their transactions and make sure that they’re getting what they paid for.

Speedy transferral

Each Tether and USD Coin might be transferred shortly and simply, which makes them ultimate for peer-to-peer transactions and remittances.

USD Coin vs Tether: What are the Key Variations?

Tether (USDT) and USD Coin (USDC) are two of the most well-liked stablecoins within the cryptocurrency house. Whereas each stablecoins share some similarities, there are additionally some key variations between them:

Launch date

Tether was launched in 2014, whereas USD Coin was launched in 2018. Which means that Tether has been round longer and has had extra time to determine itself available in the market.

Reserve Belongings

Each Tether and USD Coin are backed by a reserve of belongings, comparable to fiat foreign money and different monetary devices. Nevertheless, issues have arisen concerning the steadiness and transparency of Tether’s reserves, as the corporate has confronted accusations of utilizing unbacked reserves to help the worth of its stablecoin.

As of 2024, Tether (USDT) is primarily backed by U.S. Treasury Payments and different belongings. In response to Blockworks, roughly 58% of Tether’s reserves are held in U.S. Treasuries, with the remaining reserves consisting of money and money equivalents (about 9%), secured loans (round 9%), and varied different investments, together with crypto holdings, company bonds, funds, and valuable metals. This numerous backing has drawn scrutiny and requires better transparency and regulation.

In distinction, USD Coin (USDC) is backed by a extra easy reserve coverage, primarily consisting of money and short-term U.S. Treasuries. Round 75.6% of USDC’s reserves are held in U.S. Treasuries, whereas 24.4% stay in money at regulated monetary establishments. Circle, the issuer of USDC, ensures compliance with monetary laws by holding these reserves with regulated monetary establishments.

Circle has earned public belief by sustaining a constructive fame and offering detailed disclosures about its reserve belongings, whereas Tether continues to face controversy on account of perceived opacity and unregulated centralization. Tether’s lack of transparency has been highlighted by its omissions concerning the precise composition of USDT’s backing, contrasting sharply with Circle’s dedication to regulatory compliance and openness.

MiCA Compliance: USDT vs. USDC

Below MiCA, stablecoin issuers should get hold of e-money licenses to function inside the EU. This regulatory framework might closely affect Tether (USDT) because it faces challenges in sustaining market entry on account of issues over transparency and reserve administration. Alternatively, USDC, with its established compliance protocols and common audits, is best positioned to satisfy MiCA’s strict requirements. Because of this, European exchanges might prioritize USDC over USDT, affecting liquidity and market share within the area.

Commerce/liquidity quantity

Tether (USDT) persistently maintains the next market capitalization and bigger buying and selling quantity in comparison with USD Coin (USDC). In response to CoinMarketCap, USDT’s every day buying and selling quantity is roughly $50 billion, considerably overshadowing USDC’s $5 billion in every day transactions—roughly ten occasions extra. This substantial distinction in liquidity and buying and selling quantity makes Tether a extra well-liked stablecoin amongst merchants and buyers, because it provides better availability and market exercise.

Grow to be the neatest crypto fanatic within the room

Get the highest 50 crypto definitions it’s good to know within the trade totally free

USDC vs USDT: Concluding Ideas

Stablecoins are important to the crypto ecosystem, as they’re blockchain-based tokens with a steady worth linked to fiat foreign money. Steady tokens guarantee customers can conveniently switch and maintain worth throughout varied crypto platforms with out the publicity to cost fluctuations frequent in digital belongings comparable to Bitcoin and Ethereum. USDT, USDC, and BUSD (Binance USD) type the majority of the stablecoin sector’s market cap, making them ultimate decisions for buyers trying to develop into a part of the stablecoin market.

General, whereas each Tether and USD Coin are stablecoins designed to take care of a 1:1 worth ratio with the US greenback, there are some key variations between the 2. Tether has an extended historical past and a bigger buying and selling quantity, nevertheless it has confronted some controversy over the steadiness of its reserve belongings. USD Coin, then again, has been extra clear about its reserve belongings. But, it has a smaller buying and selling quantity. In the end, the selection between Tether and USD Coin will depend upon the person wants and preferences of the consumer.

USDT vs USDC: FAQ

Is USDT totally backed?

Tether (USDT) claims that it’s totally backed by reserves, and up to date studies recommend that its reserves are even over-collateralized. As of mid-2024, Tether has acknowledged that it holds $118.4 billion in reserves, surpassing the quantity of USDT in circulation, which is about $113 billion. This consists of a mixture of money, U.S. Treasury payments, and different belongings, offering a cushion past the 1:1 peg required for full backing.

Is Bitcoin a stablecoin?

No, Bitcoin shouldn’t be a stablecoin. In contrast to stablecoins, that are designed to take care of a set worth, Bitcoin’s worth is very risky and might fluctuate considerably primarily based on market demand and different components.

Is USDT equal to USDC?

Sure, USDT (Tether) and USDC (USD Coin) are each pegged to the U.S. greenback, and, subsequently, equal in worth. They’re designed to offer stability within the face of market volatility, providing a constant worth of 1 greenback per coin.

Which stablecoin is greatest?

Deciding between USDT and USDC is difficult: each have their advantages and disadvantages and luxuriate in robust reputations and widespread reputation. To be taught extra about how these stablecoins examine to others, take a look at our article on the 5 greatest stablecoins right here.

Is Usdt and USDC the identical?

No, they’re two completely different belongings. Each USDT (Tether) and USDC (USD Coin) are well-liked decisions within the crypto group, serving as fiat-collateralized stablecoins inside the cryptocurrency ecosystem. Regardless of their variations, these two varieties of cryptocurrency share the frequent purpose of providing a steady, digital foreign money pegged to the US Greenback.

What’s the distinction between USDT and USDC?

USDT (Tether) and USDC (USD Coin) are each stablecoins designed to stay valued at $1. They differ in a number of facets: issuer, transparency, regulation, adoption, and blockchains they run on. USDT is issued by Tether Restricted, whereas USDC is launched by Centre Consortium. USDC complies with US anti-money laundering and know-your-customer laws and is topic to regulatory scrutiny. In the meantime, Tether Restricted has encountered authorized points and has been the main target of investigations by the New York Legal professional Common. Nevertheless, USDC is much less adopted than USDT.

Is USDT higher than USDC?

There is no such thing as a easy reply to this query. When selecting between USDT and USDC, you will need to perceive the variations between the 2. USDT is extra established, whereas USDC is rising in reputation for its compliance and transparency. In the end, the selection of probably the most appropriate stablecoin is determined by particular person preferences and necessities.

What’s the draw back of USDC?

USDC, like different stablecoins, faces frequent drawbacks comparable to centralization dangers on account of its administration by a single entity, Circle, and regulatory dangers linked to the evolving monetary regulation panorama. It additionally carries counterparty dangers, counting on the trustworthiness of Circle and its banking companions. As well as, USDC is tied to the normal monetary system, inheriting its vulnerabilities, and is topic to good contract dangers inherent in blockchain expertise. Whereas providing stability, it lacks the excessive return potential of extra risky cryptocurrencies, presenting a restricted use case primarily as a steady medium of alternate or retailer of worth.

Trying to purchase stablecoins like USDT or USDC? Think about using Changelly, a good cryptocurrency alternate that lets you purchase and promote all kinds of cryptocurrencies with ease. With Changelly, you’ll be able to shortly and securely buy stablecoins utilizing your credit score or debit card with out sophisticated verification processes. Moreover, Changelly provides aggressive charges and a user-friendly interface, making it an ideal selection for each newcomers and skilled merchants. Begin shopping for stablecoins in the present day on Changelly!

Can’t load widget

Is USDC Nonetheless Secure?

Some buyers contemplate USDC a safer stablecoin than USDT, as it’s extra clear and regulatory-compliant. Its common audits and real-time studies on reserves present assurance that the token is backed by precise belongings. Conversely, USDT has been met with scrutiny on account of doubts surrounding its reserve backing and transparency.

What’s the distinction between USD and USDT?

USD (United States Greenback) is the fiat foreign money issued by the Federal Reserve Financial institution in the US. USD is a bodily foreign money within the type of paper cash and cash, backed by the US authorities and used as a medium of alternate for items and companies.

USDT (Tether) is a digital, blockchain-operated stablecoin created to stay pegged to the US greenback. It’s issued by Tether Restricted and supposedly backed by reserves consisting of an equal quantity of USD.

The important thing distinction between USD and USDT is that USD is a bodily foreign money that the US authorities points and backs, whereas USDT is a digital foreign money. As an alternative of the federal government, it’s backed by an equal quantity of USD that Tether Restricted holds in reserve. Moreover, whereas USDT intends to take care of a gentle worth of $1, the worth of USD is topic to market forces like inflation and rates of interest.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.