What have we learnt this week, that mattered for markets?

Cryptocurrencies rallied on Sunday (02/03) after Trump highlighted XRP, Solana, Cardano, Bitcoin, and Ethereum in a submit about his “Crypto Strategic Reserve.” This transfer is seen as a constructive step towards legitimizing digital property, much like a gold reserve. The administration’s shift away from strict crypto laws has additional boosted market sentiment. Our take: Latest announcement has supplied a major enhance, however sustaining these good points will depend upon continued tangible regulatory developments, an total improved risk-on sentiment, and continuation of straightforward coverage.

Though the important minerals deal between the US and Ukraine has failed (a minimum of for now, and moderately publicly), Trump has obtained concessions from different nations by stress. In latest conferences, each Macron and Starmer confused Europe’s want to extend protection spending, with Starmer pledging a $17 bil. enhance by 2027 to succeed in 2.5% of GDP. A number of different nations have additionally introduced will increase in protection spending, both instantly or sooner or later. Our take: Vital tailwind for protection shares as protection contractors might even see increased demand for army tools and providers.

Replace on US market valuations: The S&P 500 is presently priced at 21.2x ahead earnings, above its long-term common, suggesting the market is “priced to perfection,” leaving little room for disappointment. We’re already seeing some cooling in valuations for a number of high-priced shares, with the highest 5 seeing a drop of 1.5x of their multiples. Our take: Whereas this pullback in high-multiple shares could also be robust for traders who’re over-exposed, it’s a wholesome correction for the market total and has not harm the broader market. As of March 2nd, the common inventory within the S&P 500 (equal-weighted SPX) is up 2.75% year-to-date and 9.8% year-over-year.

Why are bonds rallying, and yields are shifting decrease? Partly as a consequence of risk-off sentiment and progress considerations triggered by tariffs bulletins. However less-mentioned, and equally essential is the liquidity surge from the US. The US hit the debt ceiling in January and can’t problem web new debt. In consequence, the Treasury is drawing down its Treasury Basic Account (TGA), successfully injecting liquidity into the banking system, much like QE. This liquidity surge is placing downward stress on bond yields and the greenback, whereas additionally offering some buffer towards coverage uncertainty.

Tariffs, tariffs, and extra tariffs. Trump mentioned that the 25% tariffs on Canada and Mexico will go into impact on March 4th and that he would enhance tariffs on Chinese language items one other 10% the identical day. Our take: Whereas there could also be additional room for negotiation for Mexico and Canada, we’ve got mentioned earlier than and proceed to consider, that China is handled individually from remainder of the world- we count on the worst.

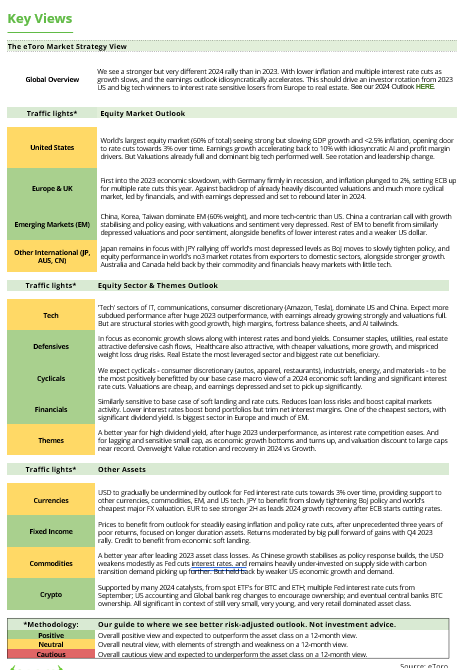

Bottomline for retail traders: Look past mega-cap AI shares as innovation expands to mid and small-cap tech corporations, globally. Look ahead to sectoral efficiency rotation from mega-cap tech to sectors like finance, healthcare, protection, renewable power. Hedge portfolios with multi-asset diversification and think about uncorrelated property like commodities for portfolio safety. Money shedding luster: bonds outperform money throughout easing cycles.

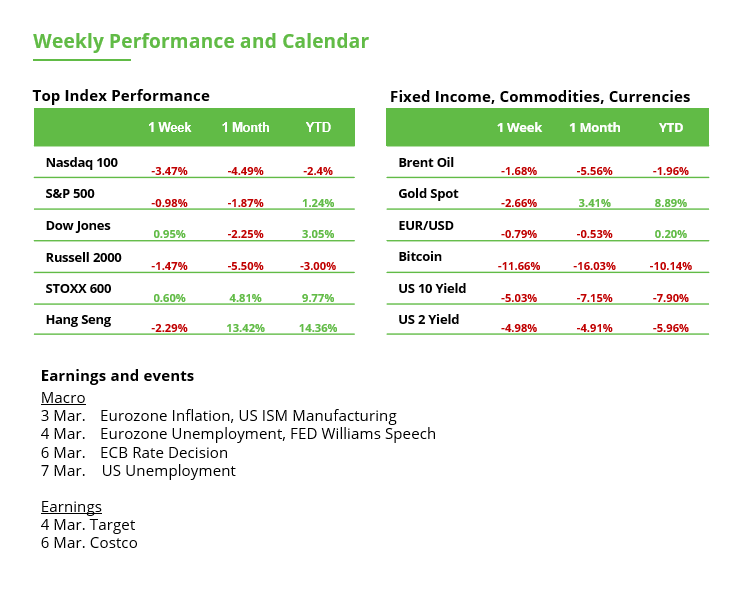

Full agenda for investors- week forward

ISM Information: In occasions of Trump’s unpredictable tariff insurance policies, main indicators just like the ISM knowledge are extra essential than ever. A transparent pattern has emerged in latest months (see chart): The Manufacturing PMI (Monday) has recovered and exited recession (50.9), whereas the Companies PMI (Tuesday) has weakened however stays resilient (52.8). Buyers ought to preserve an in depth eye on whether or not this develops right into a pattern. An escalation within the commerce conflict would primarily influence export-oriented industrial shares.

Trump’s Tariff Coverage: On Tuesday, US President Trump addresses Congress and the brand new tariffs on imports from China, Canada and Mexico come into pressure.

Non-Farm Payrolls and Powell: On Friday, US employment knowledge might be launched – latest job progress has been average. Will the slowdown proceed? Within the night, Fed Chair Jerome Powell delivers a speech that might present insights into future financial coverage. After per week filled with macroeconomic knowledge, the main target might be on whether or not the Fed maintains its cautious stance or alerts a shift towards charge cuts. Markets presently count on two charge cuts in 2025, with the primary anticipated in June.

Market Situations: If charge reduce expectations rise, shares and bonds may benefit, whereas the US greenback would possibly weaken. A weaker greenback may help commodities like gold and oil. Nevertheless, if Trump’s insurance policies push yields increased, the greenback may stay sturdy, growing worth stress on commodities.

European Inflation: On Monday, the Eurozone inflation knowledge might be launched. After rising from 1.7% to 2.5% over 5 months, inflation is now anticipated to ease to 2.3%. This might give the ECB extra room to proceed its rate-cutting cycle. A charge reduce on Thursday is already seen as sure. Decrease charges stay a key lever to revive the stagnating European financial system.

Bottomline: Whereas the US financial system seems extra steady, European equities, that are extra attractively valued, have change into more and more interesting to traders. The important thing query is whether or not the Eurozone’s progress prospects will enhance within the coming months.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.