Please see this week’s market overview from eToro’s world analyst workforce, which incorporates the newest market knowledge and the home funding view.

Markets cheer on Trump’s return to the workplace

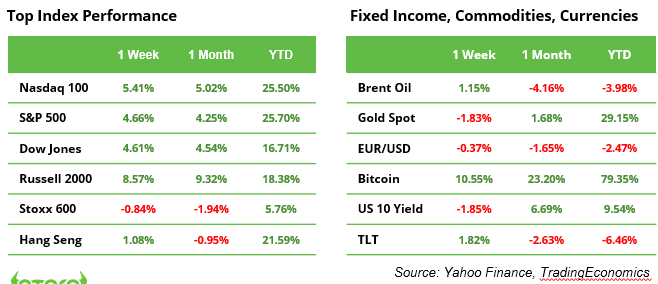

Together with his return to the White Home, Donald Trump has change into solely the second American “boomerang” President after Grover Cleveland in 1893. Fairness markets cheered, very similar to in 2016, on the promise of decrease taxes and lowered regulation. On 6 November, the S&P 500 rose by 2.5%, the Nasdaq gained 3.0%, and the Dow Jones elevated by 3.6%, setting new data led by the anticipated “Trump sectors” (see desk). The small-cap Russell 2000 surged by a powerful 5.8%, pushed by expectations of a extra beneficial local weather for deal-making and company takeovers.

Bond “vigilantes,” fearing greater debt and elevated inflation beneath Trump’s management, pushed the US 10-year yield as much as 4.5%. Bitcoin soared by 9% on Wednesday and maintained its momentum to succeed in the $80,000 degree for the primary time ever over the weekend. The US greenback strengthened to 1.07 towards the euro, marking the very best week for the buck since 2020. Tesla inventory jumped by 29% in per week, as buyers imagine Elon Musk will likely be rewarded handsomely for his robust help through the election marketing campaign.

In “different information”, the Fed minimize its coverage rate of interest by 0.25%, bringing it to a spread of 4.50% to 4.75%. In the meantime, Germany noticed its coalition authorities collapse (see subsequent web page), and China unveiled a $1.4 trillion stimulus package deal that underwhelmed buyers. The US has ordered Taiwanese chipmaker TSMC to halt shipments of probably the most superior chips to China. The commerce struggle between these two world powers is intensifying by the day, whilst Trump’s second presidency has but to start.

The week forward

Within the US, buyers will obtain October CPI numbers on Wednesday, and October retail gross sales on Friday. Moreover, the Q3 earnings season will proceed with, amongst others, outcomes from House Depot, Cisco, Disney, and Utilized Supplies, German Prime 5 shares Siemens, Deutsche Telekom and Allianz, and China’s retail giants Alibaba, Tencent and JD.com.

Desk. S&P 500 Index sector efficiency after Trump’s victory was introduced

Supply: Google Finance. Worth returns in USD between 5 and eight November 2024

Are renewable power shares bought off unjustified?

Following Trump’s “drill, child, drill” election, renewable power shares took a major hit. Enphase Vitality dropped 26%, Vestas Wind, regardless of reporting earnings, fell 23%, and Plug Energy decreased by 18%. The sector faces robust headwinds from decrease fossil gasoline costs and better tariffs on elements imported from China, which threaten to decelerate the expansion of photo voltaic, wind, and hydrogen applied sciences. Nevertheless, the rising power calls for of chip manufacturing and AI knowledge facilities could preserve all accessible power sources in demand. The sell-off appears to be extra of a market overreaction to quick political adjustments quite than a mirrored image of the sector’s future potential.

Authorities disaster in Germany, Scholz plans new elections by March

The “site visitors mild coalition” of the SPD, Greens, and FDP has collapsed. Chancellor Olaf Scholz has fired Finance Minister Christian Lindner after clashes over the 2025 funds. Scholz wished elevated investments to revive the stagnant economic system, however Lindner refused to breach the debt brake, citing his oath of workplace.

With solely a weakened SPD-Greens minority authorities, reforms at the moment are tough. This uncertainty exacerbates Germany’s fragile economic system, particularly the struggling automotive sector. The Commerzbank takeover by Italy’s UniCredit provides to the chaos, delaying vital infrastructure and renewable power tasks.

The disaster is pushing Germany towards new elections. The opposition calls for a vote of confidence this week, however Scholz plans to delay it till mid-January to finalize tasks. Elections might occur by late March, following the 60-day constitutional timeline.

Earnings and occasions

Interesting firms on three continents will report earnings this week. As well as, semiconductor tools maker ASML will host an Investor Day, updating its 2030 outlook.

Earnings releases:

12 Nov. House Depot, Shopify, Spotify, Softbank, Occidental Petroleum

13 Nov. Cisco, Tencent, Allianz

14 Nov. Disney, Utilized Supplies, JD.com, Siemens, Deutsche Put up + ASML Investor Day

15 Nov. Alibaba

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.