Siemens Power took on a variety of consideration because it has raced up ~300% over the previous twelve months. By evaluating Siemens Power’s financials and their close to (~5 12 months) future I hope to give you the mandatory data to determine if investing now stays engaging.

Enterprise Profile

Siemens Power operates throughout the whole power expertise and repair worth chain associated to energy era, each for typical and renewable power.

The enterprise operates as follows:

Gasoline Providers (GS): Gasoline and huge steam generators, massive turbines and warmth pumps.

Grid Applied sciences (GT): transmission techniques, substations, switchgear, transformers and storage options.

Transformation of Business (TI): TI is a set encompassing eElectrolyzers, stream generators, turbines, compressors and providers. It consist of assorted working segments:

Sustainable Power Methods (SES)

Electrification, Automation

Digitalization (EAD)

Industrial Steam Generators & Turbines (STG)

Compression (CP)

Siemens Gamesa (SG): onshore and offshore wind turbine elements to set up and publish set up providers and upkeep.

Siemens Power is kind of diversified, even for a conglomerate, throughout each enterprise models (conventional power and newer applied sciences) and geographically.

Funding case

The corporate advantages from massive long run tendencies such because the upgrading of our getting older electrical infrastructure and renewable power manufacturing and storage. Over that final couple of years the previous has confirmed to be a great baseline driver for the corporate. The latter nonetheless, led by SG, has run into fairly some hassle with which I’ll begin the funding case as I discover it essential to not overlook such issues. SG has been an entirely owned subsidiary since July 2023 earlier than which it already owned a big stake. In June 2023 issues surfaced associated to the standard of the 4.x and 5.x onshore wind generators. The prices of this have been north of €2 billion to date. There may be mild on the finish of this tunnel nonetheless as gross sales have resumed after a 12 months of tackling the aforementioned points.

Now to a extra optimistic word on Siemens Power as an entire, the primary case for traders is long run margin enhancements mixed with medium to excessive single digit prime line progress with all segments having a beneficial future outlook. Elevating estimates has given traders confidence that Siemens Power can recover from the SG debacle and supply a beautiful progress path going ahead.

A number of the key drivers apart from massive structural tendencies for this are imagined to be the continued restructuring at SG, together with market refocus and mission danger discount, which goals to enhance profitability and stability. Moreover, the divestment of non-core belongings offers alternatives for capital reallocation and improved strategic focus. For instance Siemens AG acquired an 18% stake in Siemens Restricted India from Siemens Power for €2.1 billion which frees up important capital, that is anticipated to be accomplished someplace in 2025.

If Siemens Power is ready to execute on these margin enhancements I consider they’ve the chance to comply with an identical path to a different industrial spinoff, GE Vernova which has been in a position to considerably enhance margins. As a big portion of close to time period income is already secured it turns into principally a margin recreation for administration which they’ve been in a position to ship on to date apart from SG.

Dangers

The elephant within the room is the difficulty associated to the standard of the 4.X and 5.X platforms from SG. Gross sales had been suspended for an prolonged time period and huge losses had been incurred within the final 2 years. If the problems will not be of a one off nature this might result in a major writedown once more. Moreover mission execution doesn’t go with out danger, price overruns, delays and technical challenges will not be unusual and stay a danger for any firm within the sector. Siemens Power additionally receives massive orders, the timing of those can acknowledge the income all through a mission could make for unpredictability within the quick time period resulting in larger earnings volatility. Moreover the corporate is a big conglomerate which makes evaluation troublesome, I might need missed gadgets (particularly as Siemens Power likes to work with adjusted numbers).

Valuation

Valuing a big conglomerate just isn’t straightforward, simply taking in total income and extrapolating is nothing greater than of venture. I took a segmental forecasting method after which I did a easy annual fee of return calculation (which I defined in an earlier article of mine about UMG) on the sum of components, on this case the ultimate calculation is finished utilizing free money stream to fairness (FCFE) as Siemens Power has a variety of incidental gadgets. I begin with order execution, order consumption and backlog after which I apply the steering supplied by administration on the margins (revenue earlier than particular gadgets) which I then modify for particular gadgets and D&A to reach at segmental EBITDA numbers (naturally that is similar reconciliation as Siemens Power makes use of), the summations will be seen in Desk 1 under (discover the 2026 soar as GT opens two factories). On this weblog article I can’t go into a lot additional element as that enormously will increase the size of this quick type weblog publish, you probably have any questions be at liberty to achieve out!

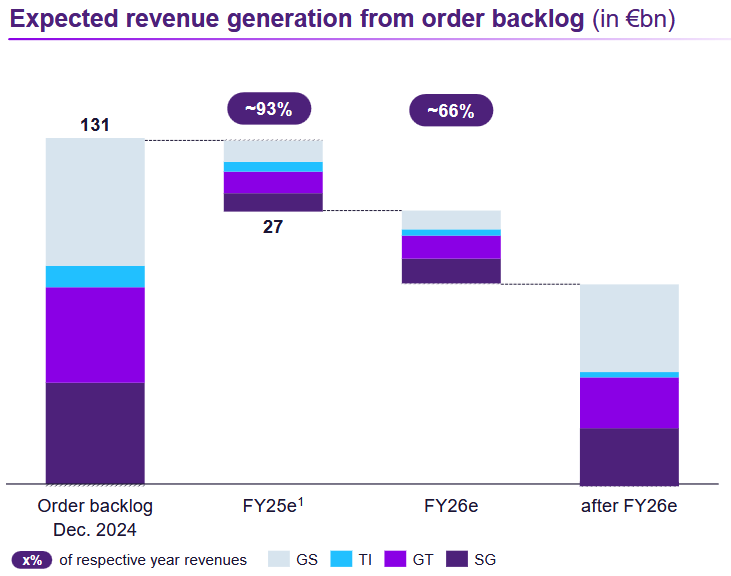

Determine 1: backlog at fiscal Q1 2025, Siemens Power

Group stage

2023

2024

2025

2026

2027

2028

2029

Income

31118

34466

37496

40419

44947

47822

50853

EBITDA

-1776

2069

2697

4290

5477

6359

7289

EBIT

-3292

558

1097

2640

3827

4659

5539

Taxes

-1202

-487

-329

-845

-1225

-1491

-1773

Curiosity

-130

-303

-100

-200

-200

-200

-200

Capex

-1228

-1514

-1000

-1000

-1000

-1000

-1000

NWC

3388

3216

1500

1200

1000

700

200

FCFE

-2464

1470

1168

1795

2402

2668

2767

Desk 1: Group stage earnings and forecast abstract, based mostly on Siemens Power forecasts and creator’s personal forecasts

Given a market cap of ~€42.5B, a present ahead FCFE yield of two.4% and an anticipated FCFE yield of 4.75% (so a number of contraction) in 2029 I arrive at a ten.19% anticipated annual return for the following 5 years. All numbers listed here are based mostly on the share value on the time of writing which was €53.6. This offers ample margin of security and in my view checks of the valuation field provided that administration has a comparatively first rate observe document on truly executing on the outlook given in earlier years.

Conclusion

Has Siemens Power run up quite a bit, sure however the underlying funding case arguably improved considerably over the previous 12 months. That is supported by long run tendencies and optimizations inside Siemens Power itself over the approaching years. Whereas income visibility presents stability, execution dangers stay. The potential upside makes Siemens Power engaging for long-term, risk-tolerant traders who desire a potential European industrial titan of their portfolio with publicity to our worldwide power infrastructure wants..

The creator of this evaluation doesn’t maintain shares in Siemens Power on the time of writing, which can affect the attitude supplied. Please conduct your individual analysis or seek the advice of with a monetary advisor earlier than making any funding choices.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.