Introduction

Ray Dalio’s All Climate Portfolio is likely one of the most well-known funding methods designed to carry out properly throughout numerous financial environments whether or not in occasions of development, inflation, recession, or deflation. The core precept behind the All Climate technique is danger parity, which balances asset courses based mostly on their danger contributions quite than capital allocation alone.

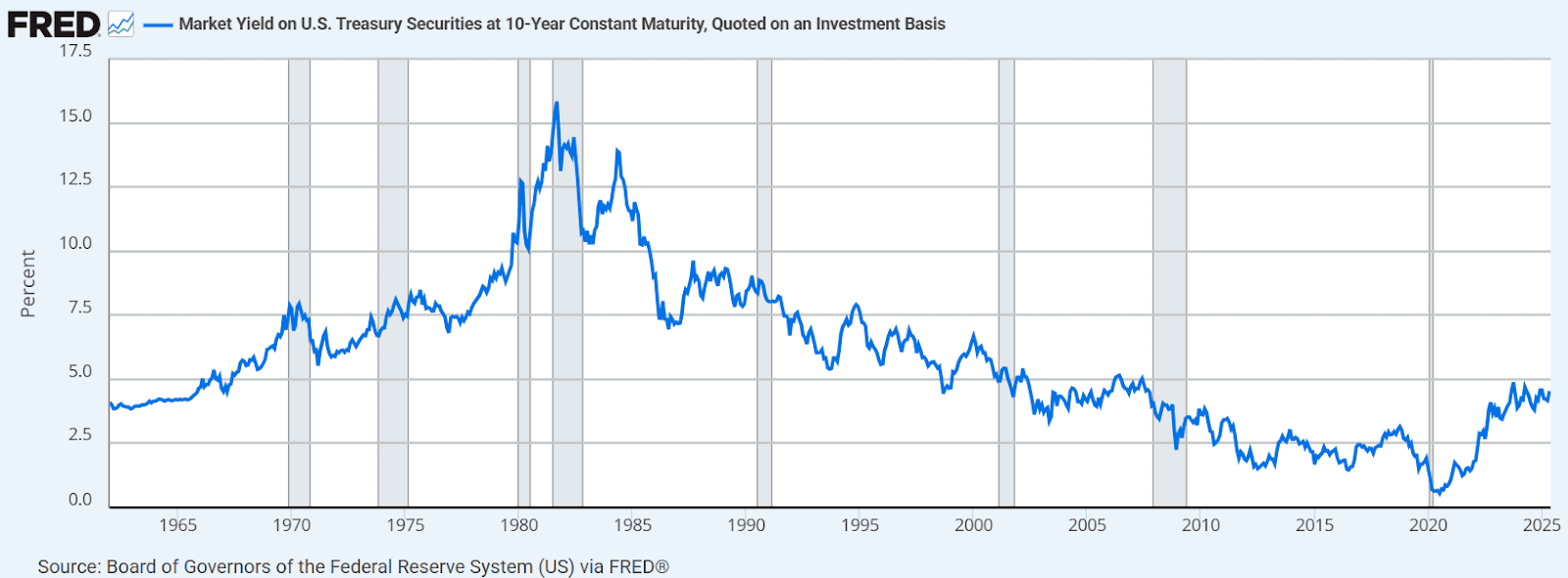

Nonetheless, the unprecedented rise in rates of interest in 2022 triggered by the Federal Reserve’s aggressive financial tightening posed important challenges to this technique. Bonds, historically a stabilizing power within the portfolio, suffered historic losses, whereas equities additionally declined on account of recession fears.

On this article, we are going to:

Look at the unique composition of the All Climate Portfolio.

Analyze the way it carried out in 2022 amid rising charges.

Focus on changes that might enhance its resilience in a high-rate surroundings.

Consider whether or not the All Climate technique stays viable for long-term traders.

1. The Authentic All Climate Portfolio: A Threat-Parity Method

Ray Dalio’s All Climate Portfolio was designed to ship regular returns no matter financial circumstances by balancing 4 key financial environments:

Rising Development (Financial enlargement)

Falling Development (Recession)

Rising Inflation

Falling Inflation (Deflation)

The normal allocation is:

30% Shares (e.g., S&P 500 or world equities)

40% Lengthy-Time period Treasury Bonds (for deflation safety)

15% Intermediate-Time period Treasury Bonds (for stability)

Further allocations to gold (7.5%) and commodities (7.5%) for inflation hedging.

The logic was that:

Shares carry out properly in development environments.

Lengthy-term bonds thrive in deflationary/recessionary intervals.

Gold & commodities defend towards inflation.

Why It Labored Earlier than 2022

From the Nineteen Eighties to 2020, the All Climate technique benefited from:

Falling rates of interest, which boosted bond returns.

Low inflation, which saved volatility in verify.

Steady financial development, supporting equities.

Nonetheless, the 2022 market regime shift disrupted this steadiness.

2. The 2022 Stress Take a look at: Rising Charges and Portfolio Drawdowns

In 2022, the Federal Reserve raised rates of interest from close to 0% to over 4% to fight inflation, the quickest tightening cycle in a long time. This had extreme penalties for the All Climate Portfolio:

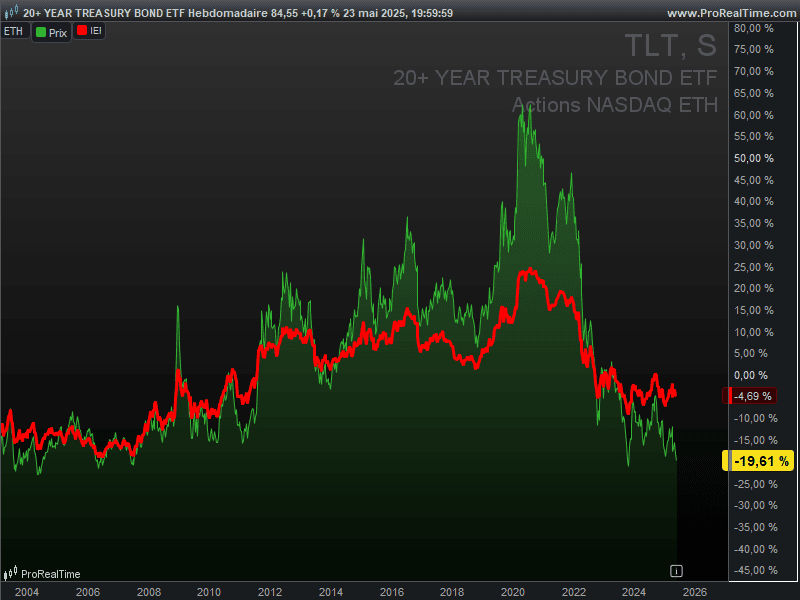

A. Bonds Suffered Historic Losses

Lengthy-term Treasuries (TLT in inexperienced) fell ~30%, their worst yr on report.

Intermediate bonds (IEF in purple) dropped ~10%.

Usually, bonds act as a hedge towards inventory declines, however in 2022, each shares and bonds fell concurrently, breaking the standard 60/40 portfolio’s diversification advantages.

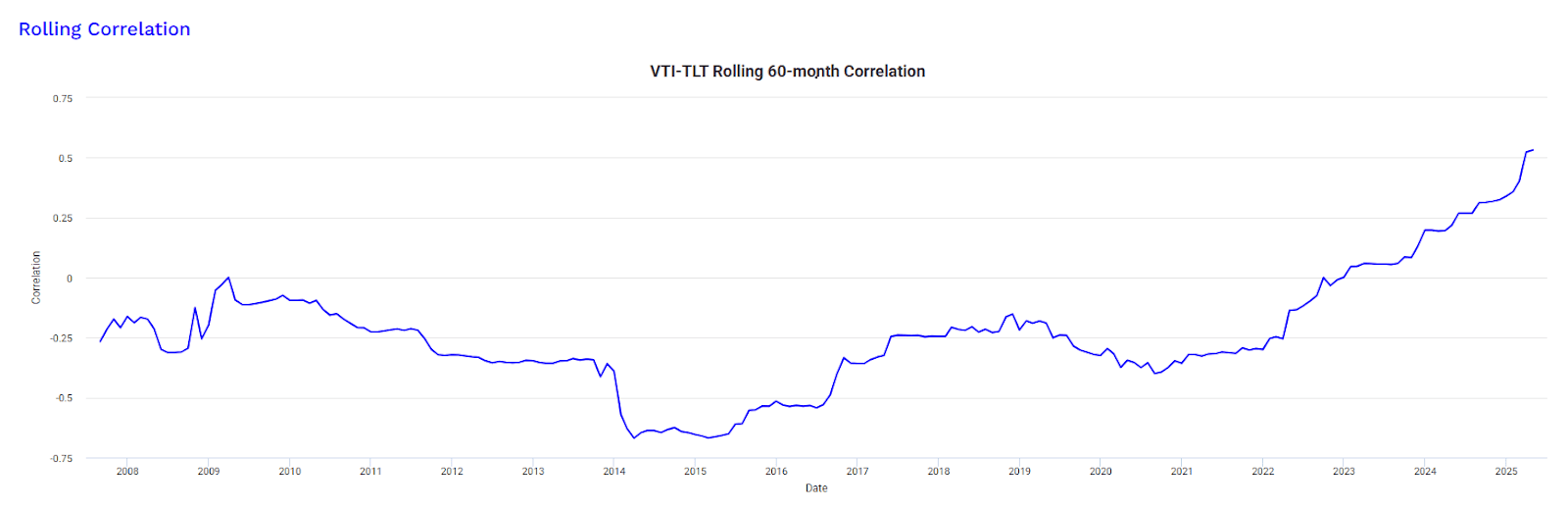

This chart reveals a major shift: the decades-long unfavorable correlation between TLT and VTI has disappeared since 2022.

B. Shares Declined As a consequence of Recession Fears

The S&P 500 dropped ~20% in 2022.

Development shares (particularly tech) had been hit hardest as greater charges diminished their future money movement valuations.

C. Gold & Commodities Had been Blended

Gold was flat to barely unfavorable (no yield in a rising-rate surroundings).

Commodities (oil, metals) surged early in 2022 however later corrected.

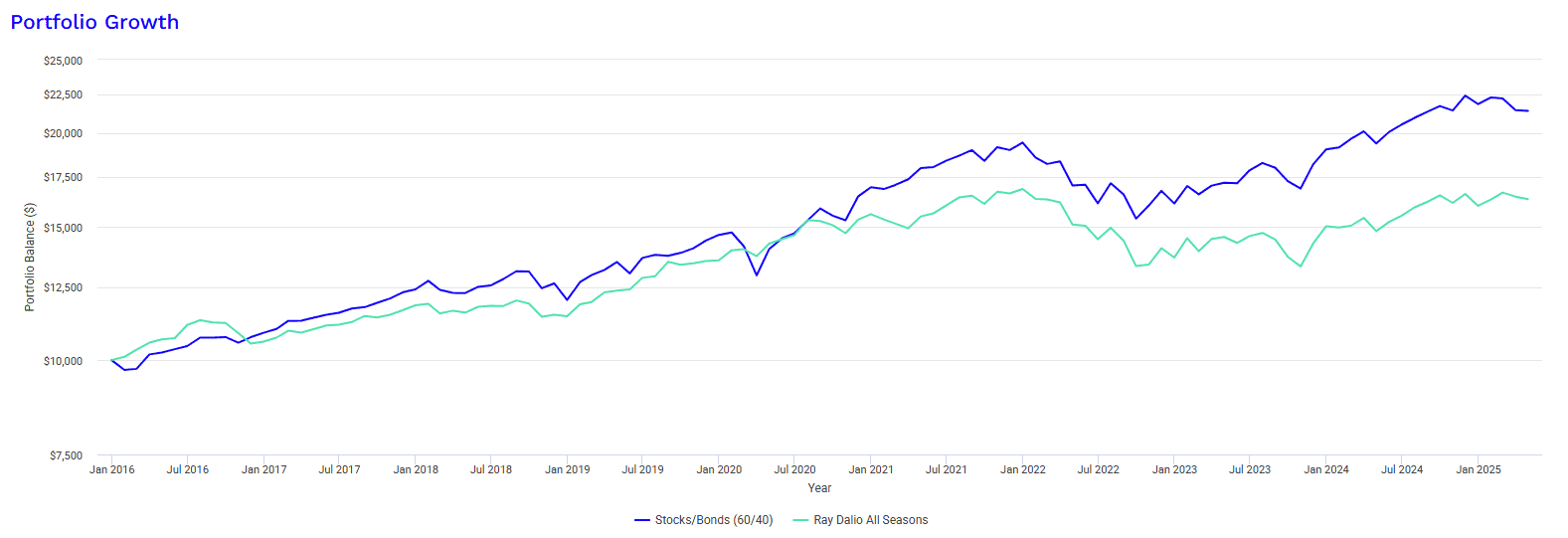

Outcome: The All Climate Portfolio Underperformed

Whereas it nonetheless fared higher than a pure 60/40 inventory/bond portfolio, the All Climate technique noticed important drawdowns (~15-20%), difficult its fame as a “set-and-forget” strategy.

3. Changes for a Larger-Fee Atmosphere

Given the regime shift, ought to traders abandon the All Climate technique? Not essentially however some changes may enhance resilience:

A. Period Threat Administration

Shorter-duration bonds usually exhibit much less sensitivity to rate of interest adjustments

TIPS are particularly designed to regulate for inflation, although their efficiency varies

B. Actual Asset Allocation

Commodities have traditionally proven resilience throughout inflationary intervals

REITs could supply twin advantages of earnings and potential inflation correlation

C. Diversification Approaches

Development-following methods demonstrated effectiveness throughout current risky markets

Present yield surroundings makes money devices extra engaging than in recent times

D. Adaptive Portfolio Development

Macroeconomic indicators can inform allocation changes, although timing is difficult

Common portfolio opinions assist align with altering market circumstances

Word on Implementation

These observations symbolize normal market rules. Precise portfolio selections ought to incorporate particular person circumstances, danger tolerance, {and professional} steerage. Market circumstances and funding outcomes are by no means assured.

4. Is the All Climate Technique Nonetheless Viable?

Regardless of the 2022 challenges, the All Climate Portfolio stays a strong long-term technique as a result of:

It’s designed for all cycles, not simply low-rate environments.

Larger bond yields now enhance future returns (10-year Treasuries at ~4.5% supply higher earnings than in 2020).

Inflation could stabilize, restoring bonds’ hedging function.

Nonetheless, traders ought to:

Anticipate decrease returns than within the 2010s.

Be ready for greater volatility in a world of elevated charges and inflation.

Think about a extra versatile model of danger parity (e.g., Bridgewater’s present strategy).

Conclusion

Ray Dalio’s All Climate Portfolio confronted its hardest check in 2022 as rising charges disrupted each shares and bonds. Whereas its efficiency was disappointing, the core rules of diversification and danger balancing stay sound.

Going ahead, traders could must:✔ Shorten bond length to cut back rate of interest danger.✔ Inflation linked bond (TIPS) to profit from sudden inflation rise.✔ Enhance actual belongings (commodities, REITs).✔ Keep versatile with tactical changes.

The All Climate technique isn’t damaged however like all portfolio, it should adapt to altering market regimes. For long-term traders, it stays a priceless framework, supplied they perceive its limitations in a high-rate world.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

Discussion about this post