On-chain knowledge exhibits that the HODLing sentiment on the Ethereum community has grown over 2024 whereas that sentiment on Bitcoin has misplaced energy.

75% Of All Ethereum Addresses Are Lengthy-Time period Holders

In a brand new put up on X, the market intelligence platform IntoTheBlock has talked about how Ethereum and Bitcoin examine in opposition to one another when it comes to long-term holders.

The “long-term holders” (LTHs) consult with the addresses which were carrying their cash since greater than a 12 months in the past, with out having concerned them in a single transaction.

It’s a statistical undeniable fact that the longer an investor holds onto their cash, the much less doubtless they grow to be to promote their cash at any level, so the LTHs, who maintain for considerable intervals, could be assumed to be fairly resolute entities.

Beneath is the chart shared by IntoTheBlock that exhibits how the proportion of LTHs has modified for Bitcoin and Ethereum over the previous 12 months.

Seems to be like ETH has surpassed BTC when it comes to this metric | Supply: IntoTheBlock on X

As displayed within the graph, Bitcoin began 2024 with the next proportion of its addresses qualifying as LTHs than Ethereum. Within the first few months of the 12 months, nonetheless, a shift began to happen as ETH’s HODLer proportion went up whereas BTC’s headed down.

It didn’t take lengthy earlier than the second-ranked cryptocurrency when it comes to market cap pulled forward of the first-ranked on this indicator. Ethereum started the 12 months with lower than 60% of its traders falling within the LTH group, however with the expansion in HODLing sentiment that has occurred all year long, the determine stands at 75% right this moment.

On the similar time, Bitcoin’s LTH proportion has repeatedly dropped, however the scale of the decline hasn’t amounted to a lot. Over 62% of the cryptocurrency’s traders are presently sitting on tokens dormant for greater than a 12 months.

The truth that extra traders have gotten diamond palms on the Ethereum community can naturally be constructive for the asset’s value, because it suggests there are fewer holders keen to half with their tokens. Bitcoin’s decline, alternatively, signifies a weakening of resolve, which can find yourself being bearish.

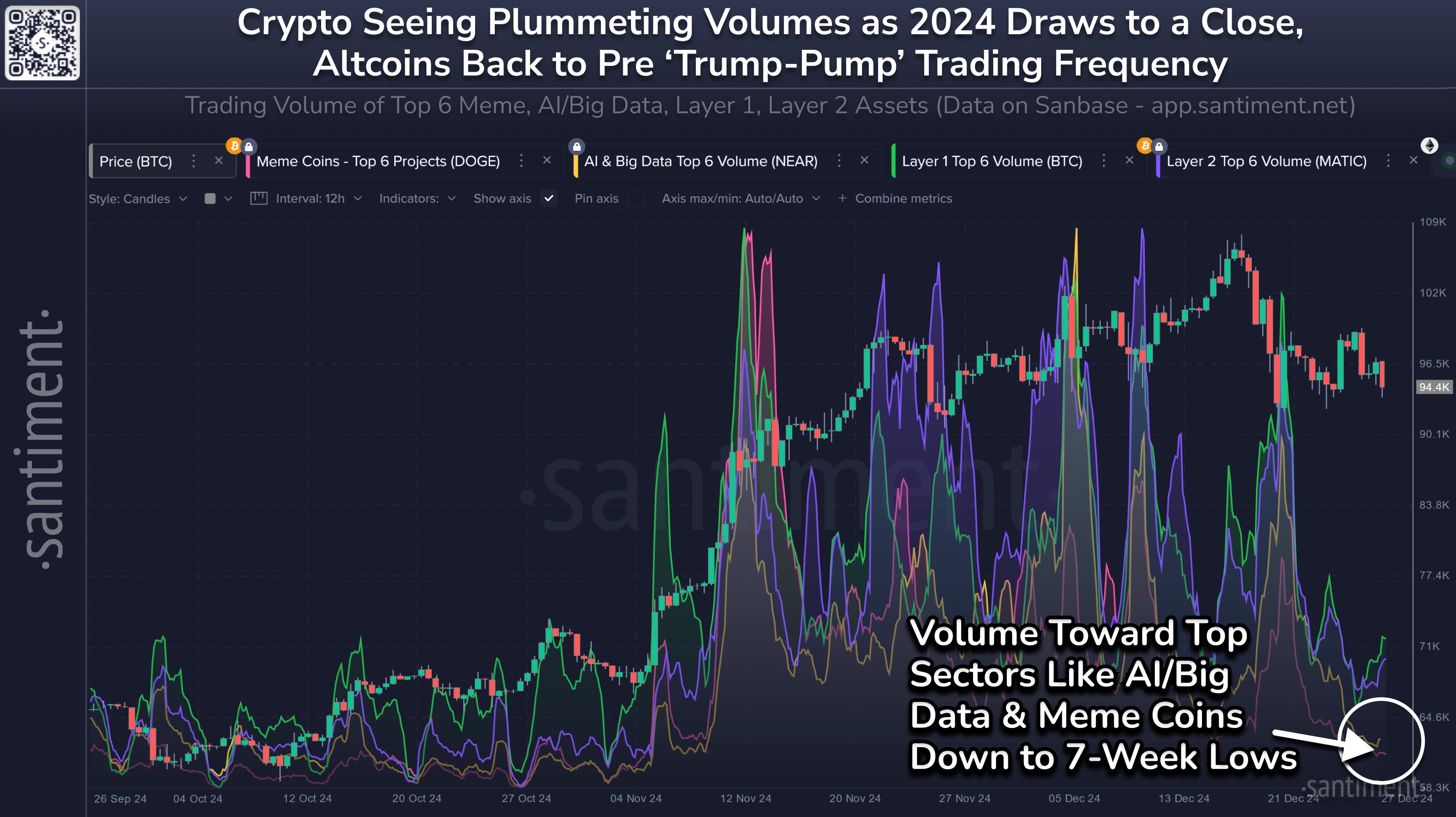

In another information, the cryptocurrency market is heading in direction of the top of 2024 on a chilly notice when it comes to buying and selling quantity, because the on-chain analytics agency Santiment identified in an X put up.

The development within the buying and selling quantity for the varied segments of the digital asset sector | Supply: Santiment on X

Within the above chart, knowledge for the mixed buying and selling quantity of the totally different market segments is proven. It seems that every one sides of the market, together with massive caps like Bitcoin and Ethereum, have seen a current decline in buying and selling exercise.

Traditionally, a low quantity of curiosity available in the market has typically meant a flat trajectory for the costs of the varied cash.

BTC Value

Ethereum has been consolidating sideways since its crash earlier within the month, as its value continues to be buying and selling round $3,350.

The value of the coin appears to have been following a downtrend in current days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, IntoTheBlock.com, chart from TradingView.com