Este artículo también está disponible en español.

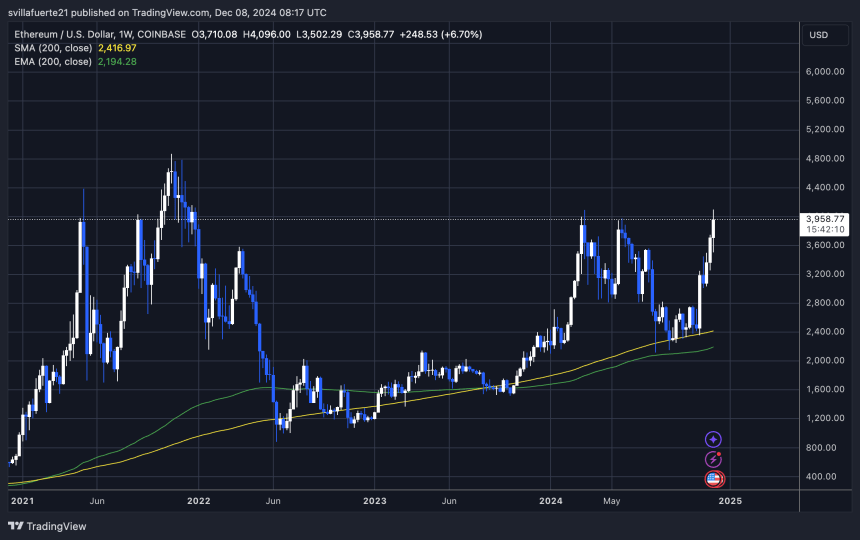

Ethereum (ETH) is making headlines because it tendencies towards the $4,100 mark, reaching a brand new yearly excessive of $4,096. This milestone, simply $3 above the earlier excessive set in March, indicators a possible resurgence for the second-largest cryptocurrency by market capitalization. The value motion has caught the eye of analysts and buyers, significantly as Ethereum continues to outperform expectations in a market dominated by volatility and uncertainty.

Associated Studying

Key metrics from IntoTheBlock shared by analyst Ali Martinez make clear the community’s exercise, revealing a surge in massive Ethereum transactions. Traditionally, such will increase in transaction quantity have been linked to important worth actions, suggesting that Ethereum’s present uptrend might have extra room to run. These developments trace at rising curiosity from institutional gamers and high-net-worth buyers, additional solidifying Ethereum’s place as a market chief.

The following few weeks promise to be pivotal as Ethereum approaches the yr’s finish. Will it maintain its momentum and shut the yr with a breakout above $4,100? Or will it face resistance and retrace? With on-chain exercise and market sentiment aligning in Ethereum’s favor, all eyes are on its subsequent transfer as merchants and buyers place themselves for what might be an thrilling near 2024.

Ethereum Transactions Surge With Value

Ethereum continues to dominate market discussions after pushing to new yearly highs on Friday. The cryptocurrency surged previous $4,096, surpassing its earlier peak set in March. This upward momentum has reignited investor curiosity, however Ethereum’s worth isn’t the one factor on the rise—its community exercise is booming as properly.

In line with information by analyst Ali Martinez (IntoTheBlock), massive Ethereum transactions are experiencing a major uptick. Martinez highlights that weekly transaction quantity has skyrocketed by over 300%, reaching a powerful $17.15 billion yesterday. This surge in community exercise indicators elevated confidence amongst institutional gamers and high-net-worth buyers, who usually precede retail adoption throughout main bull runs.

Such progress in transaction quantity traditionally correlates with sustained upward worth actions, suggesting Ethereum’s rally might not be over. Because the second-largest cryptocurrency by market cap, ETH seems well-positioned to proceed setting new highs if these tendencies persist.

Regardless of this optimism, ETH faces a key milestone forward—its all-time excessive of $4,878, set in November 2021, continues to be 20% away. Whereas Ethereum’s latest breakout has invigorated bulls, analysts warning that reaching and sustaining costs close to the ATH would require important buy-side strain and broader market power.

Associated Studying

If the present trajectory holds, Ethereum might method its ATH prior to anticipated, additional solidifying its standing because the go-to blockchain for decentralized purposes and monetary innovation. For now, buyers are carefully monitoring Ethereum’s worth motion and community information to gauge whether or not this rally has the momentum to interrupt new floor or if a pullback is imminent.

ETH Pushing Above $4k

Ethereum is at the moment buying and selling at $3,960, displaying resilience after reaching a neighborhood excessive of $4,096 simply two days in the past. This rally has introduced Ethereum again into the highlight, with buyers eyeing key ranges that would dictate its subsequent transfer.

A weekly shut above the essential $4,000 mark would sign the very best weekly shut for ETH since December 2021, a significant milestone for the second-largest cryptocurrency. Such an in depth would reinforce the bullish sentiment surrounding Ethereum, doubtlessly attracting extra buy-side strain and setting the stage for a continued rally towards its all-time excessive of $4,878.

On the flip facet, failure to realize a weekly shut above $3,880—its earlier highest weekly shut—might point out waning momentum. On this state of affairs, Ethereum could enter a consolidation section as merchants take income and the market digests latest beneficial properties. Consolidation under this stage would seemingly preserve ETH range-bound within the close to time period, with $3,880 and $4,000 performing as pivotal resistance ranges.

Associated Studying

The following few days will likely be essential as ETH navigates this essential juncture. A decisive weekly shut will seemingly decide whether or not Ethereum extends its present rally or pauses to consolidate, providing merchants alternatives and challenges on this dynamic market.

Featured picture from DALL-E, chart from TradingView