Desk of Contents:

Funding Methods for AI Shares

Market Developments in AI Shares

Benefits of Investing in AI Shares

Dangers of Investing in AI Shares

Components to Think about Earlier than Investing in AI Shares

Synthetic Intelligence (AI) swept from science fiction novels to the very core of industries world wide. AI is rising quickly and reworking fields like healthcare, finance, retail, and so forth. AI has turn out to be the middle of the technological innovation hotspot. Even, the buyers are drawn to the prosperity of those avenues. So, if you wish to dive into this wave of tech revolution, AI shares are your solely likelihood. Let’s discover the place to start or the right way to undergo this dynamic AI world. Let’s discover out!

What are the AI Shares?

Image Courtesy: idiot.com

AI shares consult with shares issued by corporations that create, apply, or have a robust curiosity in synthetic intelligence applied sciences. The businesses may develop AI fashions, embody AI of their enterprise actions, or present companies to corporations keen to use AI. The AI shares characterize software program giants to area of interest startups altering industries with automation, machine studying, and large information analytics.

The three kinds of AI shares embody:

Core AI Builders: Firms that preserve themselves on AI expertise, be it neural networks or pure language processing.

AI Adopters: Organizations utilizing AI to enhance an current services or products.

AI Infrastructure Suppliers: Firms that supply {hardware}, cloud environments, or information wanted to construct AI programs.

Finest AI Shares for 2024-2025:

The AI inventory market is brimming with potential, however choosing the right investments requires analysis and foresight. Right here’s a listing of high AI shares to observe for 2024-2025:

1. NVIDIA (NVDA):

Trade: Semiconductors

AI Software: The chief of the market, NVIDIA develops the GPUs that prepare and run AI fashions and inform functions in autonomous automobiles, information facilities, and generative AI.

2. Microsoft (MSFT):

Image Courtesy: ThoughtCo

Trade: Software program and Cloud

AI Place: It’s a sturdy strategic funding over ChatGPT’s creators OpenAI, with AI integrated into its Azure Cloud to make them a frontrunner on this house. For his or her enterprise instruments, they’ve now built-in generative into all productiveness apps beneath the Workplace 365 branding.

3. Alphabet (Google) (GOOGL):

Image Courtesy: wallpapersden.com

Trade: Web and Cloud

AI Position: Alphabet has been constructing quite a lot of completely different types of AI into its search algorithm, together with Bard AI assistant and TPUs that execute AI fashions effectively.

4. Meta Platforms (META):

Image Courtesy: brandemia.org

Trade: Social Media and Metaverse

AI Position: Meta has been investing aggressively in AI to gas new improvements each within the metaverse and social platform experiences, particularly utilizing generative and predictive AI to deepening person engagement.

5. Amazon (AMZN):

Image Courtesy: moneycontrol.com

Trade: E-commerce and Cloud

AI Position: As one among AWS’s sturdy AI choices, instruments for machine studying and collaborations with Anthropic are used for generative AI analysis.

6. Palantir Applied sciences (PLTR):

Image Courtesy: techstory.in

Trade: Knowledge Analytics

AI Position: Palantir AI is used for protection functions and enterprise-level decision-making expertise, specializing in predictive analytics.

7. Adobe (ADBE):

Image Courtesy: Periods Faculty for Skilled Design

Trade: Artistic Software program

AI Position: Utilizing generative AI instruments corresponding to Firefly, Adobe has introduced new revolutions in content material creation and productiveness beneficial properties into inventive workflows.

8. Tesla (TSLA):

Image Courtesy: Digital Developments

Trade: Automobiles and Robotics

AI Position: Dojo AI chips from Tesla allow the corporate’s improvement in self-driving, reiterating the automotive innovation supremacy pushed by AI.

9. Intel (INTC):

Image Courtesy: WCCFtech

Trade: Semiconductors

AI Position: Intel develops AI accelerators and edge computing {hardware} which might be pivotal for real-time AI processing.

10. UiPath (PATH):

Image Courtesy: uipath.com

Trade: Automation Software program

AI Position: UiPath leverages AI for robotic course of automation (RPA), simplifying and automating enterprise workflows.

Funding Methods for AI Shares:

Investing in AI shares requires a considerate technique as a result of sector’s fast innovation and potential volatility. Listed below are key methods to maximise returns whereas managing dangers:

1. Diversify Your Portfolio:

Why It’s Vital: AI shares are very broad, starting from semiconductors (NVIDIA) to cloud computing (Microsoft, Amazon), and information analytics (Palantir). Diversifying away from one among these sectors would not less than reduce the damages to dangers of overexposure to at least one market phase.

How one can Implement: Purchase Change-Traded Funds (ETFs) corresponding to World X Robotics & Synthetic Intelligence ETF (BOTZ) to supply diversified publicity to AI expertise.

2. Focus Markets Leaders and Innovators:

Why It’s Vital: Firms corresponding to NVIDIA and Alphabet enter with flying colours and a confirmed file when it comes to balanced monetary well being and a profitable historical past in AI innovation and are making dangerous investments in contrast with smaller, not well-established corporations.

How one can Implement: Analysis the monetary stability, AI challenge pipeline, and historic efficiency earlier than investing.

3. Lengthy Time period Funding:

Why It’s Vital: AI adoption is predicted to be exponential inside the coming decade. Lengthy-term investments assist in using the storms of volatility within the brief time period and benefiting from compounding returns.

How one can Implement: Focus extra on corporations with a transparent roadmap for the event of AI, and people who even have a constant reinvestment in R&D.

4. Observe Valuation Metrics:

Why It’s Vital: Some AI shares could also be overhyped and their inventory inflated. Use valuation metrics just like the Value-to-Earnings (P/E) ratio and the Value-to-Gross sales (P/S) ratio to be sure you’re investing in corporations at affordable valuations.

How one can Implement: Examine valuation metrics to business averages and benchmarks from rivals. After all, metrics could also be inaccurate, however it is a good approximation.

5. Keep Up to date with Trade Developments:

Why It Issues: AI’s dynamic nature makes it more and more common when it comes to pace as new functions are developed. Staying up to date would, thus, assist establish these early alternatives in rising applied sciences like generative AI, autonomous programs, or AI chips.

How one can Implement: Monitor monetary information, business studies, and skilled axes to be stored forward of the pack.

Market Developments in AI Shares:

Image Courtesy: studies.valuates.com

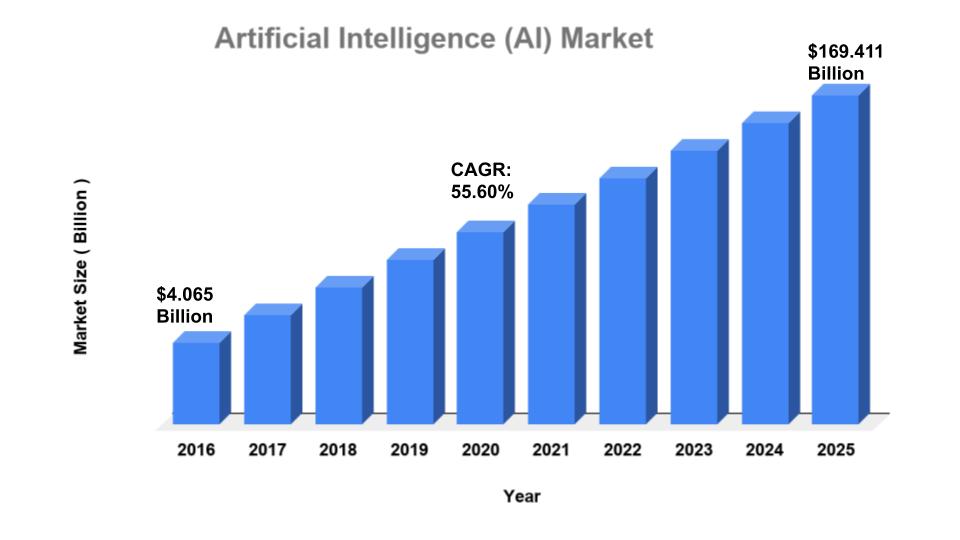

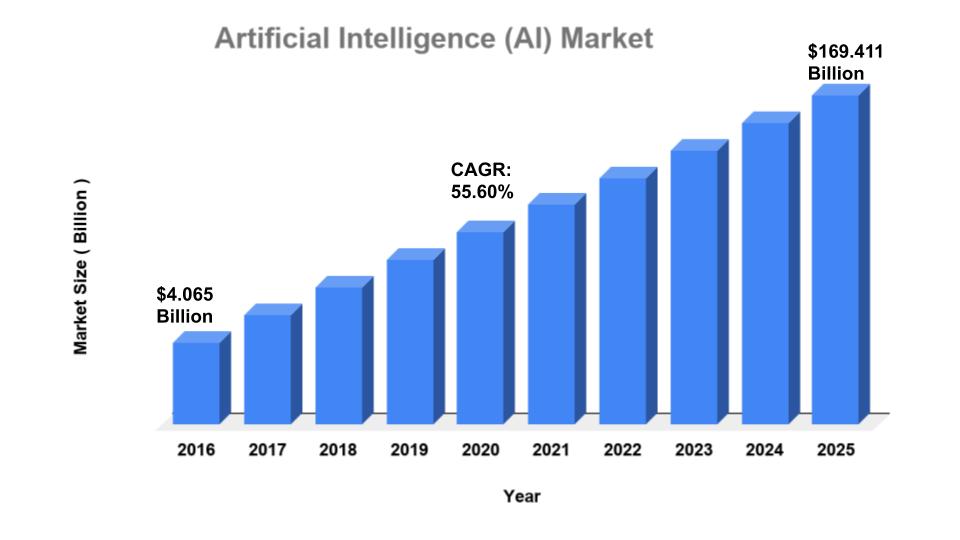

The AI market continues to exhibit sturdy progress, pushed by advances in expertise and rising adoption throughout industries. Listed below are key traits shaping the AI funding panorama:

1. Generative AI Increase:

Generative AI instruments corresponding to ChatGPT by OpenAI or Adobe Firefly have been ushering in a brand new paradigm within the industrial elements corresponding to content material era, customer support, and training. The leaders of the pattern itself witness fast progress in the direction of it, corresponding to these corporations producing synergistic outputs with OpenAI like Microsoft.

2. Elevated Adoption by Firms:

AI is used seamlessly all through industries of their working gadgets. They invested appreciable quantities into automation, predictive analytics, and buyer engagement apps. This might finally translate into extra options required for the AI of the cloud suppliers, as an example, AWS and Google Cloud.

3. Specialised AI {Hardware}:

Semiconductors of AI workloads, corresponding to GPUs from NVIDIA or AI accelerators of Intel, are related for this rising sector. Future innovation coming from hardware-obsessed corporations is prone to see steady high-demand progress.

4. Give attention to Moral and Sustainable AI:

Buyers regulate corporations with moral AI, specifically transparency, equity, and discount of power consumption. It might have an effect on the funding choices within the coming years.

5. AI in Rising Markets:

These rising nations are beginning to adapt AI to agriculture, healthcare, and training, making India, Bangladesh, and most African areas prime targets for any firm anxious to discover the rising markets since they may discover themselves with hundreds of thousands of shoppers all in search of progress.

6. Affect of Authorities and Regulation:

Governments world wide are imposing laws on AI to make sure its socially accountable use and utility. These corporations that adjust to these laws from early instances may purchase a aggressive benefit.

Benefits of Investing in AI Shares:

Investing in AI shares gives a number of compelling advantages:

1. Excessive Development Potential:

The adoption of AI expertise is foreseen to develop exponentially throughout many industries starting from healthcare, and finance to manufacturing. Firms that belong to this phase can reap the advantages of a quickly rising market.

2. Diversified Trade Impression:

Synthetic intelligence shouldn’t be confined to only one sector. It’s on the forefront of innovation in assorted streams corresponding to autonomous automobiles, and cloud computing, and offers buyers a whole portfolio in itself.

3. Technological Management:

Investing in corporations which have moved into the entrance line of AI innovation, corresponding to NVIDIA, Alphabet, or Microsoft, can result in possession of a few of the greatest.

4. Improve Income and Effectivity:

Most corporations which might be implementing AI options are saving substantial prices with large income uplifts, thus rising the worth of those corporations offering such expertise.

5. Lengthy-Time period Investments Horizon:

As a disruptive expertise, AI will have an effect on world economies over fairly a very long time span, making it certainly extremely engaging as a long-term funding alternative.

Dangers of Investing in AI Shares:

Investing in AI shares gives thrilling alternatives, but it surely additionally comes with sure dangers. Listed below are some key dangers to contemplate:

1. Excessive Valuation and Market Volatility:

AI shares are often overvalued due to market hype. Overvaluation can lead to sharp worth corrections, which makes these shares susceptible to volatility.

2. Technological Uncertainty:

AI is a fast-changing space, and applied sciences can turn out to be out of date in a single day. Firms that make investments closely in a single AI strategy might lose out if one other strategy proves superior.

3. Regulatory Challenges:

Governments across the globe are implementing AI laws primarily based on moral concerns and information safety. Modifications in regulation add to operational prices and impede innovation.

4. Dependence on Market Leaders:

Most AI corporations must rely upon collaborations or applied sciences supplied by market leaders corresponding to NVIDIA or Microsoft. The collapse of those relationships might closely have an effect on smaller corporations.

5. Financial and Geopolitical Dangers:

Financial slowdown or political tensions, as an example, between the U.S. and China, can disrupt provide chains, analysis spending, and AI expertise adoption.

6. Capital Intensive:

AI improvement requires an enormous funding in R&D. Smaller corporations lack the sources to compete with big expertise corporations.

7. Overhyped Returns:

AI shares usually construct a variety of hype however, in actuality, AI options take longer than anticipated time to deploy in real-time and thus the returns on investments.

8. Competitors and Market Saturation:

The AI market is all the time experiencing new entrants getting into the fray. This retains on diluting market shares and profitability for the main gamers.

Components to Think about Earlier than Investing in AI Shares:

There are some components that you’ve got to remember earlier than investing:

1. Firm Fundamentals: Assess an organization’s monetary well being, income streams, and reliance on AI applied sciences.

2. Aggressive Benefit: Firms with distinctive AI choices or mental property are higher positioned for achievement.

3. Market Developments: Determine traits corresponding to AI’s function in automation, healthcare, or sustainable options to select promising shares.

4. Threat Urge for food: AI shares will be risky. Guarantee your funding aligns along with your danger tolerance.

5. Regulatory Atmosphere: Think about the impression of AI laws on an organization’s operations and income.

Investing in AI shares is an thrilling journey into the way forward for expertise. Firms like NVIDIA, Alphabet, Microsoft, and Tesla are on the forefront of this transformation, providing alternatives for substantial returns. Nevertheless, as with all funding, thorough analysis, diversification, and danger evaluation are key to success.

So, what are your ideas on AI investments? Are you able to make the leap into the world of AI shares, or do you have got questions concerning the market? Let’s proceed the dialog within the feedback under!

For extra insights and updates on Blockchain, NFT, DeFi, Web3, be sure you subscribe to our e-newsletter. Keep knowledgeable on the newest traits and developments within the decentralized world!