After weeks of heavy promoting strain and protracted damaging sentiment, Ethereum is lastly displaying indicators of life. Bulls are stepping again in, trying to reclaim vital worth ranges and reverse the bearish pattern that has outlined latest months. Regardless of the renewed momentum, ETH nonetheless trades under the important thing $2,000 mark—a stage that should be breached to substantiate a significant shift in market construction and set the stage for a sustained restoration.

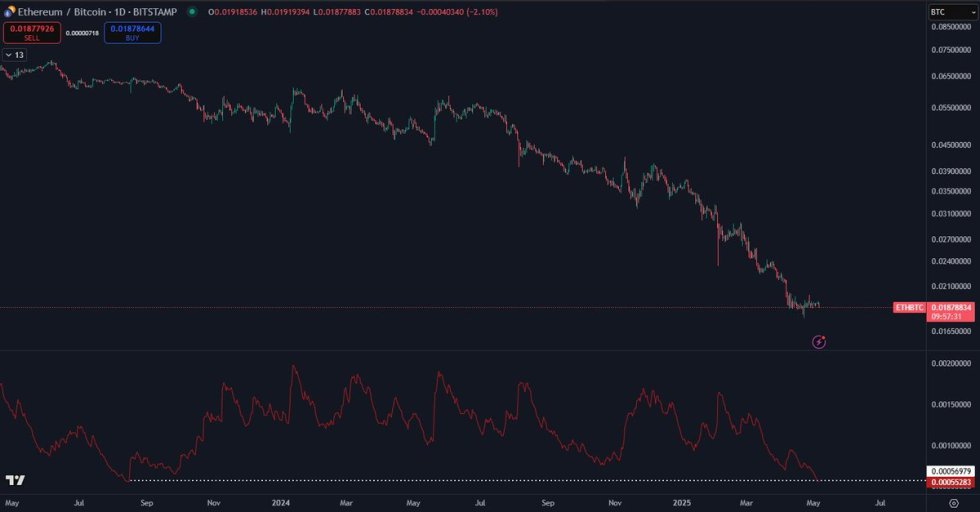

As merchants assess Ethereum’s outlook, consideration can also be turning to the ETH/BTC ratio, which has reached its lowest volatility stage in additional than two years. Based on high analyst Daan, this metric has been in a chronic downtrend, however has now stalled for over a month. Traditionally, such low-volatility durations usually precede sharp directional strikes, because the market builds strain and prepares for a breakout or breakdown.

Whereas Ethereum’s worth stays technically fragile, the mix of decreased volatility, long-term help on the ETH/BTC pair, and renewed bullish momentum on the USD chart is making a cautiously optimistic setup. The approaching days might be essential as ETH assessments resistance. A confirmed breakout above $2,000 might be the sign that Ethereum’s subsequent leg larger is about to start.

Ethereum Struggles Under $1,900 As Threat And Uncertainty Dominate

Ethereum is going through renewed strain after failing to interrupt above the $1,874 excessive set on Might 1st, leaving bulls with the pressing process of reclaiming momentum earlier than volatility takes over. The asset is at present buying and selling close to vital help, unable to determine a transparent course as world markets stay fragile. With Ethereum nonetheless down greater than 55% from its December highs, the bearish worth construction stays intact, and any additional weak spot may set off deeper draw back.

Market volatility is being fueled by macroeconomic uncertainty, notably because the U.S. and China proceed to interact in high-stakes commerce negotiations. Traders are cautious, and Ethereum’s incapacity to point out power amid a broader crypto restoration is elevating considerations about its near-term outlook.

Including to the complexity, Daan highlights that the ETH/BTC ratio is now at its lowest volatility stage in over two years. Whereas the ratio has been in a long-term downtrend, it has stalled for the previous month, suggesting {that a} breakout (or breakdown) might be close to.

Traditionally, such compression durations usually precede sharp strikes. Nonetheless, Daan notes that the low timeframe pattern has not but flipped bullish, and till it does, any rally ought to be handled with warning. For now, Ethereum stays caught in limbo.

Value Motion Particulars: ETH Testing

Ethereum is buying and selling at $1,831, displaying modest power after bouncing from latest help close to $1,780. On the 4-hour chart, ETH is trying to determine the next low and reclaim bullish momentum, however it nonetheless faces stiff resistance under the important thing $1,874 excessive from Might 1st. Value is consolidating simply above the 200-period EMA at $1,787 and the 200-period SMA at $1,699—two ranges which have served as dynamic help and resistance zones all through latest buying and selling classes.

This sideways motion highlights indecision as ETH struggles to interrupt free from its vary, with volatility compressing and quantity remaining muted. A clear breakout above $1,874 may sign the beginning of a bullish leg concentrating on the psychological $2,000 mark. Nonetheless, failure to carry above the $1,780–$1,750 area would doubtless invalidate the construction and open the door for additional draw back.

Technical indicators recommend that momentum is constructing, however not but confirmed. Till Ethereum reclaims the $1,900–$2,000 vary, the broader bearish pattern stays in play. For now, ETH is in a vital zone the place each bulls and bears have a case, making the following few classes pivotal in figuring out whether or not Ethereum continues to get well or resumes its downtrend.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post