In his current SmartCon 2024 keynote, Sergey Nazarov explored how TradFi and DeFi are converging right into a single unified Web of Contracts by means of Chainlink. This put up relies on his presentation.

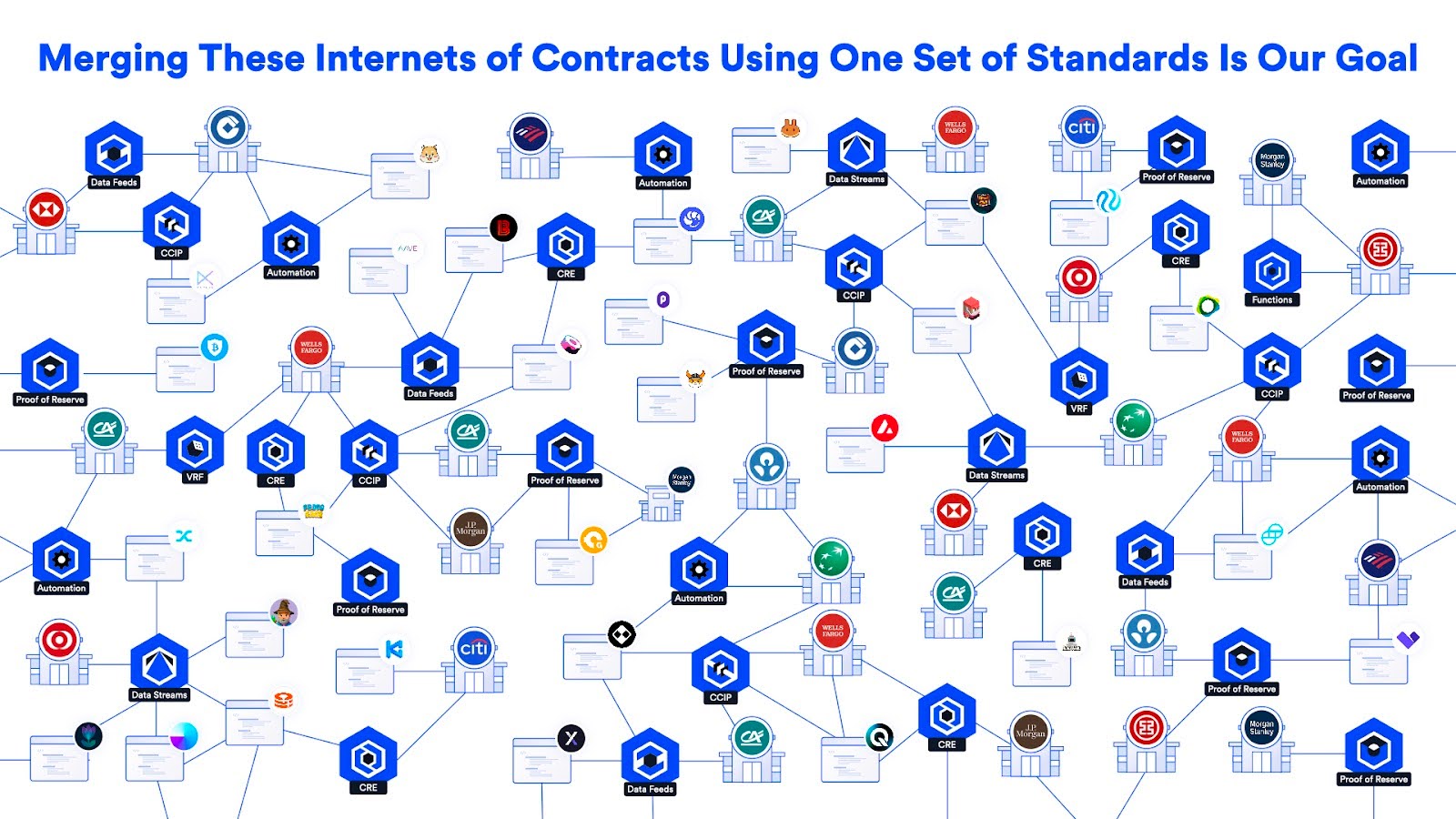

Our basic aim is to determine a world commonplace—one which works throughout each DeFi and conventional capital markets. These two sectors are set to converge, and once they do, we count on it is going to create an financial growth by combining right into a single world Web of Contracts. Chainlink’s mission is to steer this transformation by creating the usual powering this new onchain monetary system.

At present, these two worlds—DeFi and TradFi—are evolving in separate instructions. We’ve already made vital strides in establishing Chainlink as the usual for DeFi by powering a good portion of it, securing $75+ billion in DeFi TVL at its peak. Now, we’re additionally making progress in turning into the usual for TradFi capital markets.

The last word aim is to create functions that work seamlessly collectively, defining the usual for a way worth is transacted throughout your complete monetary system. That’s what success seems to be like—constructing a world commonplace that powers the Web of Contracts, which we count on will result in the financial growth that may consequence from merging these two worlds right into a single world market.

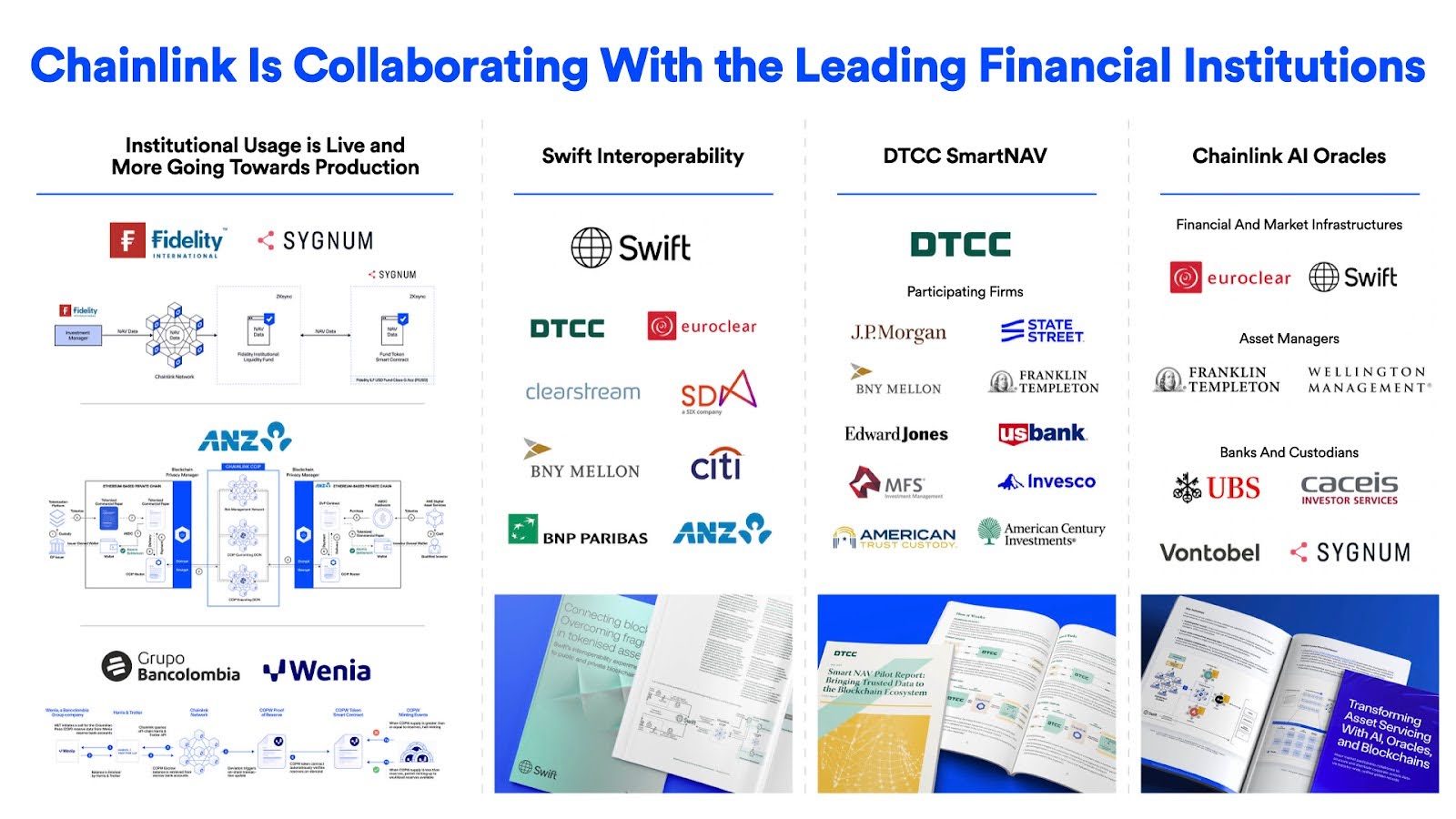

We’ve made vital progress inside TradFi markets. Along with DeFi, we’ve implementations in manufacturing for big asset managers, a number of collaborations with main monetary market infrastructures, and we’re in numerous phases of implementation with a few of the greatest banks and asset managers on the planet. Identical to we’ve efficiently established Chainlink as a world commonplace for the DeFi group, this 12 months we’ve made nice strides towards creating the usual for capital markets.

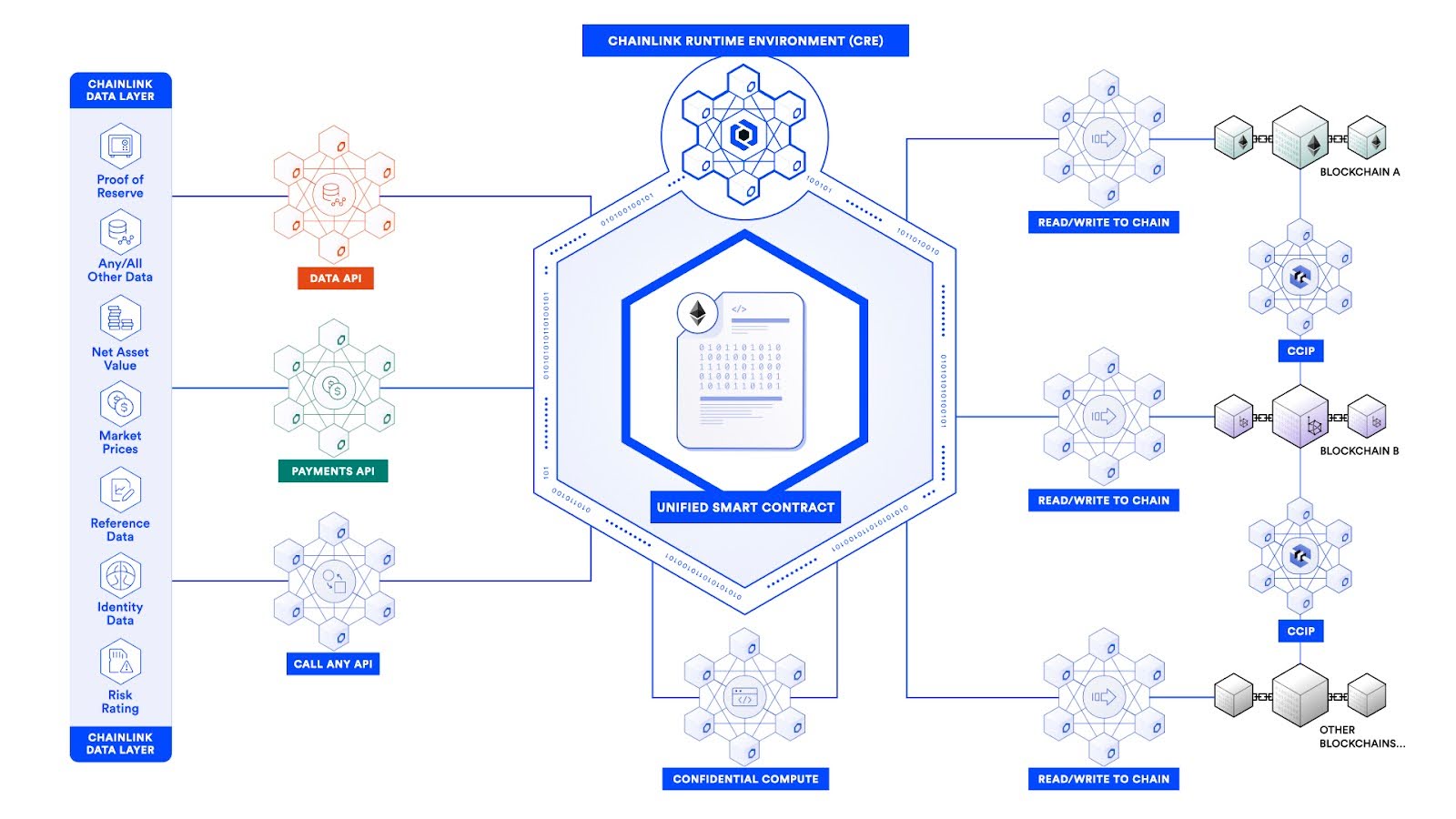

We’ve achieved this by offering a complete set of providers: knowledge, proof of reserves, id, cross-chain, and extra—all built-in into contracts. One key lesson we’ve discovered alongside the way in which is the necessity for a unified system to weave collectively these providers, blockchains, sensible contracts, and fee techniques right into a single utility.

Introducing the Chainlink Runtime Atmosphere (CRE)

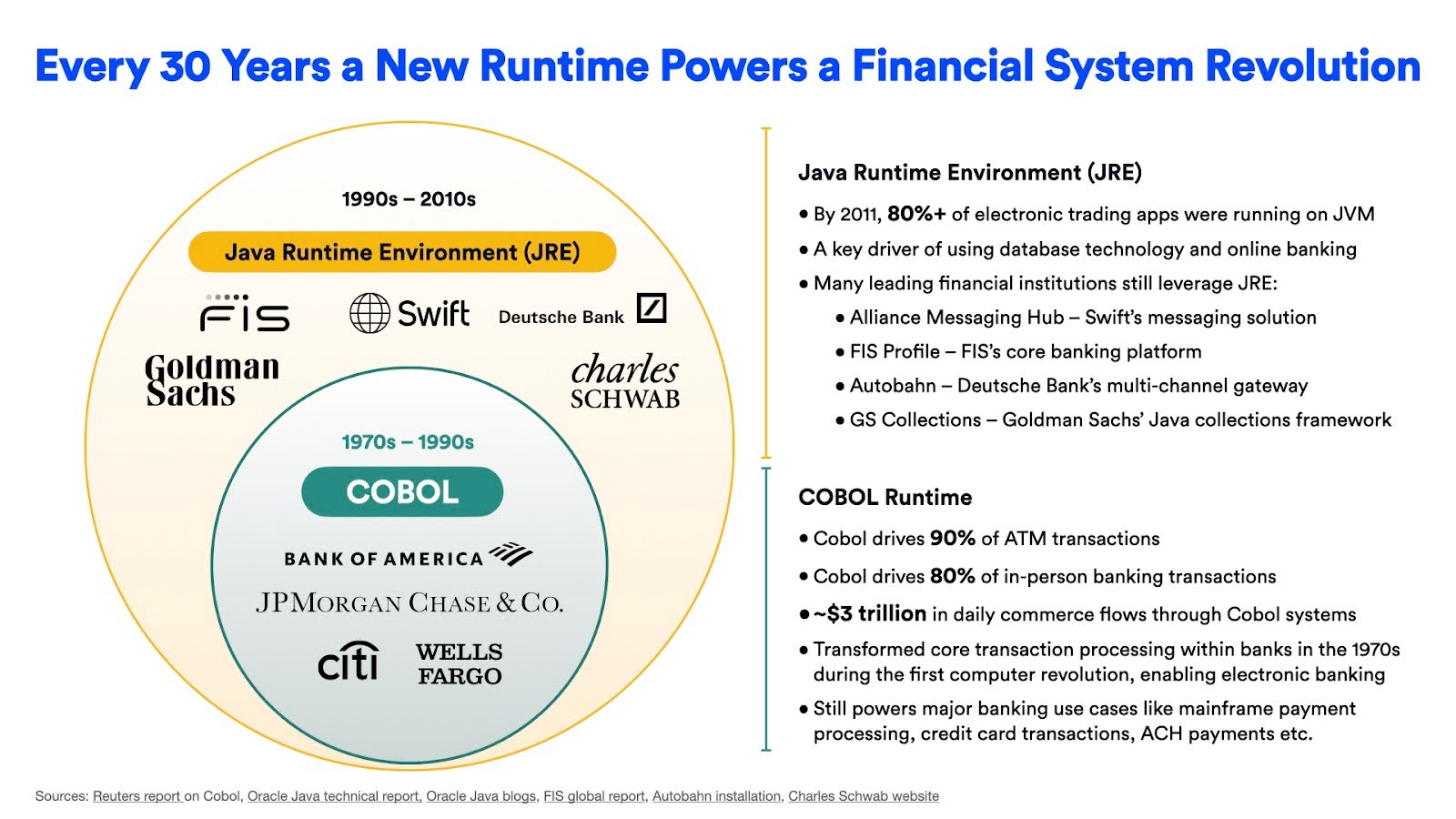

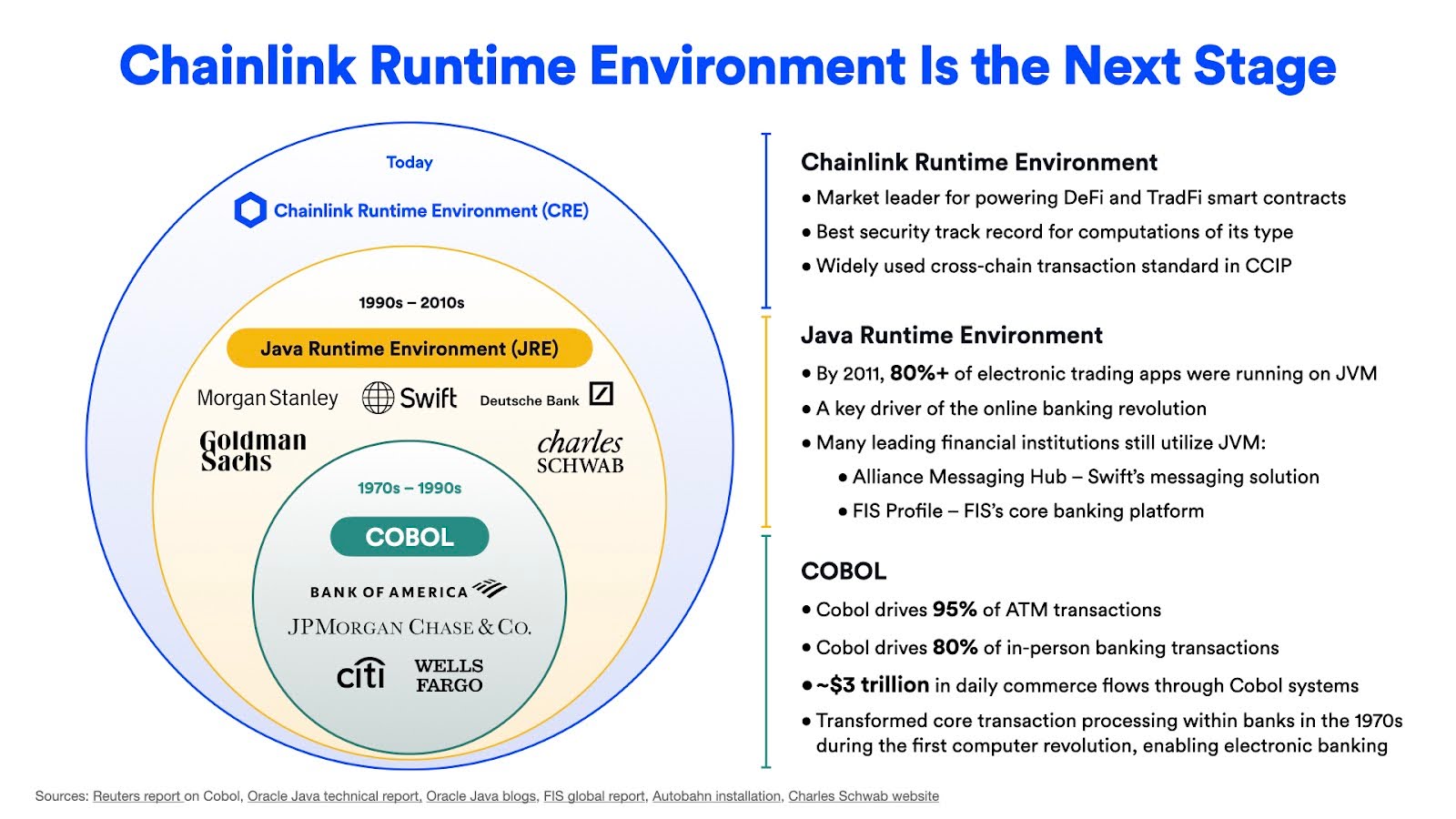

Wanting again on the historical past of monetary functions, every financial growth has been pushed by the simplification of latest applied sciences. Within the Seventies, the introduction of COBOL as a runtime expertise simplified interactions with databases and created the primary digital banking transactions. Equally, within the Nineties, the Java Runtime Atmosphere (JRE) simplified the interplay between new database applied sciences and the Web, paving the way in which for on-line banking.

Now, because the world’s worth migrates throughout a whole bunch of chains and 1000’s of oracle networks, the chance to unify these techniques right into a single utility has emerged. The aim is to permit builders to create superior functions far more rapidly than earlier than—inside days and even hours. This simplification is what has pushed financial booms up to now, and it’s what we purpose to do now with the Chainlink Runtime Atmosphere.

The Chainlink Runtime Atmosphere (CRE) is designed to play the identical function that COBOL and JRE performed in earlier financial booms in the previous couple of a long time. The CRE will coordinate blockchain applied sciences, oracle networks, and sensible contracts right into a unified utility. By simplifying the complexities of interacting with a number of techniques, the CRE will present builders with an atmosphere to simply combine current knowledge, techniques, and new blockchain applied sciences right into a single utility—that is the subsequent step in simplifying blockchain utility improvement.

We’ve already seen this work with the Swift community. Via the CRE, we built-in Swift messages with a number of blockchains to create a seamless transaction circulate. A small quantity of engineering sources was wanted to attain this, demonstrating the CRE’s energy in simplifying complicated techniques. This answer was showcased at Swift’s Sibos convention and obtained a robust response. The power to coordinate Swift messages and blockchain occasions securely and effectively is only one instance of how the CRE will simplify cross-chain interoperability and make complicated techniques extra manageable.

The adoption of the Chainlink Runtime Atmosphere is a crucial piece of our imaginative and prescient for the long run. It’s designed to unify these complicated providers into one cohesive utility, permitting builders to jot down code in languages they’re already acquainted with, reminiscent of Go and TypeScript, with different languages like Rust into account. We consider this may result in widespread adoption and make it simpler for builders to construct functions that combine sensible contracts, blockchain applied sciences, knowledge, and funds—in the end resulting in the creation of a world, interconnected community of contracts.

Privateness Is the Key to Unlocking Institutional Adoption

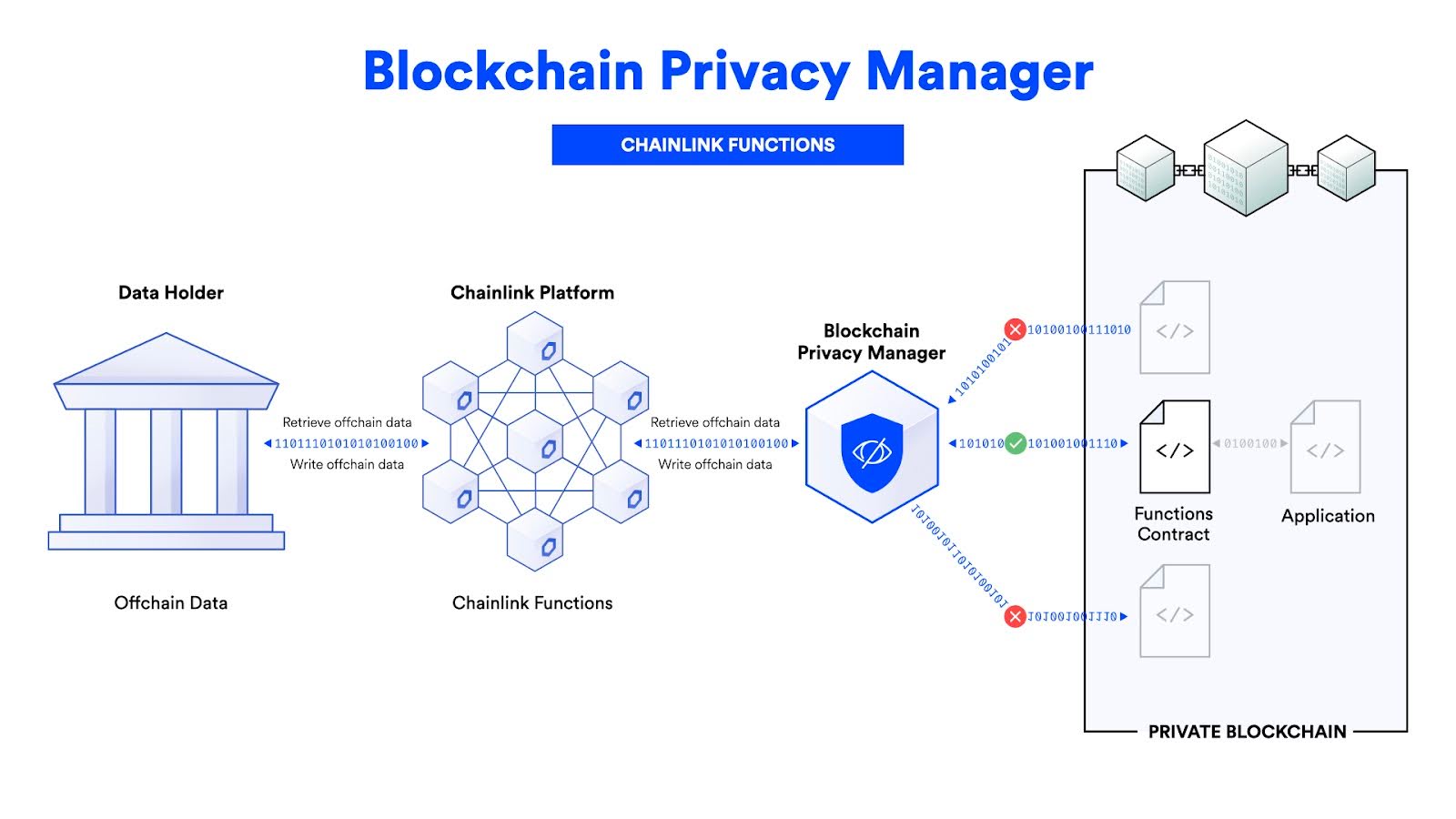

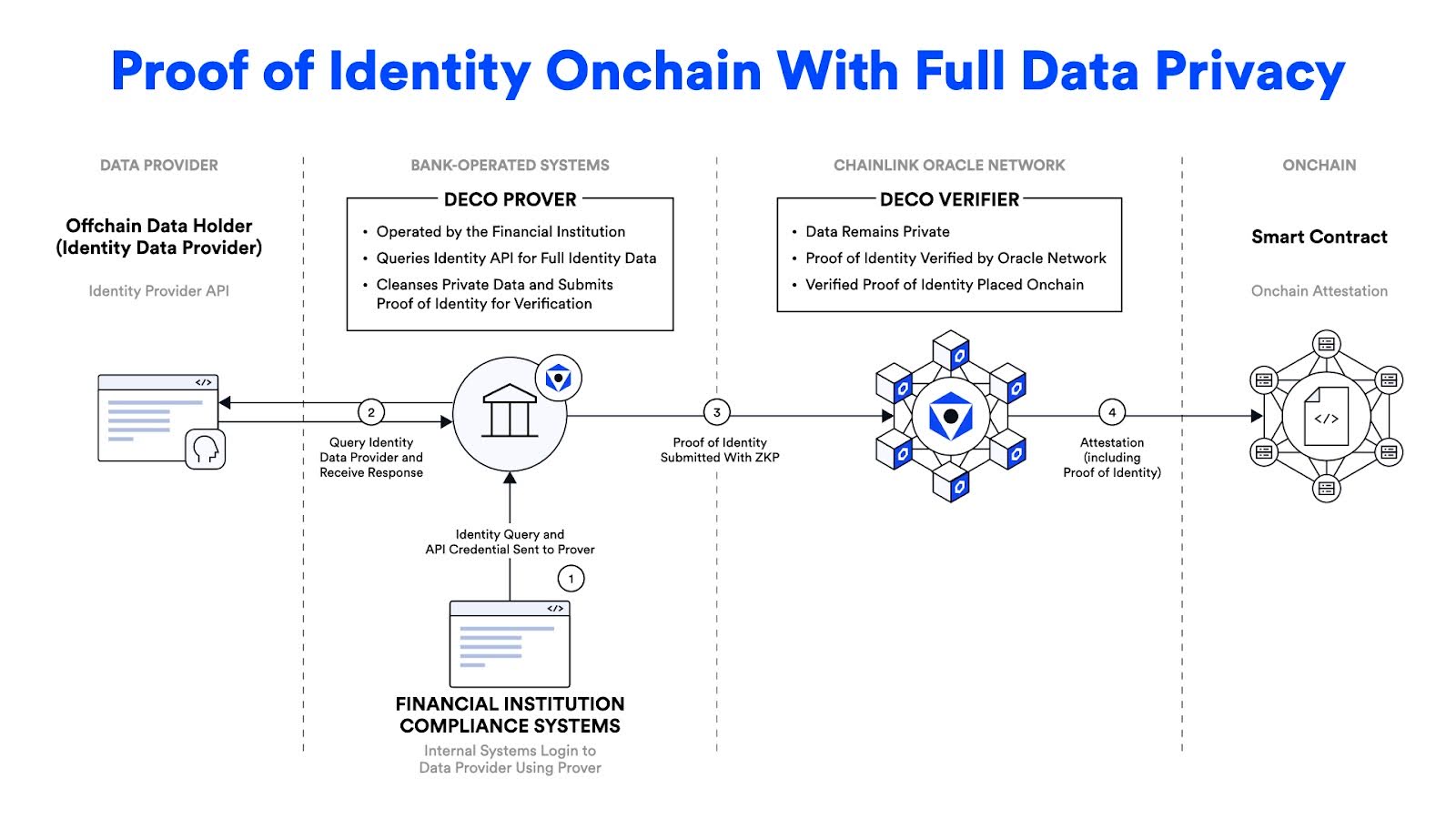

As we proceed to innovate, we’re additionally addressing privateness in blockchain transactions. For institutional transactions, privateness is crucial, and that’s why we’ve launched the Blockchain Privateness Supervisor. This device helps handle privateness throughout numerous chains by defining what data can and may’t depart a sequence. We’ve additionally utilized this device to Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to create non-public transactions, important for institutional customers.

Moreover, we’re releasing instruments just like the DECO Sandbox, which permits builders to use zero-knowledge proofs to any API and show knowledge data with out revealing delicate particulars. It is a vital development for privateness, particularly in sectors like id administration and proof of funds, the place confidentiality is essential.

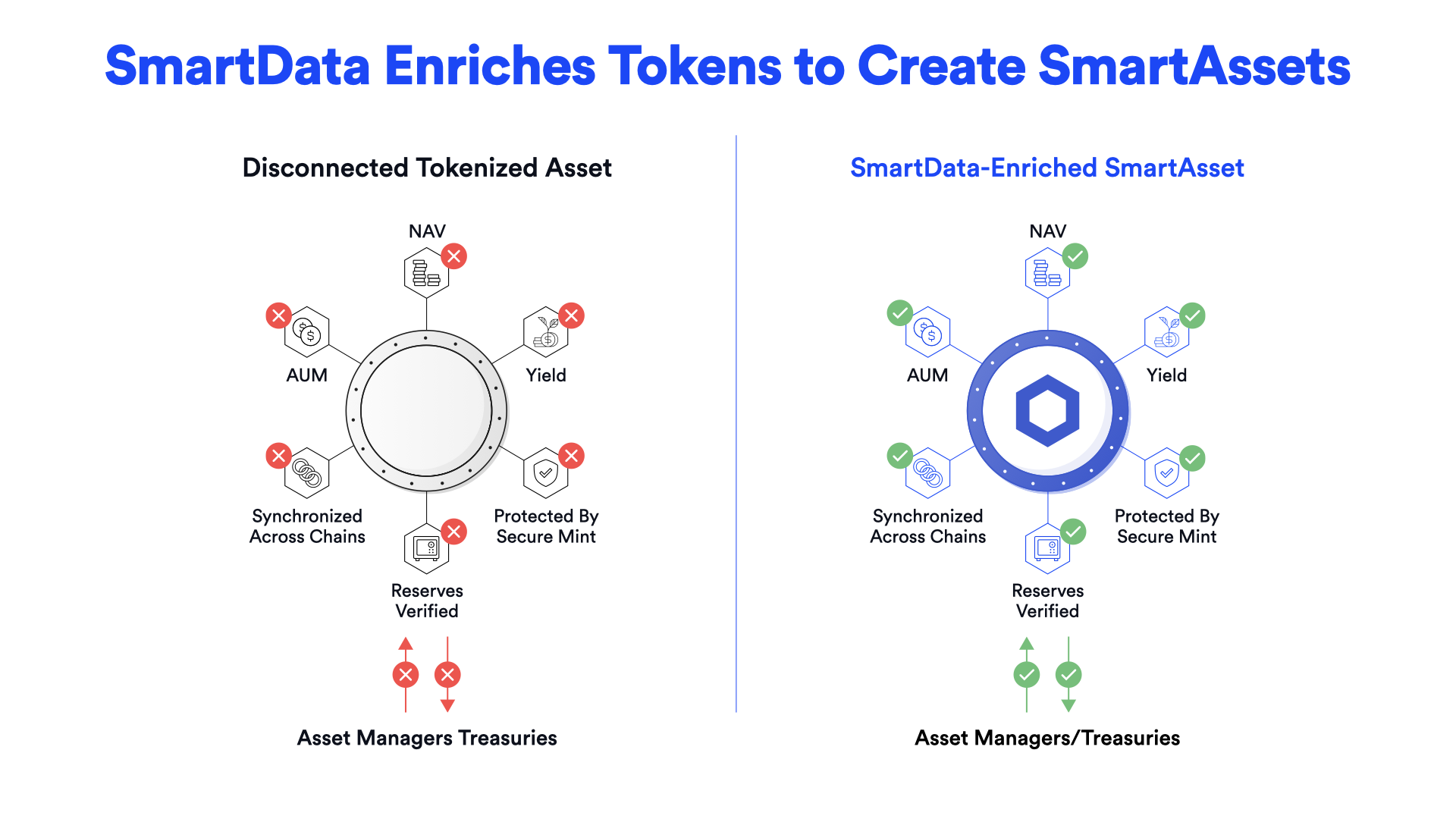

SmartData Results in SmartAssets

We additionally acknowledge the significance of making knowledge requirements. Chainlink is quickly turning into the usual for proof of reserves, a crucial ingredient within the reliability of stablecoins and commodity-backed belongings. The work we’re doing with the SmartData commonplace will additional increase the forms of knowledge that may be reliably transmitted onchain, resulting in the creation of SmartAssets which can be enriched and managed by extremely dependable knowledge feeds.

The Subsequent Evolution of Chainlink CCIP

Lastly, our imaginative and prescient extends to the continued evolution of CCIP. With options like Programmable Token Transfers, CCIP is being adopted by main blockchains as their canonical bridge answer, offering a dependable and safe technique to switch tokens throughout chains. The power to conduct transactions and handle funds seamlessly throughout a number of blockchains will play a key function within the development of this expertise.

The aim is to create a unified commonplace that spans each the DeFi and TradFi worlds. Via the Chainlink Runtime Atmosphere, we’re bringing that imaginative and prescient to life. We’re laying the groundwork for an interconnected world economic system pushed by sensible contracts, and as we proceed to develop these applied sciences, we consider Chainlink can be on the epicenter of the subsequent financial growth.