Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

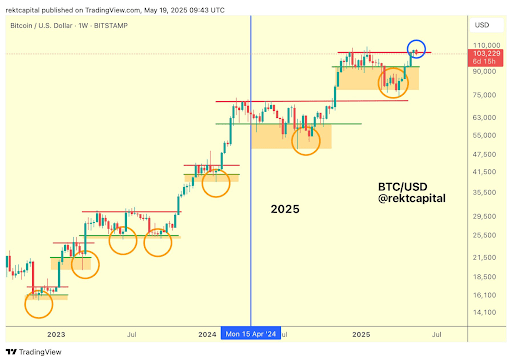

Bitcoin is presently buying and selling across the $105,000 mark after a quick uptick to $107,000 prior to now 24 hours. Notably, this marks the second time Bitcoin has rejected round $107,000 prior to now few days. Regardless of this volatility, Bitcoin managed to shut final week’s candle above a key resistance degree that had capped its value motion for weeks. This shut, recorded simply above the purple horizontal line at $103,000, has launched confidence within the continuation of the uptrend, and factors to the bulls nonetheless in command of Bitcoin’s value motion.

Bitcoin Weekly Closes Above Vary – First Bullish Step

Present Bitcoin value motion exhibits that bullish traders and patrons are nonetheless controlling the momentum behind the most important cryptocurrency and, in essence, the remainder of the crypto market. Notably, Bitcoin initially skilled a quick surge to almost $107,000 over the weekend earlier than retreating.

Associated Studying

This value motion was adopted by a dip to round $102,000, with the back-and-forth almost certainly being influenced by elements comparable to Moody’s downgrade of U.S. debt and investor reactions to potential rate of interest cuts by the Federal Reserve.

Nevertheless, in an fascinating observe, the BTC value managed to shut above the $103,000 vary throughout this primary transfer to $107,000, which is essential when it comes to technical evaluation going ahead. This sentiment is echoed by crypto analyst Rekt Capital on social media platform X, who identified the subsequent step which may play out for Bitcoin.

Submit-Breakout Retest Underway, Says Rekt Capital

The $104,000 value degree had beforehand acted as a cussed ceiling all through a lot of the latest Bitcoin value consolidation between $102,000 and $104,000 since Could 9. Nevertheless, since breaking above this degree, the following value motion has seen the Bitcoin value retracing in direction of this degree after one other rejection at $107,000.

Associated Studying

In accordance with crypto analyst Rekt Capital, the dip following the $107,000 rejection isn’t essentially bearish. As an alternative, it may very well be a part of a post-breakout retest, a sample usually seen in sturdy bullish buildings.

If this retest efficiently confirms the previous resistance as new assist, BTC might set the stage for a breakout into contemporary all-time highs. As proven within the 1W Bitcoin value chart above, the purple resistance degree could be very near Bitcoin’s January 2025 all-time excessive round $108,780.

Moreover, the chart exhibits that the latest breakout above the $90,000–$103,000 zone seems to reflect a sample of Bitcoin’s breakout after a consolidation transfer, after one other bounce from a low. On this case, the bounce occurred on the $75,000 low in early April.

If Bitcoin does rebound with sufficient buying and selling quantity round $104,000, this might present the much-needed momentum for a transfer above $107,000 and lastly above $108,700 once more. On the time of writing, Bitcoin is buying and selling at $105,555, up by 2.9% prior to now 24 hours.

Featured picture from Adobe Inventory, chart from Tradingview.com

Discussion about this post