Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin costs have jumped to $85,020 within the final 24 hours, marking a 1.2% improve that reverses among the current downward momentum. The cryptocurrency is now testing a key resistance degree that dates again to its January peak of $110,000, in accordance with market analysts.

Associated Studying

Indicators Of A Rebound Rising

Whereas Bitcoin nonetheless exhibits a 3.4% drop over the previous week and a 9.5% decline over the past month, indicators of restoration are rising. Technical analysts have noticed a robust one-day value candle that has utterly erased the losses from the earlier three days.

The Relative Power Index (RSI), a preferred momentum indicator, has bounced off its help line. This technical sign typically suggests constructing momentum for an upward value motion.

Based on stories from TradingView analysts, Bitcoin faces its most important problem on the falling development line that started on January 20. This resistance coincides with the 50-day shifting common, and Bitcoin has already examined this degree 4 occasions beforehand.

$100,000 Goal Inside Attain If Resistance Breaks

Market watchers eye a goal slightly below $100,000 if Bitcoin can break its present wall. This aim sits close to the highest of February’s barrier zone and matches the two.0 Fibonacci extension degree, a key mark utilized by merchants.

A breakthrough might sign a transfer towards a long-term bullish development for the cryptocurrency, which has confronted huge hurdles in current weeks.

The fifth take a look at of this resistance degree might show decisive for Bitcoin’s near-term value path. Merchants are watching intently to see if this try will likely be profitable the place earlier ones have failed.

Massive Holders Present Rising Confidence In Bitcoin

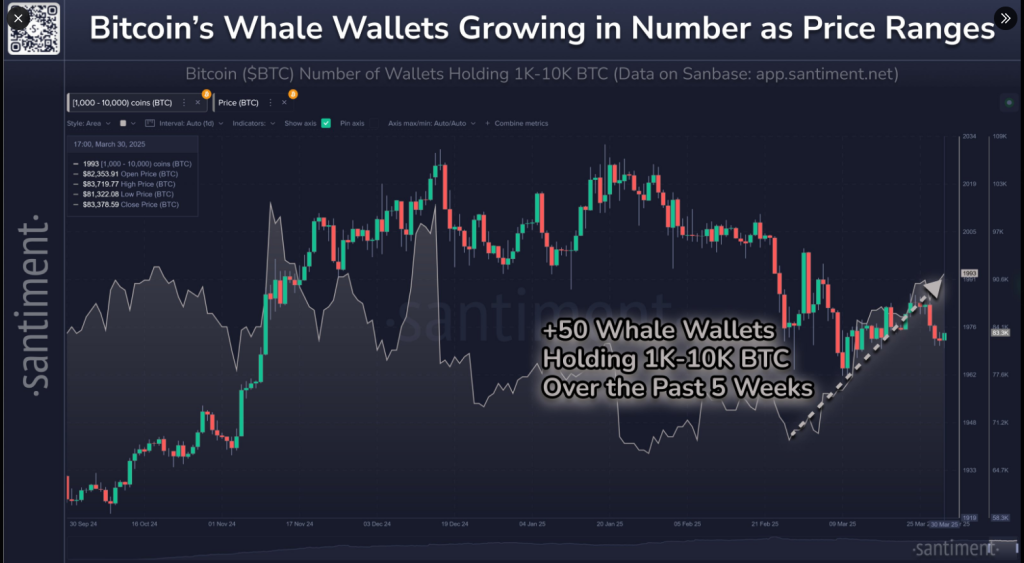

Based on figures equipped by Santiment, the wallets holding between 1,000 and 10,000 Bitcoins elevated to 1,993 by March 31. It’s the largest since December of 2024 and an increase by 2.5% inside a five-week interval when 50 giant wallets joined the market.

🐳 Bitcoin’s market worth has fluctuated between $81K to $84K Monday. And whereas costs proceed ranging as March attracts to an in depth, whale wallets (particularly 1K-10K $BTC holders) proceed rising in quantity.

There are actually 1,993 #Bitcoin wallets of this dimension, which is the very best… pic.twitter.com/iVYj9XdxAj

— Santiment (@santimentfeed) March 31, 2025

This accumulation sample by giant holders tends to lower the availability of Bitcoin in circulation. When demand stays fixed or will increase whereas provide decreases, costs are likely to go up.

Associated Studying

Change Outflows Sign Quick-Time period Bullish Outlook

The exercise of those “whale” wallets is a main gauge of market sentiment as a result of these giant holders are usually privy to classy analysis and market evaluation that information their funding decisions.

In the meantime, Bitcoin’s motion to and from exchanges exhibits a 38% decline in internet flows over the previous 24 hours. Based on IntoTheBlock analytics, this implies merchants are shifting their Bitcoin off exchanges reasonably than making ready to promote.

Featured picture from Gemini Imagen, chart from TradingView