Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) recorded slight features because the Shopper Value Index (CPI) inflation fee for February got here in decrease than anticipated. The softer inflation studying fuelled hopes of rate of interest cuts by the US Federal Reserve (Fed), probably benefiting risk-on property.

Bitcoin Jumps As Inflation Cools

In response to information from the US Bureau of Labor Statistics, the CPI elevated by 0.2% in February on a seasonally adjusted foundation, bringing the annual inflation fee all the way down to 2.8%. This determine not solely fell beneath economists’ projection of two.9% but additionally marked a decline from January’s 0.5% month-to-month enhance.

Associated Studying

Moreover, the core CPI – an inflation measure excluding meals and power costs – rose 0.2% month-over-month, underperforming most forecasts of 0.3%. On an annual foundation, core CPI got here in at 3.1%, barely beneath the three.2% consensus.

The lower-than-anticipated inflation information has reignited investor optimism, with hopes the Fed could pivot to a extra dovish financial coverage by slicing rates of interest to spice up market liquidity. Decrease rates of interest usually favor risk-on property like shares and cryptocurrencies.

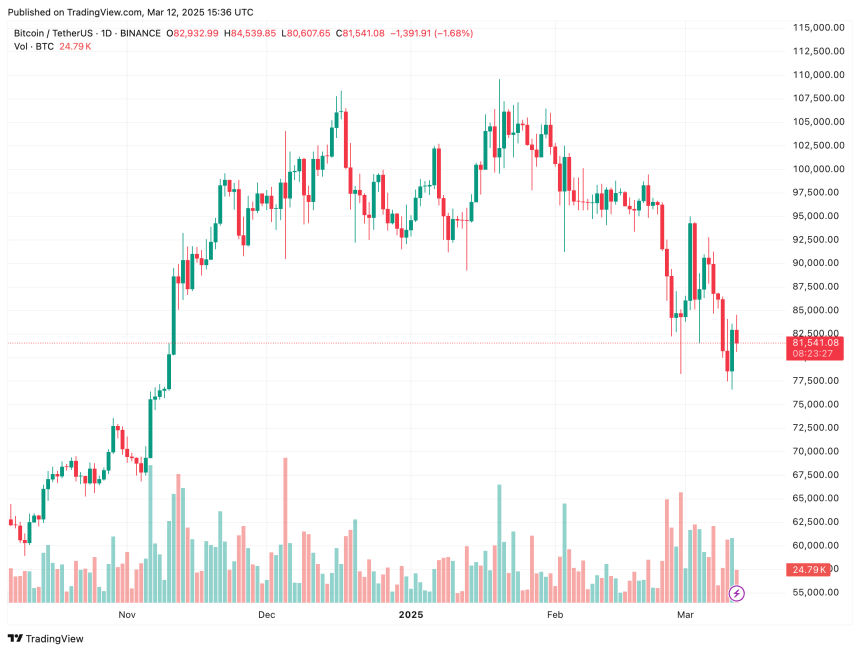

Following the info launch, BTC posted modest features, climbing from roughly $81,000 to $84,500. Main memecoin Dogecoin (DOGE) additionally noticed a 2.9% rise prior to now 24 hours.

It’s price noting that final month, BTC declined after CPI information got here in hotter than anticipated. Since then, US President Donald Trump’s financial insurance policies – significantly excessive commerce tariffs on nations like Canada, Mexico, and China – have additional hindered bullish momentum for digital property.

Earlier this month, BTC skilled one among its sharpest declines, dropping from round $94,700 on March 2 to as little as $76,800 on March 11. Over the identical interval, the entire crypto market cap shrank by roughly $600 billion, falling from $3.2 trillion to roughly $2.6 trillion on the time of writing.

BTC Value Projected To Make Restoration

Whereas the present bearish pattern has dragged BTC and different cryptocurrencies to multi-month lows, trade specialists imagine digital property are more likely to rebound within the later quarters of 2025.

Associated Studying

As an example, crypto entrepreneur Arthur Hayes not too long ago instructed that whereas BTC could face additional declines within the brief time period, central banks will doubtless resort to quantitative easing to stabilize inventory markets – a transfer that would additionally assist risk-on property get better their losses.

Equally, current evaluation by CryptoQuant contributor ibrahimcosar forecasts that regardless of the present downturn, BTC is poised to succeed in $180,000 by 2026. A weakening US greenback can be more likely to hasten the value restoration. At press time, BTC trades at $81,541, reflecting a 0.6% achieve over the previous 24 hours.

Featured picture created with Unsplash, charts from TradingView.com