Knowledge exhibits the Bitcoin dealer sentiment has been teetering on the sting of utmost greed for the previous couple of days, an indication {that a} break could also be coming.

Bitcoin Worry & Greed Index Is Sitting On The Boundary Of Excessive Greed

The “Worry & Greed Index” refers to an indicator created by Various that tells us in regards to the common sentiment current amongst buyers within the Bitcoin and wider cryptocurrency markets.

The index makes use of a numerical scale working from zero to hundred for representing the market sentiment. All values above 53 correspond to greed among the many buyers, whereas these under 47 recommend the presence of concern. The in-between ranges naturally correspond to a internet impartial mentality.

Now, right here is how the present market sentiment appears to be like, based on the Worry & Greed Index:

The worth of the metric seems to be 74 in the meanwhile | Supply: Various

As is seen above, the indicator presently has a price of 74, which suggests the buyers as a complete share a sentiment of greed and a robust one at that, contemplating the excessive worth.

Actually, this worth is so excessive that it’s proper on the gateway to a particular zone known as the acute greed. This area, which is located past the 75 stage, corresponds to euphoria among the many Bitcoin merchants. There’s a related territory on the opposite finish of the size as properly, often called excessive concern (underneath 25). When the index is on this zone, it naturally suggests the buyers are within the deepest state of despair.

Traditionally, each of those zones have held a lot significance for Bitcoin and different digital property, as main reversals have occurred when the buyers have held these mentalities. Thus, excessive greed can result in a prime and excessive concern to a backside.

Not too long ago, Bitcoin has climbed to cost ranges close to the all-time excessive, so it’s not stunning that the sentiment is heating up. Nonetheless, for now, the index hasn’t damaged into the acute greed zone but, so it’s potential that the run may have extra room to run earlier than overhype turns into a difficulty.

It solely stays to be seen how lengthy this could maintain, nonetheless, contemplating that the Worry & Greed Index has been sitting on this boundary stage for 3 straight days now.

The pattern within the Worry & Greed Index over the previous twelve months | Supply: Various

Any continuations to the rally may take the market sentiment past the acute greed threshold, at which level a reversal may change into extra doubtless, the upper the index ventures into the zone.

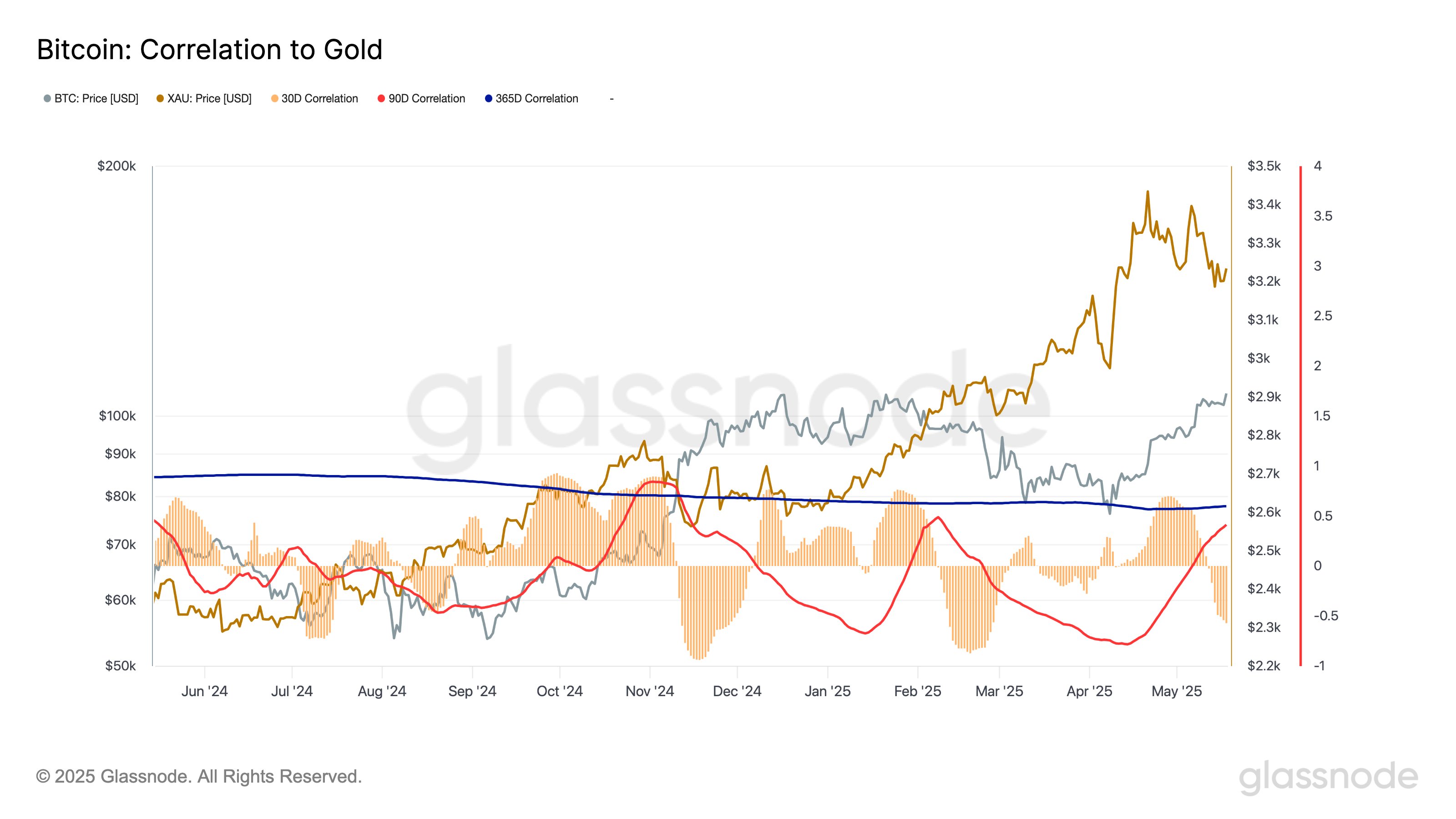

In another information, Bitcoin’s 30-day correlation with Gold has just lately declined to its lowest stage since February, because the analytics agency Glassnode has identified in an X put up.

Appears to be like like BTC’s correlation to Gold is destructive on the month-to-month timeframe | Supply: Glassnode on X

At current, the 30-day correlation between Bitcoin and Gold is sitting at a price of -0.54, which implies that over the previous month, the 2 have traveled oppositely to one another to some extent.

BTC Worth

Bitcoin noticed a pointy burst to the $107,000 stage yesterday, however the coin has since fallen off simply as quickly, as its worth is now floating round $102,300.

The value of the coin has been transferring sideways in the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, Various.me, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post