Information reveals Bitcoin has not too long ago seen a rise in futures buying and selling quantity, breaking away from the likes of Ethereum (ETH) and Solana (SOL).

Bitcoin Futures Quantity Has Rebounded Not too long ago

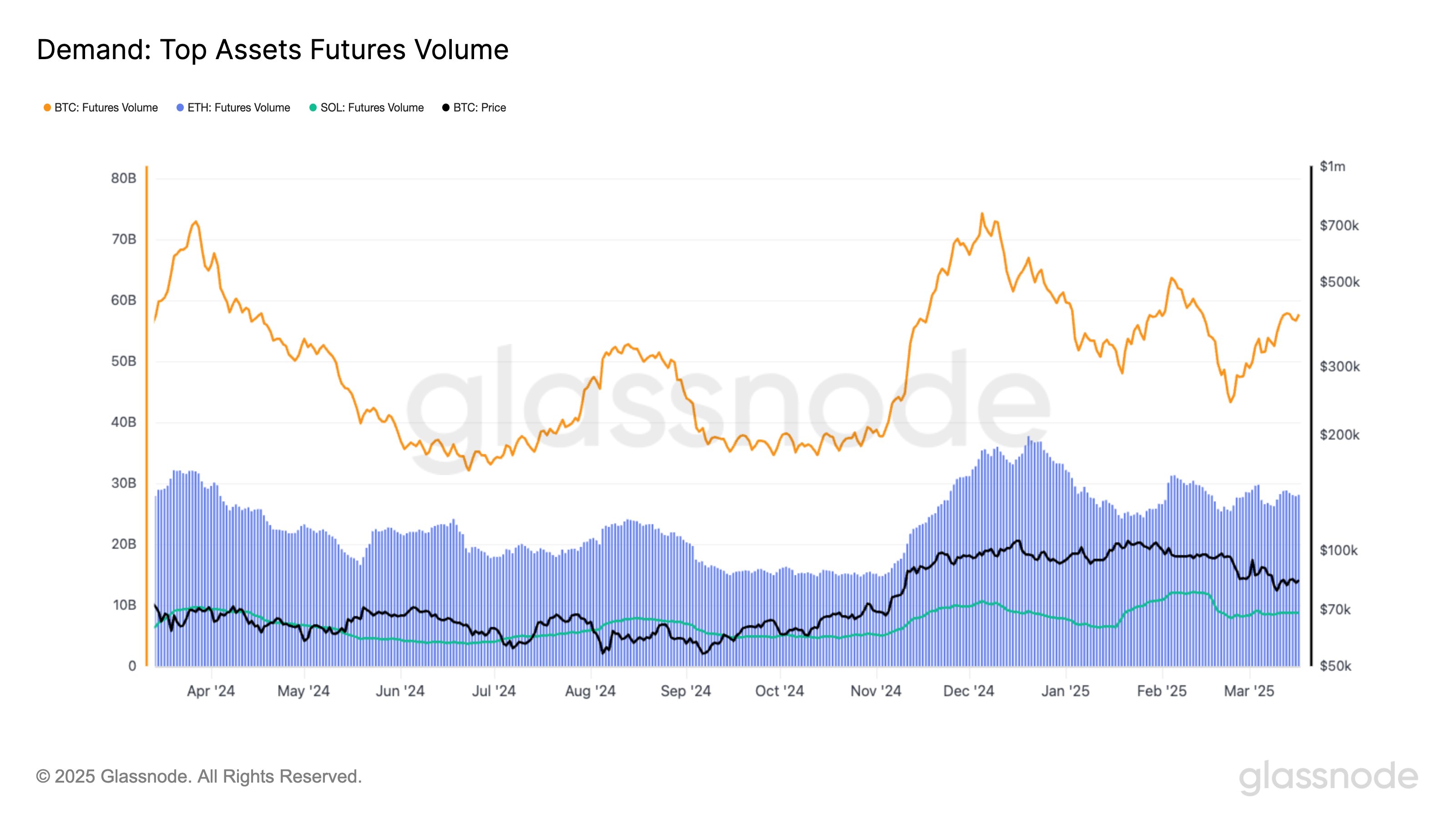

In a brand new submit on X, the on-chain analytics agency Glassnode has talked the newest pattern within the futures buying and selling quantity for Bitcoin and two different prime cryptocurrencies.

The “futures buying and selling quantity” right here refers to an indicator that retains observe of the full quantity of a given cryptocurrency that’s changing into concerned in futures-related trades on the centralized derivatives exchanges.

First, here’s a chart that places give attention to the futures buying and selling quantity of Bitcoin:

Appears to be like like the worth of the metric has been on the rise for BTC in current days | Supply: Glassnode on X

As displayed within the above graph, the BTC futures buying and selling quantity noticed a decline final month, however its worth has not too long ago discovered a rebound. At its low, the indicator approached the $40 billion mark, but it surely has since climbed to $57 billion.

“Bitcoin Futures quantity began the 12 months at $60B, peaked at $63B YTD, and now sits at $57B – 32% greater since Feb 23 however nonetheless beneath December’s $74B peak,” notes the analytics agency.

Whereas the primary cryptocurrency has registered a rise within the metric not too long ago, the identical hasn’t been true for Ethereum and Solana. From the chart, it’s obvious that the indicator has been transferring comparatively flat for these two property.

The pattern within the ETH futures buying and selling quantity over the previous 12 months | Supply: Glassnode on X

The Ethereum futures quantity measured round $32 billion initially of the 12 months and right now it sits at $28 billion, which isn’t that large of a distinction. Equally, the indicator kicked off the 12 months at $7 billion for Solana and it’s now at $8.7 billion, as soon as once more a comparatively small change.

The worth of the metric has additionally been transferring sideways for SOL | Supply: Glassnode on X

The futures buying and selling quantity serves as a glance into how the speculative curiosity round a cryptocurrency is like. The current pattern would suggest Bitcoin has been attracting the eye from the traders whereas altcoins stay stale.

In another information, the market intelligence platform IntoTheBlock has revealed in an X submit how the Bitcoin long-term holders have began to extend their provide not too long ago.

The analytics agency defines “long-term holders” because the traders who’ve been holding onto their cash since multiple 12 months in the past, with out having transferred or offered them even as soon as.

The BTC HODLers have simply seen a turnaround of their provide | Supply: IntoTheBlock on X

Based on IntoTheBlock, the long-term holders typically accumulate throughout bear markets, so this newest shift could possibly be an indication that sentiment is altering in the direction of a bearish one. The analytics agency additionally notes, nonetheless, “remember the fact that this isn’t all the time a dependable sign: i.e. in mid-2021, comparable accumulation didn’t result in a chronic downturn.”

BTC Value

On the time of writing, Bitcoin is floating round $81,800, down greater than 3% over the past 24 hours.

The worth of the coin seems to have retraced its restoration | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.