After surging into the $97,000 stage this week, Bitcoin seems to be getting into a recent bullish part. Following weeks of heightened volatility and chronic promoting stress, the market is starting to shift its tone. Bulls are gaining momentum, and the broader crypto house is exhibiting indicators of renewed confidence as worth motion heats up.

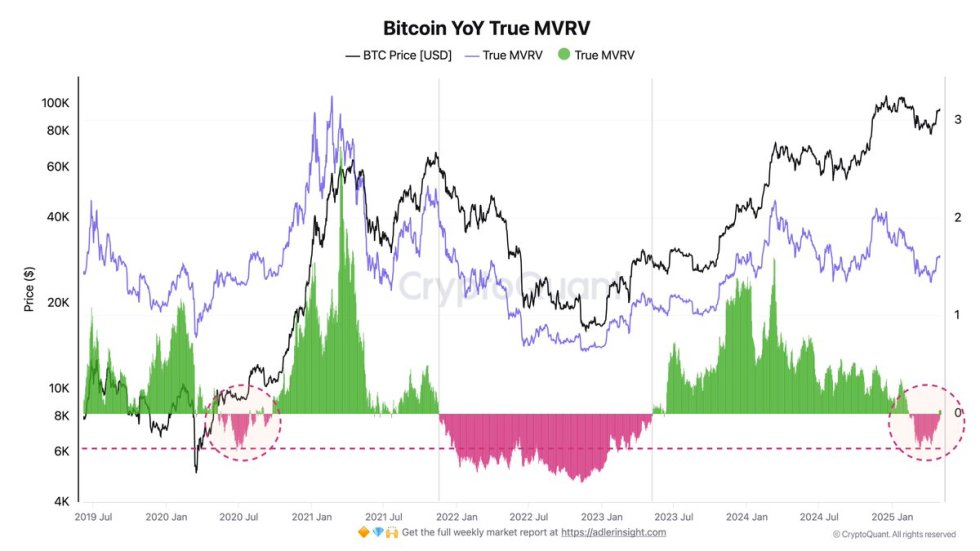

Prime analyst Axel Adler shared key insights, revealing that the return of the YoY True MVRV (Market Worth to Realized Worth) to constructive territory marks a major milestone on this cycle. This metric signifies that, on common, cash acquired over the previous yr at the moment are held at a revenue, with the present market worth sitting above the common buy worth.

This shift reduces the stress from panic sellers, a lot of whom have been beforehand underwater and trying to exit. Now, with realized earnings rising, there may be much less urgency to promote, which in flip helps worth stability and builds momentum. Consequently, investor confidence is rising, and a more healthy market construction is forming.

If this pattern continues, Bitcoin might be on the verge of a sustained transfer towards new all-time highs, signaling that the following leg of the bull market might have simply begun.

Bitcoin Holds Agency As Market Shifts Into Restoration Part

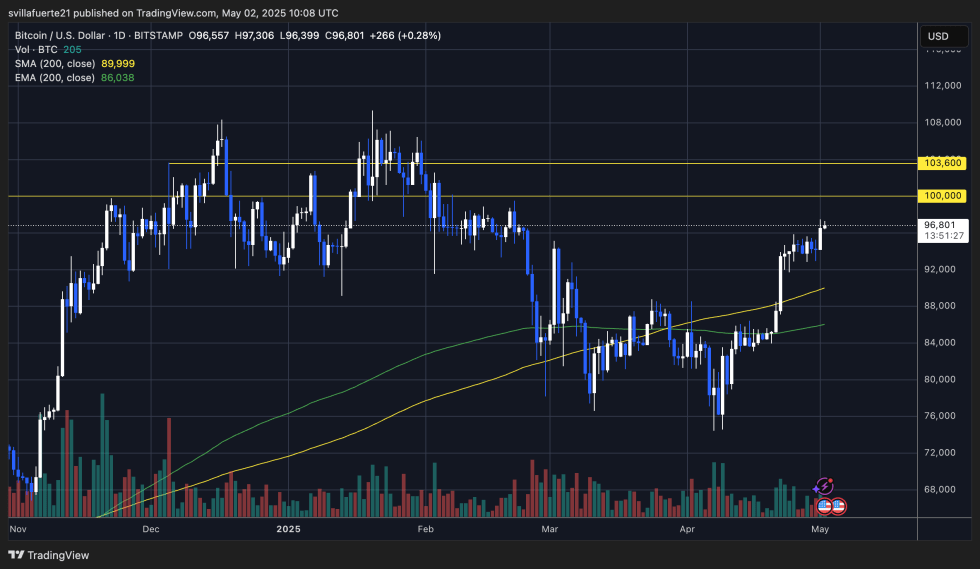

Bitcoin is at the moment going through a important problem because it struggles to reclaim the psychologically vital $100,000 stage. Over the previous two weeks, bulls have efficiently pushed the value above key resistance zones resembling $90,000 and $96,000, signaling renewed energy. Nonetheless, the momentum is being tempered by rising macroeconomic uncertainty, together with persistent fears of a world recession and continued battle between the US and China, two elements that closely affect investor sentiment throughout all markets.

Regardless of these issues, Bitcoin’s on-chain metrics are flashing indicators of a structural shift in market conduct. In line with Axel Adler, the Yr-over-Yr True MVRV (Market Worth to Realized Worth) has returned to constructive territory. Which means that, on common, the present market worth is now increased than the common worth at which cash have been acquired over the previous yr. Consequently, most holders are in revenue.

This transformation marks a vital psychological turning level. The stress from panic sellers is easing as fewer members are motivated to lock in losses. As an alternative, we’re seeing rising holder confidence and diminished sell-side exercise. Adler notes that this transition typically aligns with the beginning of a restoration part and paves the way in which for extra sustainable development.

If this pattern continues, the speculative premium will construct regularly, setting the stage for a longer-term rally. In essence, the inspiration for the following main transfer seems to be forming, and in line with Adler, probably the most attention-grabbing a part of this cycle might have simply begun.

Technical Particulars: Worth Holds Close to $97K

Bitcoin is buying and selling at $96,800 after briefly pushing above the $97,000 stage earlier within the session. Whereas bulls have maintained management all through the previous week, they’re now exhibiting indicators of exhaustion as demand seems to be stalling round present costs. Nonetheless, the value stays elevated, and momentum is constructing throughout the broader market as merchants anticipate a possible breakout.

To maintain the rally, BTC should maintain above the $95,000 stage, now performing as a key short-term help. A steady base right here might present the required gas for a continued push towards the $100,000 psychological milestone, which might verify a recent bullish leg on this cycle.

Nonetheless, if Bitcoin fails to carry $95K, short-term sentiment might shift rapidly. A break under this stage might open the door to a deeper retrace, with the following main help mendacity within the $88K–$90K zone. Given the excessive stage of macroeconomic uncertainty and blended alerts throughout world markets, merchants are more likely to stay cautious heading into the weekend.

For now, the main focus stays on whether or not bulls can construct sufficient momentum to breach $97K once more and make a convincing transfer towards uncharted territory.

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post