Bitcoin (BTC) has surged greater than 10% over the previous seven days and is at the moment buying and selling within the low $90,000 vary. Crypto analyst Titan of Crypto means that additional good points could also be on the horizon primarily based on Fibonacci extension ranges.

Bitcoin Could Climb To $135,000

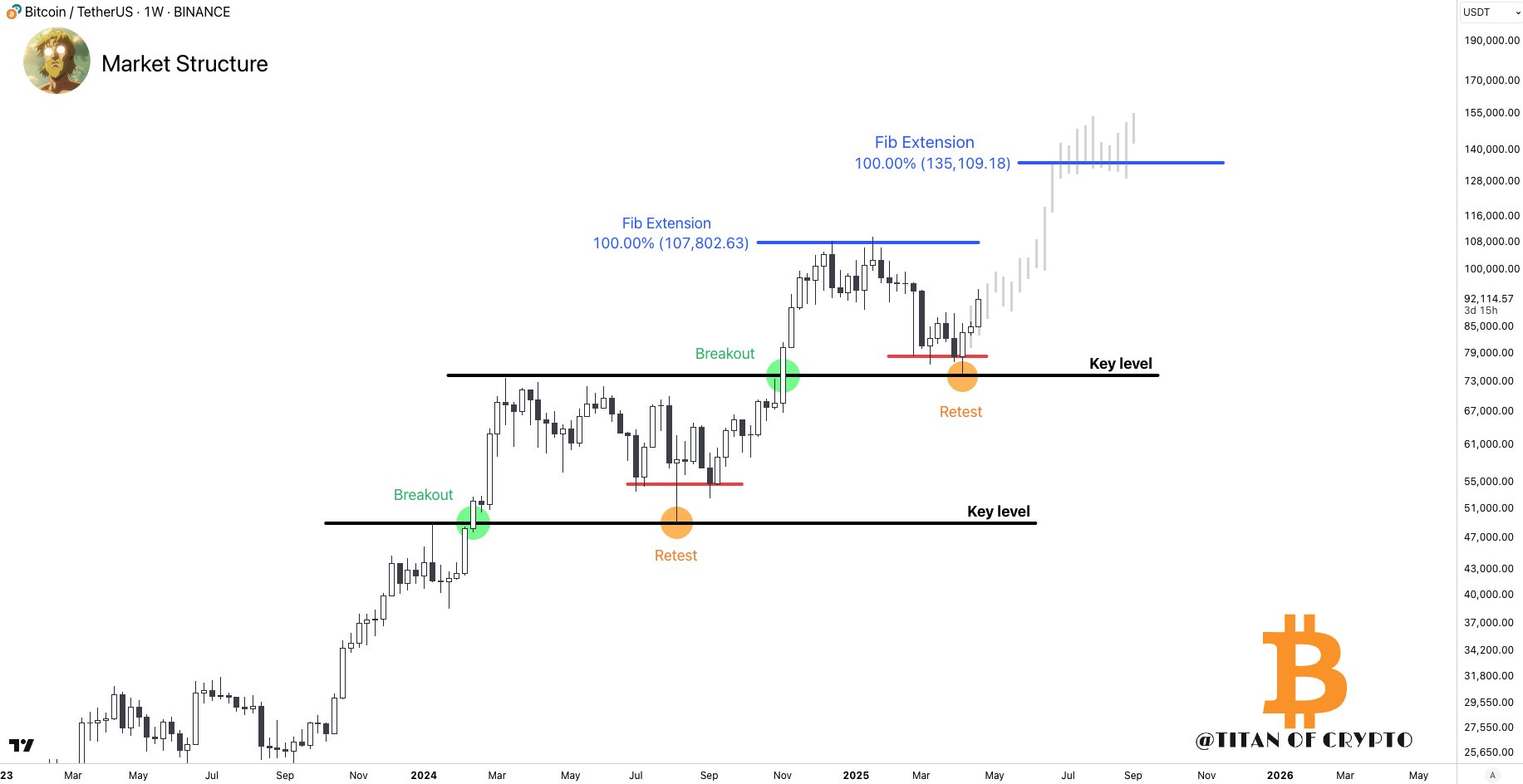

In a submit printed on X right now, Titan of Crypto outlined Bitcoin’s potential path to $135,000. Utilizing Fibonacci extension ranges, the analyst predicts that the flagship digital asset may surge as excessive as $135,109 by July-August 2025.

For the uninitiated, Fibonacci extension ranges are technical evaluation instruments used to establish potential worth targets throughout sturdy traits by projecting key Fibonacci ratios past a latest worth swing. Merchants use these ranges to anticipate the place an asset would possibly discover resistance or full a transfer after a breakout.

In response to the next weekly BTC chart shared by Titan of Crypto, a 100% Fibonacci extension from Bitcoin’s latest retest of the $76,000 assist degree initiatives its subsequent main goal close to $135,000.

The chart highlights comparable worth habits from August 2024, when BTC surged almost 100%, setting a brand new all-time excessive (ATH) round $73,000 by November 2024. If the present development follows an identical trajectory, BTC might submit a brand new ATH by July 2025.

Different crypto analysts additionally predict constructive worth motion for the main digital asset. For instance, crypto analyst Jelle shared a chart exhibiting BTC breaking by a draw back deviation.

Jelle famous that BTC is giving bulls “precisely what they need to see.” Following the latest rally, BTC skilled a shallow pullback and seems poised to verify a range-low reclaim earlier than doubtlessly pushing increased. The analyst added that BTC may subsequent check resistance close to $100,000.

Binance Knowledge Signifies An Upcoming Brief Squeeze

Including to the bullish case is buying and selling information from Binance. In response to a CryptoQuant Quicktake submit by Novaque Analysis, BTC outflows from the trade have risen considerably since April 19.

The surge in withdrawals is backed by declining trade reserves, suggesting lowered short-term promoting stress and a market more and more pushed by retail members. The submit states:

Excessive-leverage longs have been flushed out between $82K and $88K, indicating that weak arms had been eradicated. Giant brief positions stay vulnerable above $92,000, creating the potential for a brief squeeze, which could act as the subsequent step increased.

Broader macroeconomic components may additionally contribute to BTC’s upside. As an example, rising considerations over the US Federal Reserve’s autonomy might drive traders towards decentralized property like Bitcoin. At press time, BTC trades at $93,302, up 0.8% within the final 24 hours.

Featured Picture from Unsplash.com, charts from X and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.