Bitcoin confronted intense promoting strain following renewed geopolitical tensions within the Center East, as Israel launched a preemptive strike on Iran. The information despatched shockwaves by world monetary markets, triggering a wave of risk-off sentiment and sharp liquidations throughout main crypto exchanges. BTC dropped over 5% within the aftermath, briefly dipping under key transferring averages however finally holding agency above the $100,000 psychological mark.

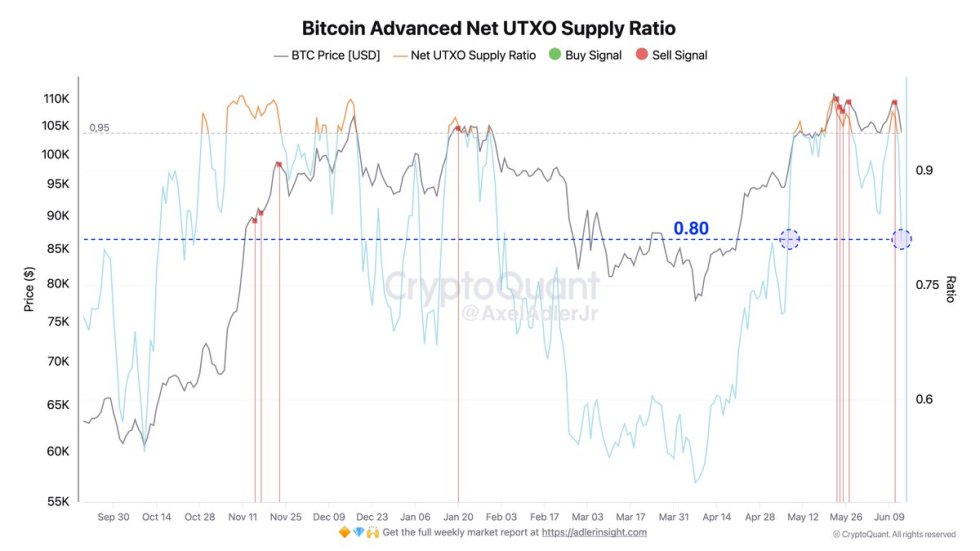

Regardless of the spike in volatility, analysts stay cautiously optimistic. Prime analyst Axel Adler shared knowledge exhibiting that the Superior Internet UTXO Provide Ratio—a key metric for figuring out market inflection factors—fell sharply from a neighborhood peak of 0.96 on June 11 to 0.806 simply 48 hours later. Traditionally, if this ratio continues its downtrend and stabilizes under 0.80 on the every day chart, it flashes a traditional “purchase sign,” typically previous robust market recoveries.

With BTC holding essential assist and long-term holder conviction remaining excessive, many market contributors are watching carefully for affirmation of a backside. Because the macro narrative evolves, all eyes are on Bitcoin’s capability to take care of its footing and doubtlessly use this correction as a base for its subsequent leg larger.

Bitcoin Prepares For Enlargement Amid Geopolitical Volatility

Bitcoin is approaching a pivotal second because it hovers close to the $104K–$105K area, with analysts eyeing a possible breakout previous the $112K all-time excessive. A profitable push above this resistance may set off an explosive market growth and ship BTC into a brand new value discovery part. Whereas bulls look like in management, rising macroeconomic dangers—together with heightened Center East tensions, persistent inflation fears, and rising US Treasury yields—are making a unstable surroundings that challenges investor confidence.

Adler highlighted a essential on-chain sign: the Superior Internet UTXO Provide Ratio, which peaked at 0.96 on June 11, has since declined to 0.806. Traditionally, if this ratio dips under 0.80 on the every day chart and holds, it typically marks a textbook “purchase sign,” signaling robust accumulation. Adler notes {that a} short-term base for a brand new micro-rally may type across the $102K–$105K vary. Nevertheless, if the ratio continues to say no and BTC breaks under $100K, the market may see a renewed wave of promoting strain.

Over the previous 24 hours, risk-off sentiment has intensified throughout world markets. Oil and gold spiked as traders sought security amid fears of broader regional battle. In the meantime, fairness markets slid sharply following Israel’s preemptive strike on Iran. In crypto, over $360 million in lengthy positions have been liquidated in a single day throughout main centralized exchanges, underscoring the fragility of sentiment.

Regardless of the turbulence, Bitcoin’s capability to remain above key assist zones suggests resilience. Market watchers are carefully monitoring the $100K–$105K space because the battleground that might decide whether or not BTC consolidates for a bullish breakout or enters a deeper correction.

BTC Worth Evaluation: Crucial Help At $103,600 Holds The Key

The chart exhibits Bitcoin buying and selling at $105,056 after a unstable drop from the $112K stage earlier this week. BTC is at the moment hovering simply above an important assist zone between $103,600 and $105,000. This vary has acted as each resistance and assist a number of instances in latest months and now serves as a key battleground for the short-term pattern.

The 50-day transferring common sits close to $103,188 and aligns carefully with horizontal assist at $103,600, reinforcing this space as a possible bounce zone. If bulls can maintain this stage, the setup stays constructive for an additional try on the $109,300 resistance, which has capped upside actions all through Could and June.

Nevertheless, the latest spike in quantity throughout the newest decline suggests elevated promoting strain, doubtless tied to macro headlines, together with the Israel-Iran battle. If value closes under $103,600, the following important assist may very well be discovered across the 100-day transferring common close to $93,799.

For now, BTC is consolidating above assist, however the path ahead will depend on whether or not bulls can defend this zone and reclaim momentum towards $112K. A confirmed breakdown may invalidate the bullish construction and open the door to a deeper retracement.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post