After an explosive multi-week rally, Bitcoin has paused its upward momentum on the $105K stage, retracing to search out assist within the $101K–$100K vary. This pullback follows a interval of aggressive shopping for that pushed BTC via a number of key resistance zones, together with $90K and $100K, igniting optimism throughout the crypto market. Whereas the retracement could seem as a slowdown, many analysts view it as a wholesome consolidation earlier than one other potential leg increased.

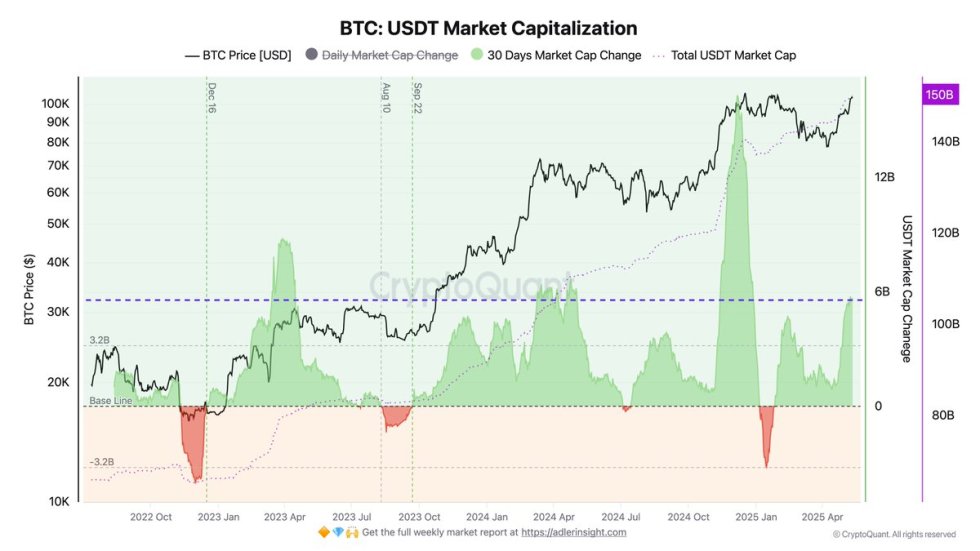

Including gasoline to the broader bullish sentiment, CryptoQuant knowledge reveals that over the previous 20 days, greater than $6 billion in liquidity has entered the market via newly issued USDT. This huge capital injection brings Tether’s whole market capitalization to a powerful $150 billion, additional highlighting rising investor curiosity. With such liquidity flowing into the ecosystem, consideration now turns as to if Bitcoin can maintain its present assist zone and proceed its push towards all-time highs.

This era of consolidation could possibly be pivotal. If BTC manages to carry above $100K, the bullish development stays intact. In any other case, a deeper correction may unfold because the market digests latest positive factors. All eyes are actually on value habits round this essential vary.

Altcoin Rotation Accelerates As Bitcoin Stalls Under All-Time Highs

Bitcoin is at present buying and selling at a essential stage, with bulls striving to defend the $100K zone and reclaim $103K to aim a breakout above the all-time excessive at $109K. Whereas BTC stays in a structurally bullish place, it has didn’t push increased after reaching $105K final week, triggering a retracement that now exams key assist ranges. Holding the $100K vary is crucial to keep away from a deeper correction and to take care of momentum in what has been one of many strongest rallies of the yr.

Nonetheless, consideration is starting to shift elsewhere available in the market. High analyst Axel Adler shared insights on X, revealing that $6 billion in recent capital has entered the crypto house over the previous 20 days via newly issued USDT, pushing Tether’s whole market cap to $150 billion. Whereas this inflow of liquidity initially supported Bitcoin’s surge, the development has just lately began to favor altcoins.

As Bitcoin dominance begins to say no, Ethereum and different high altcoins are absorbing a significant portion of the capital inflows. This rotation suggests rising investor confidence in higher-risk alternatives, particularly as ETH reclaims key ranges and altcoins present breakout potential. If Bitcoin continues to consolidate, altseason momentum could speed up additional within the coming weeks.

BTC Testing Resistance As Consumers Defend Key Ranges

Bitcoin is at present consolidating slightly below the $103,600 resistance after a pointy rally that noticed the value surge from beneath $90K to above $105K in lower than two weeks. As seen within the each day chart, BTC has repeatedly examined the $103,600 stage—an space that acted as a ceiling through the January and March highs. Regardless of a number of breakout makes an attempt, the value has but to safe a clear each day shut above this stage, indicating sturdy provide strain.

Assist now sits across the $100K–$101K vary, which coincides with the psychological spherical quantity and the earlier breakout zone. To date, bulls have managed to defend this stage, displaying power in sustaining the present construction. The 200-day SMA at $91,781 and the 200-day EMA at $87,508 are far beneath present value ranges, confirming Bitcoin’s sturdy uptrend but additionally suggesting an overheated short-term setup.

A sustained breakout above $103,600 would open the trail towards retesting the all-time excessive at $109K. Nonetheless, failure to carry above $100K may set off a deeper retrace towards decrease demand zones. For now, Bitcoin stays in a bullish posture, however the market is awaiting affirmation from quantity and value motion to validate the following transfer.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post