Desk of Contents:

Core Ideas & Key Options of DeFi

Main DeFi Platforms and Instruments

Advantages and Dangers of DeFi

DeFi Use Circumstances and Functions

1. Introduction to DeFi:

Welcome to the world of Decentralized Finance or DeFi, the place the ability of finance is shifting from massive establishments to the fingers of on a regular basis individuals such as you and me. Simply think about a monetary world with none middlemen like banks, advanced charge constructions, and geographical restrictions. DeFi is a quickly evolving sector the place you’ll be able to take loans, make investments, commerce, and get monetary savings instantly between people. Sounds futuristic, proper? Nicely, sure, the long run is already right here with DeFi.

On this weblog, we’ll dive into the world of DeFi, discover what it’s, the way it works, and why is it capturing the eye of tech fanatics and establishments alike. By the tip, we could have an concept of how DeFi has reworked its strategy towards monetary providers. Prepared? Let’s get began!

What’s DeFi?

Image Courtesy: 101blockchains.com

So, what precisely is DeFi? Decentralized Finance, or DeFi, refers to a set of monetary providers and merchandise constructed on blockchain expertise. In contrast to conventional finance, which depends on centralized establishments like banks or brokers, DeFi makes use of sensible contracts and blockchains to supply monetary providers on to customers.

Consider it like this: as an alternative of going to a financial institution to get a mortgage or deposit your cash, you work together with a decentralized community (typically utilizing cryptocurrencies) the place sensible contracts deal with the whole lot routinely. No middlemen, no intermediaries—simply you, the protocol, and the group that drives it.

Who Invented DeFi? The Historical past and Evolution:

Let’s go on a fast journey by the historical past of DeFi. There isn’t a single inventor of DeFi, however there’s a time limit from which this all begins: in 2009, Satoshi Nakamoto created Bitcoin. The decentralized nature of Bitcoin supplied the technological feasibility that monetary providers may exist exterior a conventional banking system.

Nonetheless, the concept of DeFi developed extremely with the introduction of Ethereum in 2015. Ethereum launched the world to this phenomenon known as a sensible contract, self-executing contracts that routinely carry out transactions based mostly on predefined guidelines. This innovation marked a major pathway to extra elaborate monetary purposes.

The primary DeFi mission that gained main consideration was MakerDAO in 2017, which allowed customers to borrow the DAI stablecoin by locking up Ethereum as collateral. And that has additionally triggered this exponential growth of the ecosystem. For instance, Uniswap, Aave, and Compound are the leaders in decentralized lending, buying and selling, and funding merchandise.

Significance and development of DeFi within the crypto area:

Right here’s an in-depth exploration of the significance and development of decentralized finance (DeFi) within the crypto area:

A. Democratization of entry to finance:

DeFi opens monetary providers to a world viewers not segmented by location, wealth, or entry to conventional banks. Whereas centralized monetary establishments are likely to deny providers for credit score scores, geography, or political causes, DeFi stands open to everybody if they’ve an web connection.

DeFi permits peer-to-peer saving, borrowing, lending, and investing instantly with out the necessity for intermediaries in areas the place the infrastructure of banks is scarce. Decentralized infrastructures enable residents from creating nations to entry the worldwide financial system for a greater life of their respective economies.

The brand new adoption research on DeFi point out that the majority customers are from areas characterised by excessive inflation and low banking service. This, due to this fact, highlights the position DeFi performs in bringing financial inclusion.

B. Take away Intermediaries and Minimize Prices:

Whereas the present monetary providers embrace banks, brokers, and exchanges, which all depend on intermediaries to hold out a transaction, it permits for an additional value, inefficiency, and slowing down of a deal. In DeFi protocol, this sensible contract routinely conducts transactions, so middlemen are usually not wanted to be concerned thereby chopping down some prices of a transaction.

Good contracts are self-executing agreements coded on the blockchain, thereby automating lending and buying and selling processes with decrease charges. Customers can then retain the next proportion of earnings plus simplify sophisticated processes.

DeFi’s market has grown from leaping bounds. At the moment, the value-locked TVL throughout numerous platforms has reached greater than $50 billion, which displays the elevated calls for of shoppers for cost-efficient options to conventional finance.

C. Yield farming and decentralized lending:

DeFi is exclusive as a result of it will possibly provide monetary incentives within the type of yield farming and decentralized lending. Customers can use the supply of liquidity to DeFi protocols and thereby reap rewards within the type of rates of interest or governance tokens, thereby augmenting returns on property.

The significance of lending protocols in DeFi is that, in contrast to financial savings accounts, that are low-interest-yielding accounts, it gives good yields by peer-to-peer lending that motivates individuals to carry their property within the ecosystem of DeFi. It accelerates the expansion of DeFi.

The rise of yield farming by way of protocols comparable to Compound and Aave has drawn hundreds of thousands of crypto buyers searching for greater yields, thus bringing large capital inflows into DeFi.

D. Modern Monetary Merchandise and Tokenization:

DeFi has revolutionized finance by introducing progressive monetary merchandise, together with decentralized exchanges (DEXs), artificial property, and tokenized derivatives. These merchandise present new methods to commerce, make investments, and hedge towards market dangers, providing flexibility unmatched by conventional finance.

Tokenization permits the creation of digital property that characterize real-world property, comparable to shares, actual property, or commodities, making these property extra accessible and tradeable on the blockchain. This democratization of funding expands entry and liquidity to new asset courses.

DeFi’s continued product innovation and collaboration with different sectors, like decentralized autonomous organizations (DAOs) and NFT initiatives, spotlight its development and rising affect in remodeling conventional markets.

E. Elevated Safety and Transparency

DeFi leverages blockchain expertise’s inherent transparency and safety features. Transactions on decentralized platforms are publicly recorded on a distributed ledger, guaranteeing traceability and minimizing fraud threat. Customers have management over their funds with out reliance on centralized custodians.

With transparency, customers can confirm sensible contract operations and monetary knowledge. This stage of openness builds belief and accountability in DeFi protocols, a major departure from conventional opaque banking operations. Audits and open-source sensible contracts additional strengthen safety, though they arrive with their very own dangers.

As consciousness round monetary safety and knowledge privateness will increase, DeFi has grown to characterize a key pillar in creating trustless, censorship-resistant monetary methods, mirrored by rising institutional curiosity and billions of {dollars} in buying and selling quantity throughout DEXs.

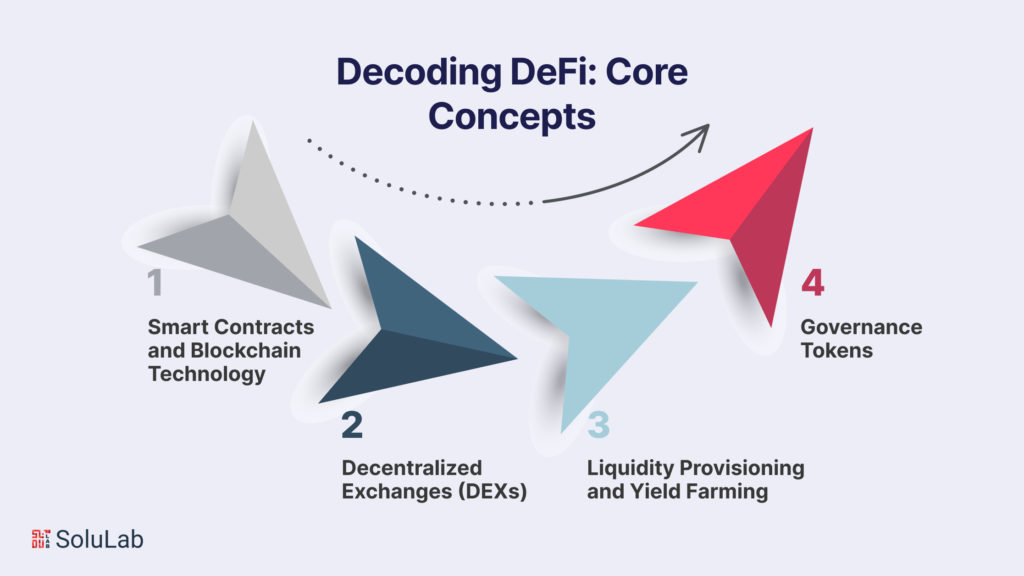

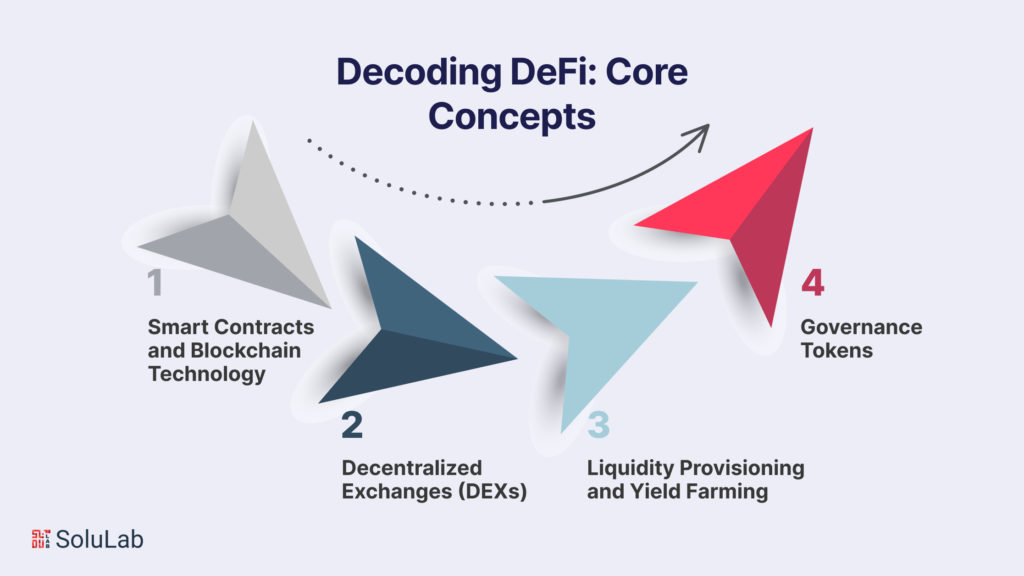

2. Core Ideas & Key Options of DeFi:

Image Courtesy: solulab.com

DeFi is an thrilling area the place decentralization meets innovation, and it’s rising at an exponential charge. Let’s break down the core ideas of DeFi in easy phrases that can assist you perceive why it’s so essential and the way it works.

A. Decentralization:

Decentralization is the core philosophy of DeFi. Banks and monetary establishments personal cash in conventional finance. DeFi, runs instantly on the blockchain, like Ethereum, leading to no central authority for the consumer’s assets-thus, consumer management. It’s about eradicating intermediaries and guaranteeing openness, safety, and privateness for everybody.

B. Good Contracts:

Consider sensible contracts as simply items of code for self-executing agreements on a blockchain with the phrases of settlement put in place, and carried out routinely, with out interference from a intermediary. It’s actually organising a contract between you and the machine the place one by no means forgets and goes precisely the place it was led to by the contract!

C. Decentralized Exchanges (DEXs):

DEXs allow customers to commerce their cryptocurrencies with each other instantly with out some middleman authority, be it Binance or Coinbase. These are run on sensible contracts whereby the transactions happen instantly on the blockchain. A highly regarded model of DEXs contains Uniswap and SushiSwap, that are taking the crypto world storm with better freedom and management of your trades.

D. Yield Farming and Liquidity Swimming pools:

In order that’s one of many cool issues you are able to do in DeFi- earn some passive earnings. The very idea of yield farming is incomes some rewards by offering liquidity to DeFi platforms. While you stake your crypto right into a liquidity pool, you assist make trades and transactions attainable; you get curiosity or tokens in return. It’s like placing your cash to give you the results you want, while not having you to do something!

E. Stablecoins:

Stablecoins are cryptocurrencies engineered to maintain a steady worth, sometimes pegged to the standard foreign money just like the US greenback. The perfect of each worlds – stability provided by conventional foreign money and blockchain advantages – does promise actual which means within the type of stablecoins. Like USDC and DAI, with lending, borrowing, and even buying and selling, you can’t endure by the hands of utmost volatility witnessed with some cryptocurrencies comparable to Bitcoin and Ethereum.

F. Lending and Borrowing:

Think about with the ability to borrow cash or earn curiosity in your property, with out going to a financial institution. Nicely, that’s the energy of DeFi lending and borrowing platforms! Companies like Aave and Compound permit you to lend your crypto to others in change for curiosity or borrow property by collateralizing your personal. It’s decentralized peer-to-peer finance at its most interesting, with no banks or credit score scores concerned.

G. Governance Tokens:

In DeFi a lot of the platforms use governance tokens which permit customers to precise opinions concerning the path they see the protocol in. You may even vote on proposals about upgrades, modifications, and new options by holding such tokens. It’s a democratic method of decision-making and due to this fact demonstrates management of the group over the long run platform.

Decentralized Finance Defined: A New Period in Finance

Decentralized finance (DeFi) is remodeling the way in which we take into consideration monetary methods. It’s a set of monetary providers constructed on blockchain expertise, providing options to conventional banks and monetary establishments. As an alternative of counting on central authorities, DeFi operates on sensible contracts and decentralized purposes (dApps), enabling direct, peer-to-peer transactions with out intermediaries.

With DeFi, you’ll be able to lend, borrow, commerce, and spend money on digital property instantly out of your pockets, having fun with advantages like decreased charges, quicker transactions, and elevated accessibility. Key ideas embrace decentralized exchanges (DEXs), yield farming, stablecoins, and governance tokens, all of which empower customers with extra management over their monetary actions.

In essence, Decentralized Finance Defined means monetary freedom, safety, and innovation, all pushed by the blockchain. As DeFi continues to develop, it’s clear that it’s greater than only a development – it’s the way forward for finance.

3. Main DeFi Platforms and Instruments:

Image Courtesy: kryptochannel.com

The DeFi (Decentralized Finance) ecosystem is prospering, with numerous platforms and instruments empowering customers to take management of their monetary actions with out counting on conventional banks or intermediaries. Right here’s an summary of a few of the hottest platforms which can be driving innovation on this area:

A. Uniswap:

Uniswap is a decentralized change (DEX) constructed on Ethereum that permits customers to commerce tokens instantly from their wallets. It makes use of an automatic market maker (AMM) mannequin, which depends on liquidity swimming pools somewhat than conventional order books. This implies customers can commerce with out intermediaries, instantly swapping tokens at costs decided by the pool’s provide and demand.

Major Use: Token buying and selling and liquidity provision.

B. Aave:

Image Courtesy: globalhappenings.com

Aave is a decentralized lending and borrowing protocol that permits customers to earn curiosity on deposits and borrow property towards collateral. A key function of Aave is its flash loans, which allow customers to borrow with out collateral if the mortgage is repaid throughout the identical transaction. This opens up distinctive arbitrage and liquidity alternatives.

Major Use: Lending, borrowing, and flash loans.

C. Compound:

Compound is one other standard DeFi lending platform that allows customers to lend and borrow cryptocurrencies. When customers lend property to the platform, they obtain cTokens in return, which characterize their declare on the property and any accrued curiosity. Compound’s protocol routinely adjusts rates of interest based mostly on provide and demand for every asset.

Major Use: Crypto lending and borrowing.

D. Yearn Finance:

Image Courtesy: cardanolibrary.web

Yearn Finance is a yield aggregator designed to maximise returns on deposited funds by routinely shifting property between numerous DeFi protocols to optimize yields. It gives “Vaults” the place customers can deposit property, and the protocol will deploy these funds throughout a number of DeFi initiatives based mostly on a technique that seeks the very best returns.

Major Use: Yield farming and yield optimization.

E. Synthetix:

Image Courtesy: blockchainwelt.de

Synthetix is a protocol for creating and buying and selling artificial property that mimic the worth of real-world property like shares, commodities, and fiat currencies. Utilizing sensible contracts, Synthetix permits customers to achieve publicity to property with out instantly proudly owning them, thereby broadening DeFi’s attain past cryptocurrencies.

Major Use: Artificial asset creation and buying and selling.

F. MakerDAO:

Image Courtesy: u.at present

MakerDAO is the protocol behind the DAI stablecoin, a decentralized stablecoin pegged to the US greenback. It permits customers to create DAI by collateralizing different cryptocurrencies in a Maker Vault.

Major Use: As a key participant within the stablecoin area, MakerDAO helps stabilize the unstable crypto market and facilitates lending, borrowing, and buying and selling with better worth predictability.

G. Curve Finance:

Image Courtesy: fxprofitsignals.com

The curve is a decentralized change optimized for stablecoin buying and selling and low-slippage swaps. It focuses on stablecoins and tokenized property with comparable worth, like wrapped tokens.

Major Use: By providing low charges and minimal slippage, Curve is an important platform for liquidity suppliers and merchants in search of environment friendly stablecoin trades, making it a significant participant within the DeFi sector.

DeFi Pulse and Its Significance:

Image Courtesy: moralismoney.com

DeFi Pulse is a number one analytics and rating platform for decentralized finance initiatives. It tracks and shows key metrics for the DeFi ecosystem, providing insights into the whole worth locked (TVL) throughout completely different protocols, lending and borrowing charges, market dominance, and extra. The TVL metric, which represents the whole quantity of property staked in DeFi initiatives, serves as a important indicator of the sector’s well being and development.

Significance of DeFi Pulse:

DeFi performs a major position within the DeFi market. Let’s get to learn about that.

Market Insights:

DeFi Pulse gives a complete overview of the DeFi market, together with the top-performing platforms, traits, and development statistics. This makes it a useful device for buyers, researchers, and fanatics who need to sustain with the evolving DeFi area.

Transparency:

By providing real-time knowledge and analytics, DeFi Pulse promotes transparency within the DeFi ecosystem. It permits customers to make knowledgeable choices based mostly on correct and up-to-date info.

Monitoring Efficiency:

The platform ranks initiatives based mostly on their TVL, giving customers a way of which protocols maintain probably the most property and, by extension, consumer belief and market exercise. This helps customers uncover new platforms, monitor their favourite initiatives, and perceive shifts in market dominance.

4. Advantages and Dangers of DeFi: Understanding the Execs and Cons

Decentralized finance (DeFi) has revolutionized the way in which we entry, handle, and develop our wealth, but it surely additionally comes with challenges and dangers. By understanding each the benefits and downsides, you may make extra knowledgeable choices about collaborating on this quickly evolving area.

Advantages of DeFi over Conventional Finance:

Image Courtesy: weblog.coinremitter.com

A very powerful advantages of DeFi are –

A. Monetary Inclusion:

DeFi gives entry to monetary providers to anybody with an web connection, eradicating limitations imposed by conventional banking methods. No extra ready on financial institution approvals or credit score scores – you’re in management.

B. Transparency and Safety:

Transactions are recorded on public blockchains, making each motion traceable and offering unparalleled transparency. The decentralized nature of DeFi additionally reduces the chance of censorship or manipulation.

C. Decrease Prices:

By eliminating middlemen and conventional gatekeepers, DeFi considerably reduces transaction charges, making monetary providers extra reasonably priced.

D. Decentralized Management:

In contrast to conventional banks that maintain custody over your funds, DeFi means that you can retain full management of your property by non-custodial wallets and decentralized protocols.

E. Versatile and Modern Merchandise:

DeFi introduces distinctive alternatives, together with yield farming, liquidity mining, and the creation of artificial property, pushing the boundaries of what’s attainable together with your cash.

Potential Dangers and Challenges in DeFi:

There are many dangers and challenges while you’re utilizing DeFi. So, you simply want to concentrate on these potential dangers and challenges of utilizing DeFi:

A. Good Contract Vulnerabilities:

Whereas DeFi is constructed on code, bugs or safety loopholes might be exploited, resulting in important losses or hacks. Trusting code alone might be dangerous.

B. Regulatory Uncertainty:

DeFi operates in a largely unregulated atmosphere, which means sudden authorities actions or authorized modifications can influence consumer operations and platform compliance.

C. Market Volatility:

The crypto market is understood for its excessive volatility, which may have an effect on each the steadiness and worth of property utilized in DeFi protocols.

D. Liquidity Dangers:

Low liquidity in sure DeFi protocols might end in worth slippage and difficulties when executing massive transactions or exiting positions.

E. Scams and Fraud:

DeFi’s open nature has attracted unhealthy actors who exploit inexperienced customers by fraudulent schemes or rug pulls, making it essential to analysis and train warning.

5. DeFi Use Circumstances and Functions: Remodeling Finance and Past

Decentralized Finance (DeFi) is altering the face of conventional finance by providing open, permissionless, and decentralized monetary providers on blockchain networks. Right here’s a fast overview of its key use instances, real-world purposes, and the way it’s remodeling industries:

A. Lending and Borrowing:

Customers can lend or borrow cryptocurrencies with out intermediaries, incomes curiosity or accessing loans with overcollateralized property.

Instance: Aave and Compound enable customers to deposit crypto into liquidity swimming pools and earn curiosity or use their property as collateral for loans.

B. Decentralized Exchanges (DEXs):

DEXs allow peer-to-peer buying and selling of cryptocurrencies instantly from wallets, with no central authority.

Instance: Uniswap permits customers to swap tokens seamlessly with out a intermediary.

C. Stablecoins:

Stablecoins are pegged to steady property like fiat currencies, providing a steady retailer of worth within the crypto ecosystem.

Instance: Dai is a stablecoin pegged to the US greenback, providing stability inside DeFi methods.

D. Yield Farming and Staking:

Customers earn rewards by offering liquidity or staking property in DeFi protocols, typically incomes excessive returns.

Instance: Platforms like Yearn Finance optimize yield farming methods for customers.

E. Insurance coverage:

Decentralized insurance coverage platforms cowl sensible contract failures, hacks, or different dangers, providing transparency and honest premiums.

Instance: Nexus Mutual gives insurance coverage for DeFi protocols, mitigating sensible contract dangers.

F. Funds and Remittances:

DeFi permits borderless, low-cost funds and remittances, bypassing conventional charges and intermediaries.

Instance: Initiatives like Celo allow quick, cost-effective cell funds for underserved populations.

Actual-World Functions of DeFi:

DeFi’s purposes lengthen past crypto buying and selling, reaching real-world customers with progressive options. For instance, Microloans provided by platforms like Goldfinch empower debtors in underserved areas, whereas tokenized actual property initiatives comparable to RealT enable fractional possession of property.

How DeFi is Remodeling Numerous Industries:

Right here’s how DeFi is remodeling the entire web3 business.

A. Finance and Banking:

DeFi gives individuals world wide entry to monetary providers, no matter their location or conventional banking standing. It’s selling monetary inclusion and creating new methods to speculate, save, and entry credit score.

B. Insurance coverage:

Decentralized insurance coverage protocols like Nexus Mutual present a clear, decentralized various to conventional insurance coverage, with sensible contracts routinely paying claims when circumstances are met.

C. Gaming and NFTs:

DeFi is merging with the gaming world, enabling play-to-earn economies the place gamers earn tokenized property, in addition to NFT-based in-game objects that may be traded or monetized in open marketplaces.

D. Provide Chain Administration:

DeFi-based provide chain options improve transparency and cut back inefficiencies by monitoring the motion of products utilizing blockchain, making a tamper-proof file of transactions and contracts.

6. Way forward for DeFi:

Image Courtesy: Cointelegraph

The way forward for DeFi holds has each thrilling potential and complicated challenges. As DeFi continues to mature, we’re prone to see better integration with conventional finance, making it accessible to a broader vary of customers. Rising traits, like cross-chain interoperability, may bridge completely different blockchains, enabling seamless transactions throughout platforms. Moreover, as DeFi good points extra mainstream traction, regulatory frameworks might develop to deal with safety issues, bringing much-needed stability and client safety to the area.

Nonetheless, DeFi’s future isn’t with out hurdles. Safety will proceed to be a major focus, as protocols work to guard customers towards hacks and malicious assaults. On the innovation aspect, DeFi is prone to drive new monetary services and products, revolutionizing the whole lot from asset administration to insurance coverage. With extra eyes on the area, DeFi may finally turn into a world monetary commonplace, empowering individuals worldwide with unprecedented management over their funds.

Rising Tendencies and the Future Outlook of DeFi:

Rising traits shaping DeFi embrace cross-chain interoperability (connecting a number of blockchains), decentralized id options for safer consumer verification, and the rise of layer-2 scaling options to cut back transaction prices. Moreover, “Actual-World Asset (RWA) tokenization” is gaining momentum, making conventional property like actual property tradable on decentralized markets.

Platforms like Aave are introducing real-world asset markets, enabling loans backed by tokenized actual property or bonds.

Professional Opinions and Predictions:

Specialists predict that DeFi will evolve to turn into extra user-friendly, interoperable, and controlled, bridging conventional finance with decentralized methods. Some imagine that DeFi’s flexibility will drive mass adoption of decentralized finance in international economies, whereas others stress warning because of dangers like regulation and safety vulnerabilities.

Vitalik Buterin, co-founder of Ethereum, emphasizes scaling options and regulatory readability as important elements for DeFi’s continued success.

7. Conclusion: Embracing the Way forward for DeFi

As we’ve explored, the way forward for decentralized finance (DeFi) is full of immense potential and thrilling alternatives. The important thing traits driving DeFi’s evolution embrace better cross-chain interoperability, the combination of real-world property into decentralized markets, and the continued growth of user-friendly platforms. Specialists predict that as DeFi grows, it is going to result in extra monetary inclusion, improved accessibility, and a shift towards a decentralized monetary ecosystem, all whereas dealing with challenges like regulation and safety.

DeFi’s speedy growth is redefining conventional monetary methods. Rising traits like cross-chain interoperability and Actual-World Asset tokenization are set to reshape DeFi. Professional predictions spotlight the necessity for scalability, regulatory readability, and wider adoption of decentralized platforms. The way forward for DeFi gives thrilling potentialities, and staying forward of those traits is essential for anybody within the evolving world of finance.

Now’s the time to discover the alternatives that DeFi gives. Dive into the world of decentralized finance and keep up to date with the most recent developments to make knowledgeable choices. Don’t miss out on the way forward for finance—subscribe to our publication for normal updates and knowledgeable insights on all issues Web3 world.