On-chain knowledge exhibits the Bitcoin long-term holders have shed a major quantity of the cryptocurrency from their holdings lately.

Bitcoin Lengthy-Time period Holders Have Been Realizing Notable Income Not too long ago

In its newest weekly report, the on-chain analytics agency Glassnode has mentioned about how provide has shifted between BTC short-term holders and long-term holders lately.

The “short-term holders” (STHs) and “long-term holders” (LTHs) right here seek advice from the 2 essential divisions of the Bitcoin market achieved on the idea of holding time. The traders who purchased their cash inside the previous 155 days fall within the former cohort, whereas those that have been holding for longer than this era are put within the latter one.

Statistically, the longer an investor holds onto their cash, the much less possible they change into to promote mentioned cash at any level. Thus, the STHs might be thought of to incorporate the weak fingers of the market, whereas the LTHs characterize the resolute entities.

Now, right here is the chart for the provides of the 2 teams shared by the analytics agency within the report:

As displayed within the above graph, the Bitcoin LTHs have participated in a selloff lately, as their whole holdings have decreased by round 1.1 million BTC. This means the value explosion past $100,000 has been too good for even these diamond fingers to sit down out on.

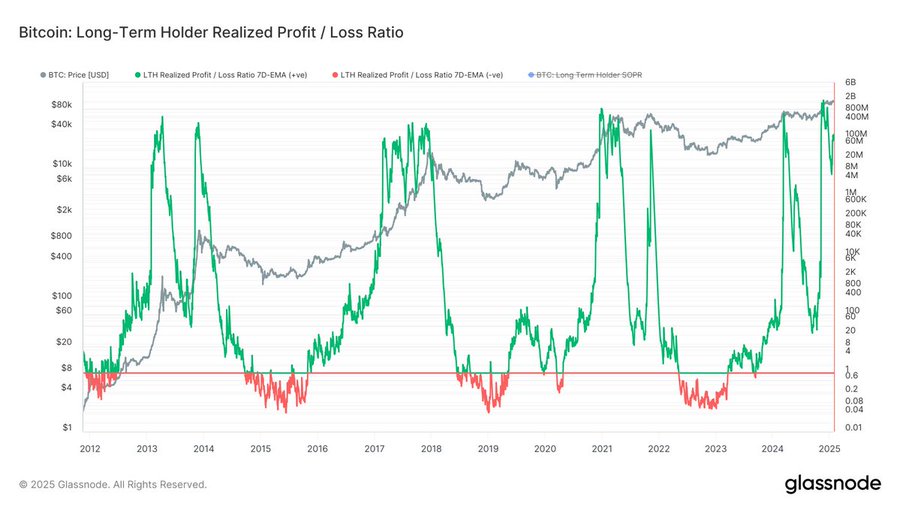

In a submit on X, Glassnode has shared the info of how the ratio between the revenue and loss locked in by the LTHs has in contrast has lately.

From the graph, it’s seen that the Bitcoin LTHs have seen a way more huge profit-taking quantity than loss-taking one lately. This pattern was additionally witnessed in every of the previous bull runs.

The sample isn’t shocking, because the LTHs are inclined to amass such an enormous quantity of beneficial properties by means of their persistence that by the point the bull run rolls round, they’re prepared to reap huge numbers.

Naturally, as the most recent promoting from the LTHs has occurred, the STH provide has elevated by the identical quantity. At any time when the LTHs promote, some new purchaser is available in to take their cash.

Throughout bull markets, a excessive quantity of contemporary demand tends to circulation in that absorbs the profit-taking from the LTHs. As long as the steadiness available in the market maintains, the rally continues. As soon as the demand runs out, nonetheless, the value reaches a high.

It now stays to be seen how lengthy the Bitcoin market can proceed to soak up the aggressive profit-taking spree from the HODLers.

BTC Value

On the time of writing, Bitcoin is buying and selling round $105,100, up greater than 2% during the last week.