Please see this week’s market overview from eToro’s international analyst crew, which incorporates the most recent market information and the home funding view.

Most markets rose steadily in anticipation of Donald Trump’s presidency

Final week provided one thing for each sort of investor. Bond and small-cap traders discovered some aid in softer-than-expected inflation information, which brought about the US 10-year yield to fall from 4.76% to 4.62%. Worth traders have been happy with strong US financial institution earnings, all of which exceeded expectations. Development and AI traders welcomed TSMC’s announcement of a deliberate improve in capital expenditures for 2025 to roughly $40 billion, sparking hypothesis about which portion will fund a brand new state-of-the-art manufacturing facility within the US.

In the meantime, cryptocurrency fanatics have been astonished by the launch of a Trump memecoin, which skyrocketed to billions in market worth. This surge additionally lifted Bitcoin by 11%, though it brought about a decline in lots of altcoins. China’s GDP development within the fourth quarter of 2024 rose to five.4%, arguably pushed by front-loaded exports looking for to keep away from larger tariffs beneath Trump’s presidency.

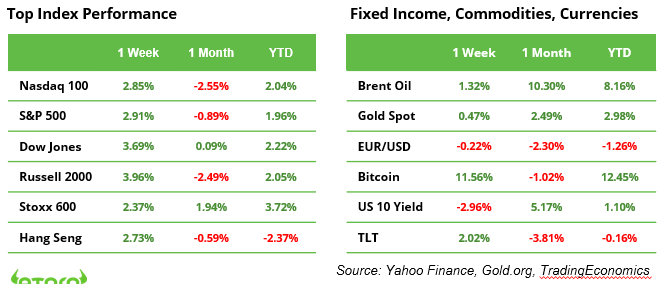

Main fairness indices closed the week in constructive territory. The S&P 500 and Nasdaq 100 have been up by 3%, whereas the Dow Jones and Russell 2000 gained 3.7% and 4.0%, respectively. The European STOXX 600 and the China-focused Cling Seng additionally posted positive aspects of two.4% and a pair of.7%, respectively. The UK FTSE 100 Index reached a brand new all-time excessive above 8,500 factors on Friday (see chart).

Macro Outlook for the week

All of the above came about within the wake of Donald Trump’s inauguration on Monday, 20 January, a day when US markets have been closed in observance of Martin Luther King Day. This week in macro, traders will concentrate on the UK’s unemployment and wage development information, following final week’s lower-than-expected inflation, retail gross sales, and GDP figures. Markets are factoring in vital price cuts by the Financial institution of England in 2025, aiming to facilitate a smooth touchdown for the financial system.

Consideration can even flip to Germany’s financial sentiment index, as traders search indicators of enhancing sentiment, notably in mild of latest GDP information displaying the financial system contracted for a second consecutive yr. Notably, Germany stays the one main industrialized nation the place GDP per capita is projected to remain under 2019 ranges via 2025.

FTSE 100 Index reached a brand new all-time excessive above 8,500 factors on Friday

Who decides the destiny of the yen, the Financial institution of Japan or Donald Trump?

The yen and the euro have been dropping floor towards the greenback for months, with the buck buoyed by a robust US financial system and the “Trump Commerce,” pushed by proposed tax cuts and looming tariffs.

Final week introduced some aid: EUR/USD climbed above 1.027, whereas USD/JPY fell 1% to 156.2. Yen merchants responded to Financial institution of Japan (BoJ) Governor Kazuo Ueda’s hints of a possible price hike this Friday, following key inflation information due earlier that day.

Nevertheless, Japan’s choices stay restricted. Years of sluggish development and excessive public debt preserve the financial system reliant on low rates of interest. Whereas the BoJ would possibly stabilise the yen, a significant rally appears unlikely. A weaker US greenback might show extra impactful than any BoJ coverage shift.

The yen’s destiny could in the end relaxation with Trump. His inauguration on Monday might form markets, with a robust greenback nonetheless the baseline beneath his “America First” agenda. Nevertheless, softer tariffs or fiscal insurance policies might weaken the greenback and provides the yen some respite.

Earnings season: huge names reporting

The earnings season is getting into its essential second week, with seven of the world’s high 100 largest corporations reporting their 2024 This fall earnings (see under). Buyers ought to recognise that some inventory costs could have been influenced by the upcoming presidential transition. In his remaining days, Joe Biden allotted $26 billion to wash vitality tasks. In the meantime, Donald Trump has repeatedly said his intention to impose a 20% tariff on all items offered to the US, and a 60% tariff particularly on items from China. Execution orders, signed by Trump in his first week, might change federal insurance policies from the beginning and trigger sudden market actions.

Macro and earnings information releases

Macro

UK unemployment, Germany ZEW (22/1), Japan CPI, BoJ price determination, World PMI (24/1)

Earnings

21 Jan. Netflix, Charles Schwab, 3M, United Airways

22 Jan. Procter & Gamble, Johnson & Johnson, GE Vernova, Amphenol

23 Jan. GE Aerospace, Texas Devices, American Airways

24 Jan. American Specific, Verizon, NextEra Power

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.