Este artículo también está disponible en español.

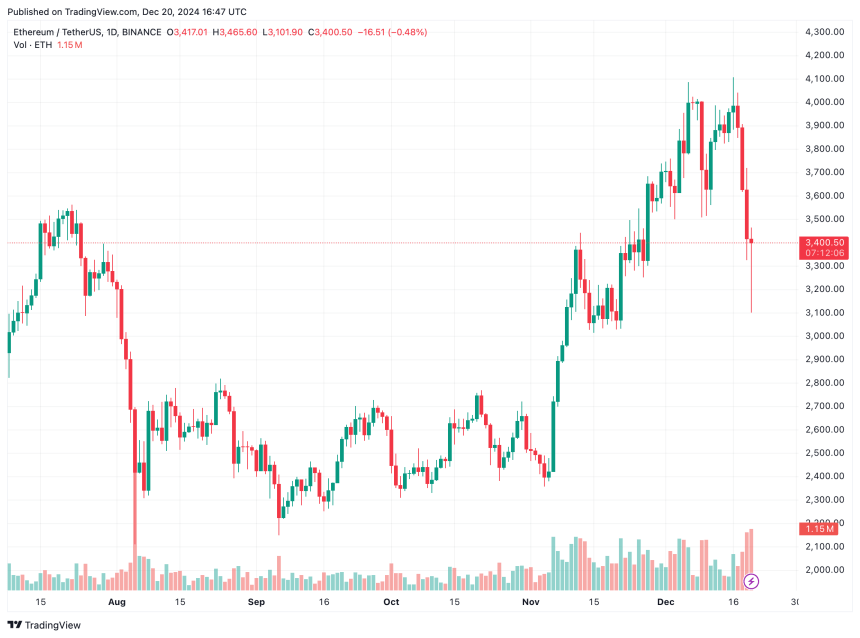

As a consequence of yesterday’s crypto market rout, Ethereum (ETH) has now confronted rejection on the key $4,000 resistance stage for 3 times since March 2024. The second-largest cryptocurrency by reported market cap is now buying and selling on the $3,400 stage, down 6.7% previously 24 hours.

What’s Behind Ethereum’s Underwhelming Worth Efficiency?

Whereas ETH has posted a decent 47% year-to-date (YTD) achieve, it has been outpaced by different main cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP, which have recorded considerably increased returns in the identical interval. A number of components look like holding again Ethereum’s value momentum.

Associated Studying

One contributing issue is Ethereum’s comparatively weaker model recognition versus Bitcoin. This was highlighted by the lackluster response to the launch of spot ETH exchange-traded funds (ETFs) in August. The introduction of those ETFs did not generate any significant value motion for ETH.

Knowledge additional reveals a big disparity in investor curiosity between the 2 belongings. The overall internet belongings held in U.S. spot ETH ETFs presently quantity to $11.98 billion. In distinction, spot BTC ETFs maintain $109.66 billion – almost ten instances as a lot.

Moreover, yesterday noticed over $60 million in outflows from spot ETH ETFs, marking the biggest single-day outflow since November 19. Crypto analyst Ali Martinez identified that social sentiment round ETH has reached its lowest level in a yr. Nonetheless, based mostly on historic tendencies, this might paradoxically sign a bullish alternative for Ethereum.

Futures merchants have additionally turned bearish on ETH, because the aggregated premium for futures positions flipped adverse for the primary time since November 6. The market downturn triggered Ethereum’s largest liquidation occasion since December 9, with $299 million liquidated in a single day. Such large-scale liquidations usually result in cascading sell-offs and heightened value volatility.

One other recurring concern stems from the Ethereum Basis’s tendency to promote ETH close to native value peaks. In a latest X put up, Lookonchain famous that the Ethereum Basis bought 100 ETH on December 17. Following this sale, ETH’s value has dropped roughly 17%.

Additional skepticism surrounds Ethereum’s provide issuance. A latest Binance Analysis report highlighted that ETH’s comparatively excessive issuance price raises questions on its “ultrasound cash” narrative, which suggests Ethereum is a deflationary asset.

Is Ethereum Set For A Bounce?

Seasoned crypto analyst @Trader_XO acknowledged that they purchased spot ETH on the $3,200 value stage yesterday. The analyst added that they anticipate “an excellent few weeks” of value consolidation earlier than ETH’s subsequent leg up.

Associated Studying

In the meantime, crypto dealer @CryptoShadowOff recognized a possible ascending triangle formation on ETH’s month-to-month chart. In keeping with their evaluation, ETH may drop additional to the $2,800 vary earlier than concentrating on a brand new all-time excessive (ATH).

Market analyst @CryptoBullet1 emphasised that on the 4-hour chart, ETH has not been this oversold since August 5, indicating a bounce could also be on the horizon. At press time, ETH trades at $3,400, down 6% previously 24 hours.

Featured picture from Unsplash, charts from Coinglass, X, and Tradingview.com