Bitcoin is beneath stress as bullish sentiment begins to fade and sellers regain management. After weeks of energy, BTC is now testing the crucial $92,000–$93,000 assist zone, trying to substantiate this stage as a base for continuation. Nonetheless, if promoting stress continues to rise, a breakdown beneath this space may set off a sharper correction and sign a weakening pattern.

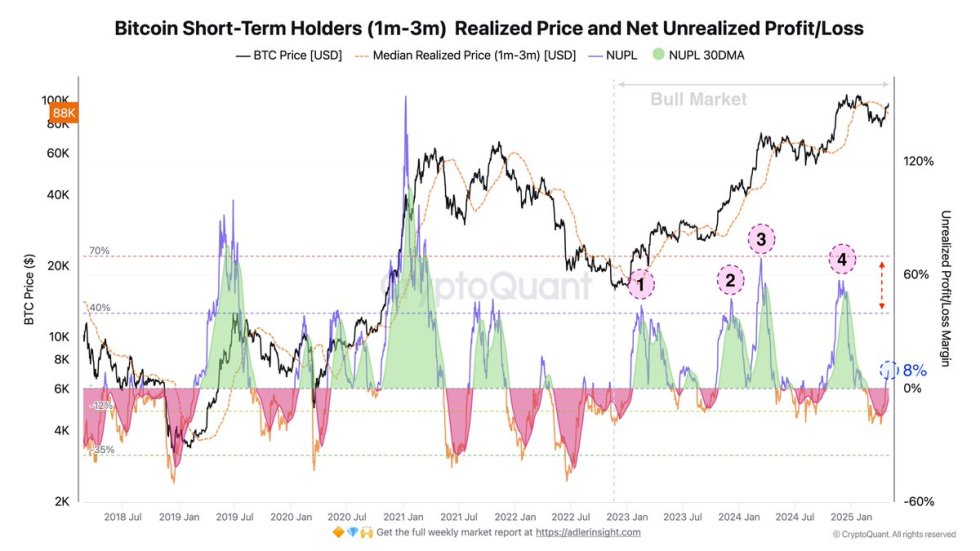

Prime analyst Axel Adler shared insights that spotlight a key threat issue: within the present bull cycle, short-term holders are inclined to take earnings as soon as their Web Unrealized Revenue and Loss (NUPL) exceeds 40%. Traditionally, this stage marks the purpose the place speculators start to dump their positions, growing spot market provide and creating downward stress on value. With Bitcoin just lately exhibiting indicators of stalling close to $98,000 and momentum cooling, merchants are rising cautious.

Though the construction stays intact for now, BTC should maintain the $92K area to keep away from flipping key assist into resistance. A clear bounce from this stage may revive the bullish case, however failure to carry may shift sentiment additional bearish. As market members watch intently, Bitcoin faces one in all its most severe exams on this cycle. The following transfer might outline the pattern for weeks to return.

Bitcoin Enters Pivotal Vary: Consumers Goal $100K Breakout

Bitcoin is buying and selling inside a vital value vary, the place a drop beneath $90,000 may set off a shift in momentum towards the draw back, whereas a breakout above $100,000 may spark a robust new leg of the bull cycle. After enduring months of promoting stress from its all-time highs, BTC is exhibiting renewed energy and trying to substantiate a broader bullish setup for your entire market. The latest push above $92K was a key technical step, however now bulls should defend that stage and construct momentum towards a sustained breakout.

Market situations, nonetheless, stay unstable. The present surroundings is formed by macroeconomic uncertainty and rising geopolitical tensions, creating unpredictable swings throughout crypto and conventional markets. Nonetheless, Bitcoin’s value construction suggests bulls are gaining the higher hand—at the least for now.

Adler shared insights on the position of short-term holders (1–3 months), who are sometimes probably the most aggressive market members. This group contains skilled speculators, a lot of whom commerce Bitcoin by way of ETF platforms. Traditionally, on this bull cycle, when their Web Unrealized Revenue and Loss (NUPL) exceeds 40%, they start to take earnings, inflicting promote stress. Presently, NUPL sits at simply 8%, with its 30-day SMA nonetheless destructive at -2%, signaling that short-term holders will not be but promoting in massive numbers.

This low NUPL stage suggests minimal fast promoting threat, which reinforces the bullish case. So long as NUPL stays subdued, Bitcoin may have room to proceed climbing earlier than profit-taking begins. The approaching days shall be crucial—holding above $90K and constructing towards $100K may open the door for a breakout, whereas failure to take action might usher in renewed weak point. All eyes stay on Bitcoin because it stands at a decisive second on this cycle.

Worth Motion Particulars: Holding Sturdy However Dealing with Resistance

Bitcoin is at present buying and selling round $94,158 after a modest pullback from the latest native excessive close to $97,000. The each day chart exhibits that BTC stays nicely above each the 200-day easy shifting common (SMA) at $90,542 and the 200-day exponential shifting common (EMA) at $86,381, suggesting that the broader pattern stays bullish.

After breaking via the important thing $90K stage in April, Bitcoin rallied strongly however is now consolidating slightly below the psychological $100K resistance. Quantity has began to taper off, indicating short-term indecision as bulls and bears battle for management. A continued maintain above $92K would reinforce the bullish case, probably setting the stage for a renewed breakout towards $100K and the earlier cycle excessive of $103,600.

Nonetheless, a breakdown beneath $92K may sign a lack of momentum and enhance the probability of a retest of the 200-day SMA close to $90K. This stage now serves as essential assist and shall be intently watched by merchants.

Total, Bitcoin stays structurally sturdy, however the subsequent few each day candles shall be crucial. A decisive transfer above $97K may ignite the subsequent leg up, whereas a lack of $90K would threat flipping the pattern short-term bearish.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Discussion about this post