Do you know that the whole chip trade depends on one single firm? And the true kicker? It’s not Chinese language or American. A very powerful semiconductor producer is from the Netherlands, and it’s referred to as ASML. Proper now, it’s buying and selling at ranges final seen within the 2022 bear market. On this article, we’ll dive into why this monopolistic large might be the true AI winner of 2025.

With one of many strongest MOATs on this planet, ASML is a key enabler of the AI revolution

AI is turning into a matter of nationwide safety, necessitating home chip manufacturing and driving demand for ASML

Learn on to search out out if ASML is a match to your portfolio…

The AI revolution is reshaping how we work together with the best invention earlier than it — the pc. Three years in the past, AI felt like a dangerous wager. As we speak, the larger threat lies in overlooking it. And that applies past investing.

Though market sentiment across the AI revolution has cooled down in latest weeks, knowledge reveals that the AI trade has solely gotten hotter. Personal investments are on monitor, governments are pouring tens of billions into sovereign chip and AI infrastructure, and AI fashions are more and more extra clever and helpful.

However making AI chips, that are fabricated from transistors 30,000 instances smaller than a human hair, is essentially the most superior manufacturing course of on earth. That’s the reason just one firm on this planet can produce the unimaginable machines that do it. ASML has constructed a monopoly due to its large technological benefit.

Discover ASML inventory on eToro!

Their flagship EUV lithography machines use an excellent exact laser to attract circuits onto a chip so tiny, it’s like sketching a complete metropolis on a grain of rice. The method entails mirrors so clean that if scaled to the dimensions of the moon, their imperfections could be smaller than a blade of grass. That’s as a result of a traditional mirror would take in the laser’s miniature lightwaves, which should hit a droplet of tin – half the width of a human hair, shifting at 200 meters per second – useless middle, 50,000 instances a second. However we’re getting too technical right here. If you’d like extra particulars on ASML’s machines, I like to recommend studying their annual report right here.

However why would ASML be the AI winner of 2025?

AI is not simply chatbots and picture mills. With rising capabilities in army and cybersecurity purposes, AI is turning into a matter of nationwide curiosity. It’s clearly seen within the semiconductor commerce between the US and China. The US has not too long ago blocked Nvidia from promoting the H20 – its “dumbed-down” model of its Hopper chip – to China, citing safety dangers. In the meantime, China has put the load of its authorities behind sovereign AI.

As a result of the event of AI is so fast, no one is aware of what capabilities is perhaps found. It’s more and more clear that we’re in an AI arms race, and everyone seems to be making an attempt to get forward. As a result of many main AI fashions are open supply, governments try to focus on the step earlier than that, the manufacturing course of. In case your rival has worse expertise, they’ll’t get the most effective AI mannequin. At the very least in idea.

However semiconductor provide chains are among the many most complicated on this planet. A chip is perhaps designed within the U.S., manufactured in Taiwan, packaged in Vietnam, examined in China, and eventually shipped again to the U.S. That’s the reason growing home chip manufacturing capabilities is turning into a strategic goal for the world’s main economies, that are realising that their interconnection is turning into a vulnerability.

And what’s step one to construct home modern chip foundries? That’s proper, shopping for lithography machines from ASML. No different firm on this planet is competing on this discipline. It’s simply too complicated and costly.

Let’s check out ASML’s enterprise mannequin to see the way it can leverage this case.

ASML’s Enterprise Breakdown & SWOT Evaluation

As a result of nature of ASML’s enterprise, buyers will need to have a deep understanding of its machines. ASML really manufactures machines starting from the cutting-edge high-NA EUV to less complicated applied sciences the place ASML competes with Nikon and Canon. The 2 predominant classes, EUV and DUV, during which ASML holds a monopoly, made up 86% of 2024 income. That’s why we’re giving them particular consideration on this evaluation. These are additionally its predominant progress drivers.

EUV: The Future Of Chipmaking

Something under 13.5 nm requires an EUV machine to fabricate. These embody chips just like the Snapdragon 8, Apple M3, Tesla Dojo D1 or Nvidia H100.

A typical semiconductor manufacturing plant, or “fab”, accommodates between 10 – 30 of those machines. So with each deliberate fab, you possibly can anticipate that quantity of orders for ASML.

These will not be common machines both. 150 ASML specialists are wanted to assemble the modular design, which is then shipped to prospects, the place remaining meeting can take as much as six months, 120 engineers, and over 20 vehicles and three cargo planes. So It’s not like you possibly can decide these up and transfer them to a different facility. However upon getting them, they’ll work for as much as 30 years.

These machines value between 200 – 250 million {dollars} a pop, with cutting-edge fashions costing as much as $ 400 million. Their upkeep prices additionally run into the tens of thousands and thousands yearly. So in the event you think about a brand new fab in Arizona for instance, with shall we say 10 EUV machines, that’s over 2,5 billion {dollars} of income for ASML. For an organization that did practically 30 billion $ in income in 2024, that’s a fairly large ticket.

Due to the excessive prices, solely a handful of corporations can afford them. TSMC, Samsung and Intel at the moment make up nearly all of ASML’s demand. This makes it simpler to challenge future demand by monitoring growth plans of those three corporations.

TSMC is increasing its manufacturing capabilities with three fabs in Arizona, one in Kumamoto, Japan, one in Taiwan, and one in Dresden, Germany. Intel is increasing its US fab footprint too, with two modern fabs underneath development in Arizona, two in Ohio and two in Magdeburg, Germany. Samsung is constructing two fabs in Texas and increasing capability in South Korea.

Put money into chip leaders with eToro’s Chip-Tech Sensible Portfolio!

As we are able to see, demand for EUV is prone to keep elevated within the coming years, with computing necessities prompting fabs to pursue smaller, 2nm expertise utilizing high-NA EUV, ASML’s newest innovation. Intel was the primary in line to order these machines.

It’s necessary to notice that ASML shouldn’t be transport EUV to China. Right here, we’re as soon as once more coming again to politics, as a result of ASML is dealing with export restrictions. The US has been urgent ASML to not promote to China since 2018, additional proving the delicate nature of this expertise. Nevertheless, ASML does enterprise with China of their much less superior DUV section. Let’s check out that.

DUV: Outdated However Not Out of date (get the Terminator pun?)

DUV lithography is much less superior, however nonetheless vital and extensively utilized in each older nodes, starting from 28 – 90nm, and fewer vital layers of vanguard nodes, serving as a complement to EUV. DUV is used for automotive chips, built-in circuits, RF chips, show chips, and others.

Right here, the record of shoppers is for much longer, as they’re utilized in a variety of gadgets. The most important ones embody TSMC, Samsung, SK Hynix, Micron, Intel, and plenty of Chinese language companies.

Key progress drivers for these machines embody AI, self-driving, IoT & good gadgets, and HBM and different reminiscence. It’s necessary to notice that each EUV chip requires DUV as properly. Fabs comprise round double the quantity of DUV machines in comparison with EUV.

DUV are less complicated to fabricate and assemble as properly, “solely” taking 3-5 months to assemble. The prices of DUV instruments vary from 10 million {dollars} for the best ones used for ICs to 80 million for superior instruments used to complement EUV in modern chip manufacturing. Upkeep prices attain 4-6 million $ per instrument.

Now that we all know what they do, let’s have a look at the SWOT evaluation.

Strengths: aggressive benefit (monopoly in >80% of income), large up-front prices for opponents, vital provider (chip fabs have to make use of ASML machines), strategic expertise (international locations are more and more making an attempt to develop home chip manufacturing capabilities, boosting demand), large order backlog (ASML has sufficient orders for greater than a 12 months forward)

Weaknesses: difficult provide chain (typically with a single provider on this planet), publicity to tariffs (EU firm transport to USA), unstable demand (ASML’s machines are a giant, one time funding, so demand can waiver)

Alternatives: AI (modern AI chips depend on EUV expertise, and demand is rising), Automotive (Ongoing electrification and FSD requires many superior chips for automobiles), authorities help (governments are subsidizing home chip producers)

Threats: AI mannequin developments (extra environment friendly fashions may probably scale back demand for extra highly effective chips), commerce conflict (tariffs may harm ASML’s provide chain and US may stress it to cease DUV enterprise with China)

Do you need to study extra about ASML? Take a look at Neža Molk’s evaluation!

ASML’s Newest Quarterly Name Helps Development Thesis

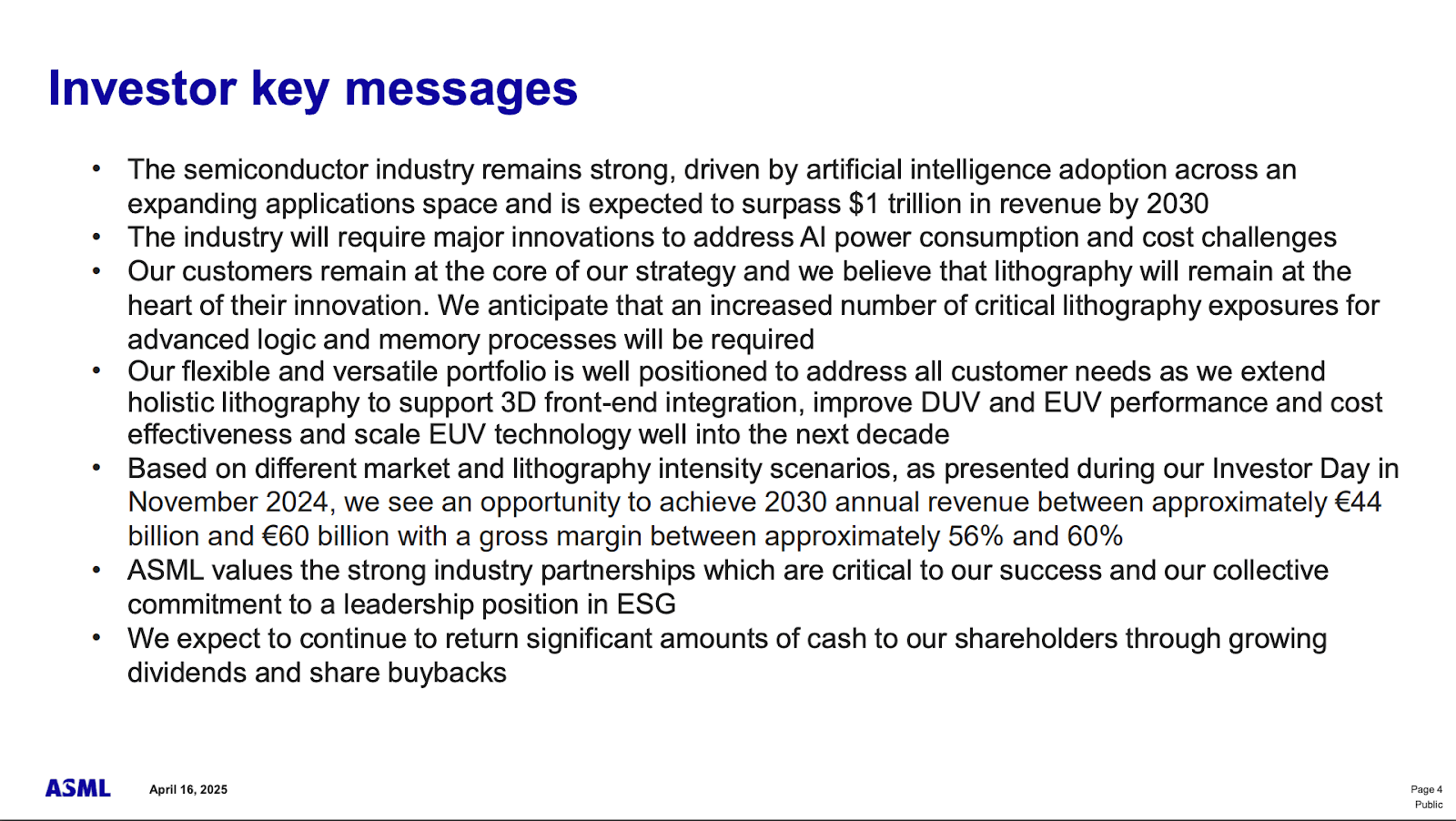

In ASML’s newest quarterly name, administration mentioned some very attractive issues supporting my progress thesis.

First, tariffs haven’t affected AI chip demand, and are doubtless not going to have an effect on ASML’s commerce with the US, as its expertise is essential to the administration’s goal of increasing the US’s semiconductor manufacturing capabilities.

Particularly, CEO Christophe Fouquet famous that: “the announcement of tariffs haven’t modified the enterprise dialog we have now with our prospects” and CFO Roger Dassen added that ASML expects that: “the lion’s share of the tariff burden must be borne by the following aspect within the worth chain,” hinting at how semiconductor fabs will in all probability bear essentially the most tariff influence as ASML has vital bargaining energy due to its distinctive place.

However the irreplaceability of its machines offers producers a powerful argument to foyer towards tariffs on ASML’s machines. ASML acknowledged this on the earnings name, saying that it “is perhaps the explanation why semiconductors at the moment are exempt from tariffs,” including that this situation “is being acknowledged by the U.S. administration.”

AI remains to be driving robust demand throughout the entire provide chain. In abstract, administration mentioned that main investments are already dedicated by corporations decided to compete within the AI race. Primarily based on buyer conversations, ASML sees 2025 and 2026 as strong progress years fueled by this momentum, with vital chip manufacturing investments already locked in and future commitments trying very strong.

One other crucial subject is China, as a result of it’s anticipated to make up 25% of 2025 gross sales. ASML mentioned that Chinese language demand may be very robust, notably due to the growth of the electrical automobile trade, but in addition AI and mainstream chips. In truth, Chinese language demand is healthier than anticipated just a few months in the past.

ASML additionally confirmed that the growth of sovereign chip manufacturing is anticipated to drive demand for its machines, saying this development will drive up demand throughout the whole worth chain.

Is ASML Inventory Undervalued?

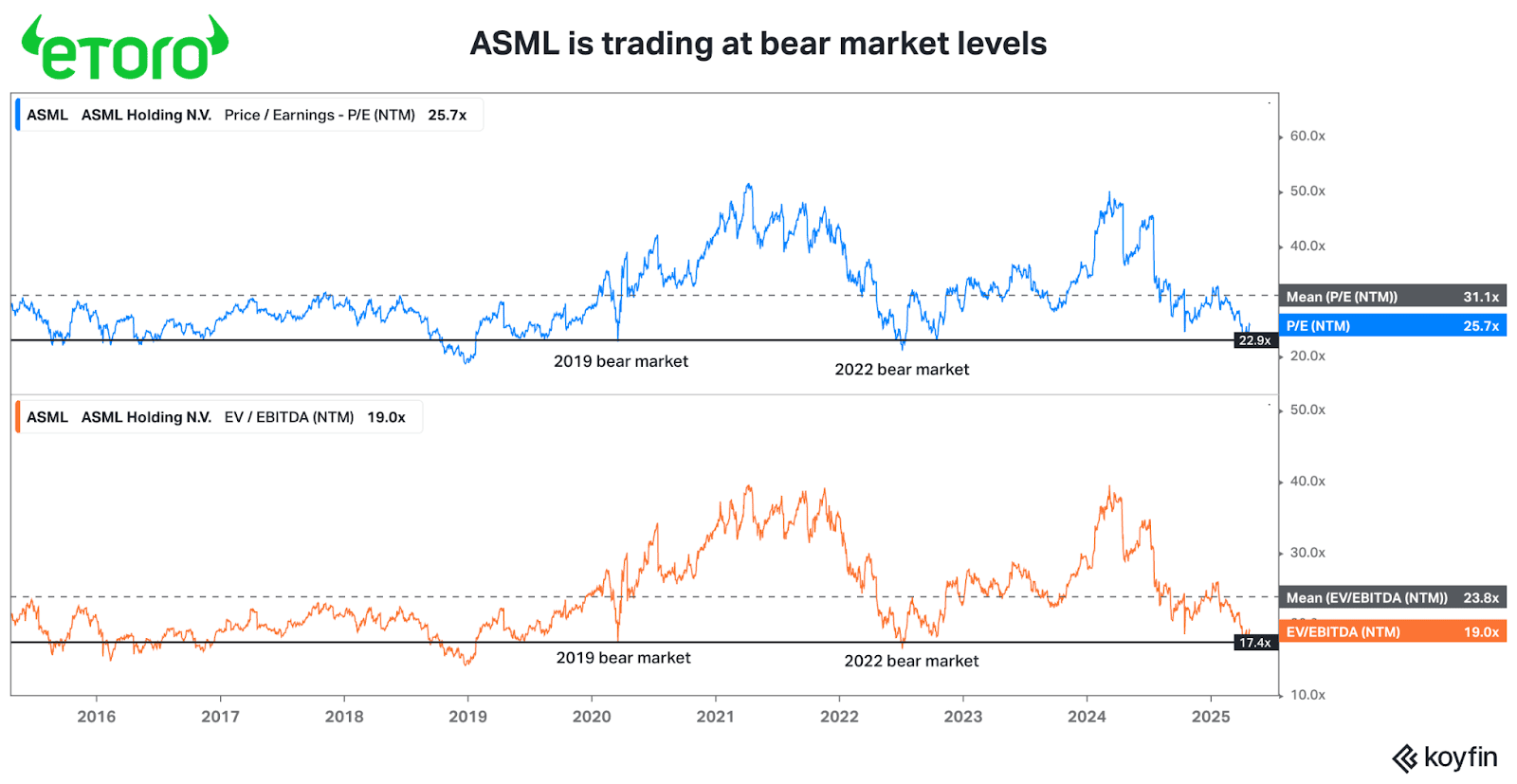

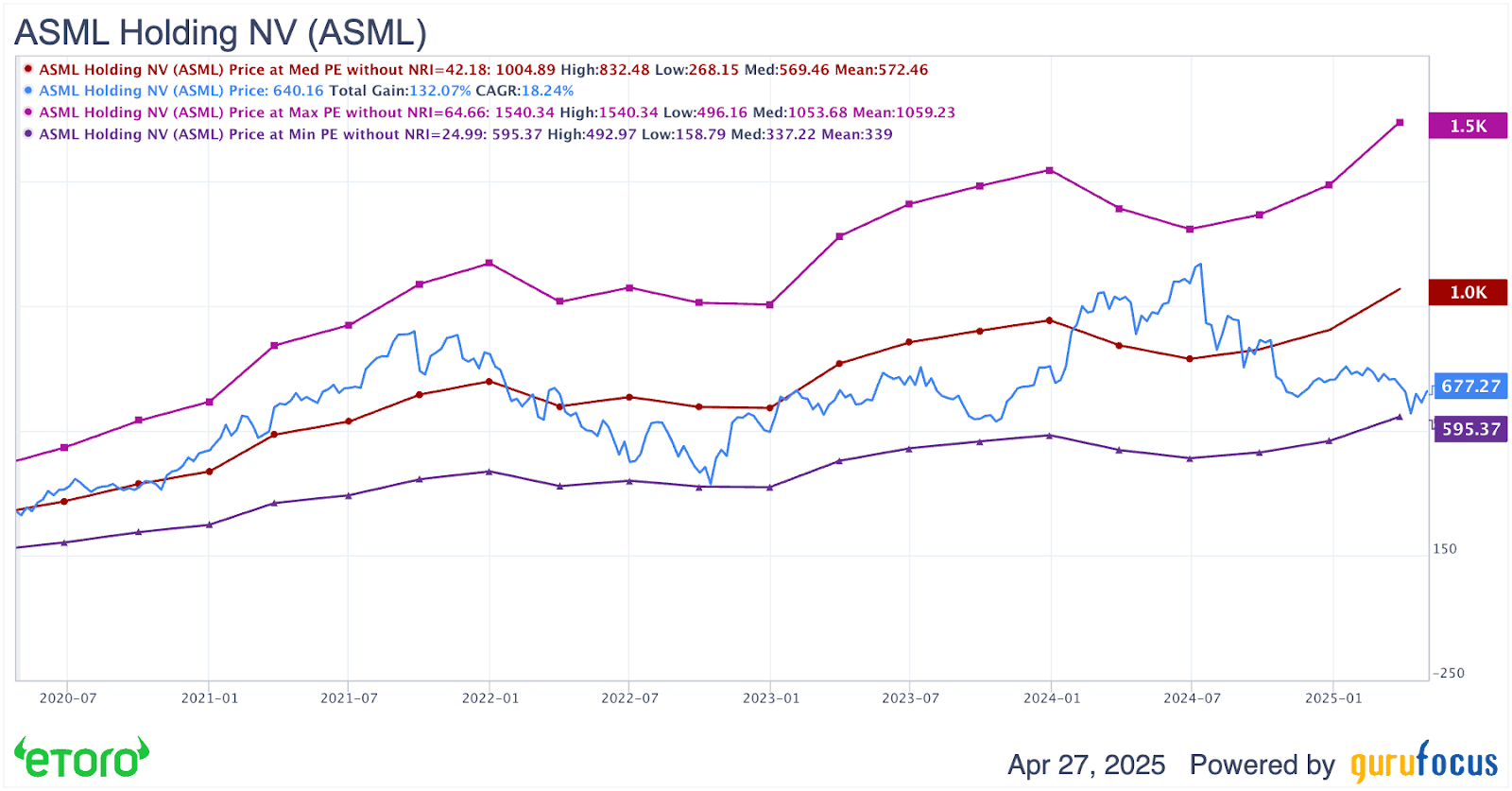

Right here comes the juicy half. Regardless of all of those optimistic components talked about above, ASML has grow to be a casualty of investor pessimism. Its shares are buying and selling at severely depressed ranges. relative metrics, it’s clear that ASML is buying and selling far under its imply over the previous ten years, suggesting a possible 20% upside.

The undervaluation turns into even clearer when trying on the valuation metrics since ChatGPT was launched, which began a large wave of investments into chip expertise.

One other chart I like to take a look at is the value at max, median, and max multiples. As you possibly can see, the shares at the moment are buying and selling at an alarmingly low worth, probably creating a large alternative.

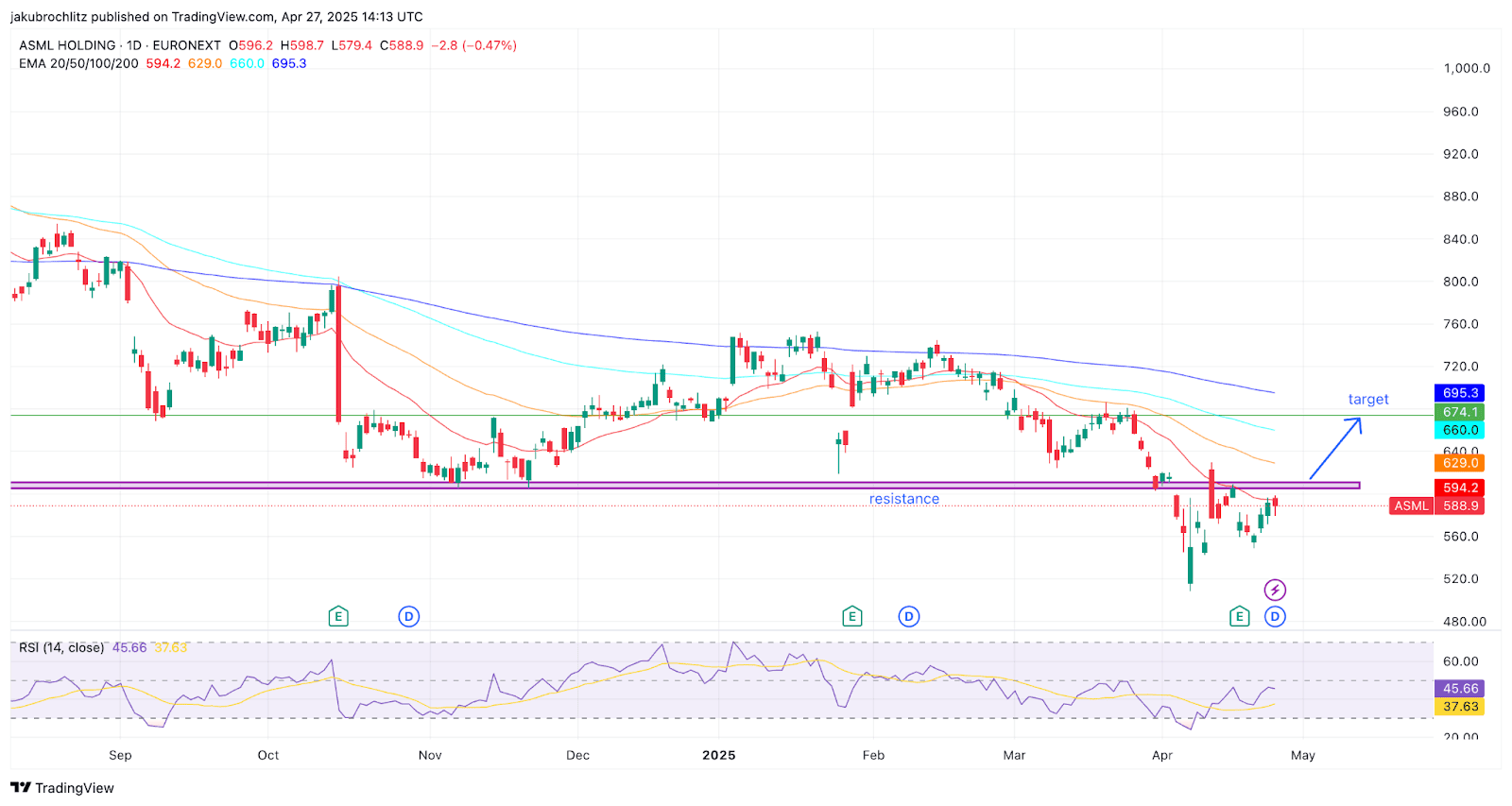

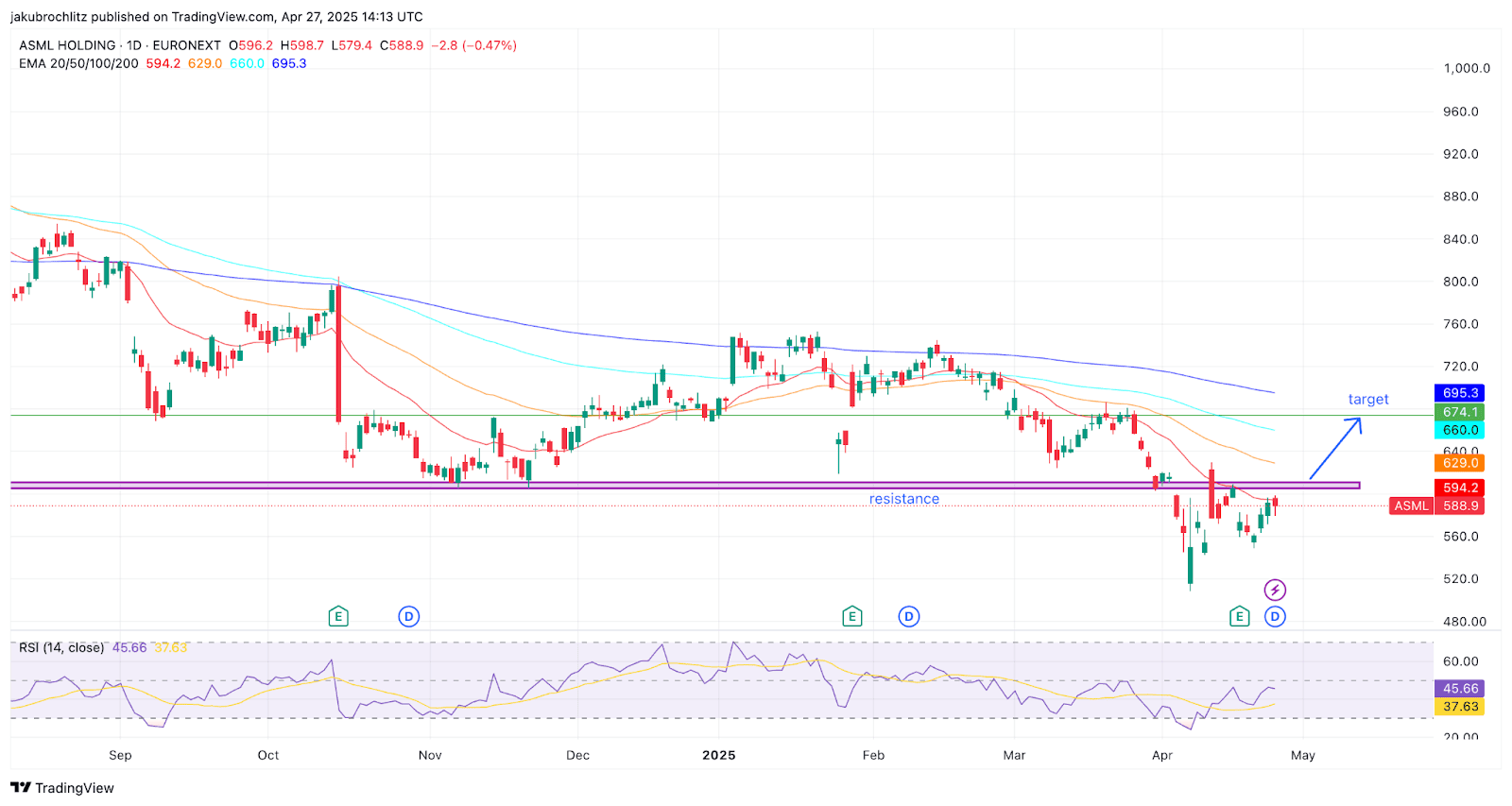

Trying on the inventory from a technical perspective, we see a clearly outlined resistance degree at across the 610 $ mark. If we handle to interrupt that subsequent week, we may see the inventory rally 10% till it meets the second main resistance degree at 670$. Breaking the EMA’s alongside the way in which may present momentum help.

Is ASML Inventory A Purchase?

The market is generally environment friendly more often than not. There are two methods a inventory turns into undervalued. Both the market costs in too little upside potential, or it costs in an excessive amount of draw back threat. In ASML’s case, it’s the latter.

Discover ASML inventory on eToro!

Tariffs, AI mannequin enhancements, and total souring sentiment have all weighed on ASML’s shares. Nevertheless, I imagine that the market is severely mispricing the impact of this case on ASML. The corporate has a number of tailwinds going for it, making it unreasonably priced on the present ranges. Let’s have a look at three attainable outcomes:

Bull case: Trump’s tariff deal spares ASML’s machines, recognizing their vital significance within the semiconductor trade. AI demand stays on monitor, permitting ASML to execute on its progress technique. Fabs proceed to broaden within the US because of authorities incentives and demand indicators. On this case, we may see a minimum of a 30% upside within the medium time period.

Base case: Trump’s tariffs hit ASML, which is ready to move down the prices to prospects due to its vital bargaining energy. Greater costs stifle fab growth within the US, probably making 2025 one other transition 12 months for ASML till the mud settles. On this case, ASML nonetheless has 10% upside potential because of already deliberate growth offers.

Bear case: Tariffs plunge the US right into a deep recession, slowing AI demand and hurting ASML’s prospects. ASML shouldn’t be in a position to maneuver out of this, and progress will get harm. Even then, the inventory has restricted draw back at this worth, as the corporate is anticipating to double by 2030.

Did you discover this evaluation useful? Share it with others on eToro!

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.