The value of Ethereum continues to battle within the month of April, because it barely holds above the $1,600 stage over this weekend. Regardless of its underwhelming efficiency, a number of traders are nonetheless retaining an eye fixed out for the second-largest cryptocurrency by market cap. As such, a well-liked crypto dealer on the social media platform X postulated that it is likely to be time to purchase the Ethereum token once more.

Has ETH Value Reached A Backside?

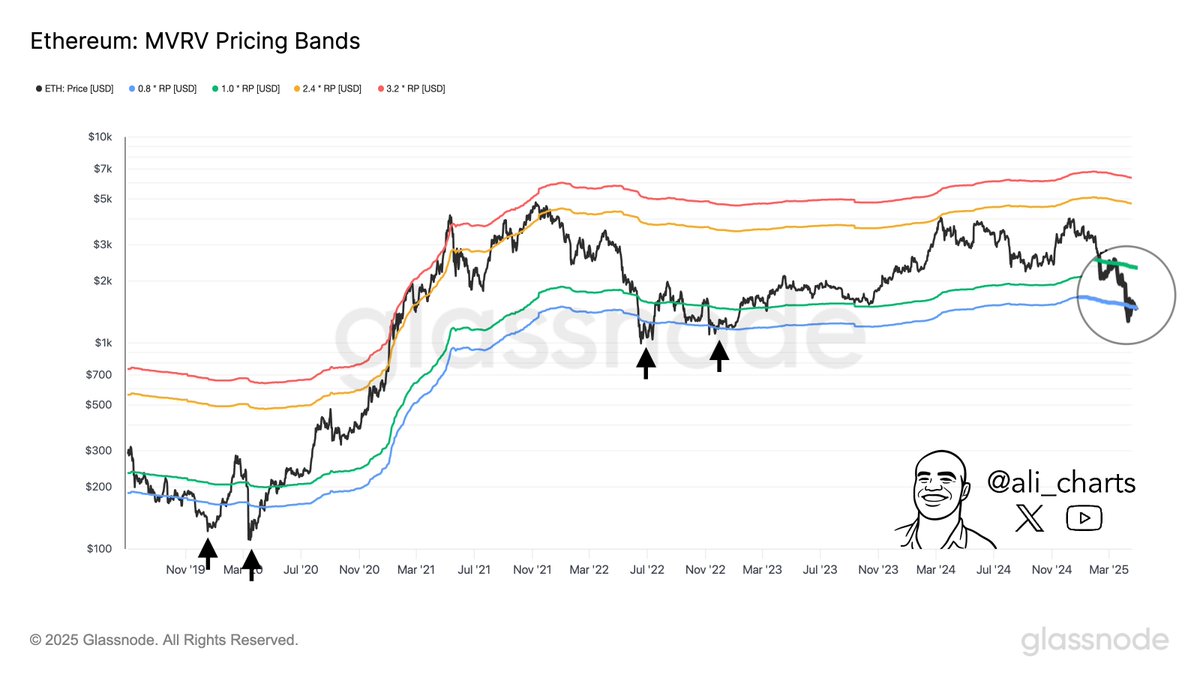

In an April 19 put up on X, distinguished crypto analyst Ali Martinez revealed that Ethereum has hit a vital on-chain stage, which could possibly be bullish for the worth. This on-chain commentary revolves across the Market Worth to Realized Worth (MVRV) Pricing Bands, which are based mostly on a set of MVRV values that sometimes describe the extremes of the market cycles.

The MVRV (Market Worth to Realized Worth) ratio is an indicator that tracks the ratio between a coin’s market cap and its realized cap. When the worth of this ratio is bigger than 1, it implies that extra traders are thought of to be in revenue in the mean time.

Sometimes, the MVRV ratio presents perception into how the worth the traders maintain (the market cap) measures towards the worth they put in (the realized cap). In the meantime, the pricing bands assist to estimate the extremes of a coin’s market cycle, the place excessive ranges point out excessive unrealized revenue and low ranges sign excessive unrealized loss.

For context, a excessive MVRV worth is taken into account a value high sign, as merchants are normally extra more likely to offload their belongings when they’re within the inexperienced. In the meantime, when the MVRV ratio is low, it implies that the market cycle has reached a backside.

Supply: @ali_charts on X

The blue pricing band represents extraordinarily low ranges, the place the MVRV has been beneath 0.8 for round 5% of buying and selling days. In the meantime, the pink pricing band marks extraordinarily excessive ranges, with the MVRV worth trending above the two.4 mark for round 6% of the buying and selling days.

As proven within the chart above, the worth of Ethereum has dropped beneath the blue pricing band prior to now few days. Traditionally, each time the worth of ETH falls to this extraordinarily low stage, it implies that the altcoin has bottomed out and is likely to be gearing up for a pattern reversal.

Ethereum Value At A Look

As of this writing, the worth of ETH sits simply above $1,610, reflecting 1.4% improve prior to now 24 hours. In keeping with information from CoinGecko, the altcoin is down by 2% prior to now seven days.

The value of ETH on the every day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.