The Ethereum token has been beneath vital bearish strain over the previous few months, shedding virtually half of its worth within the first quarter of 2025. Together with the remainder of the altcoin market, ETH bled severely following the announcement of latest commerce tariffs by United States President Donald Trump.

Curiously, the suspension of those commerce tariffs didn’t have as a lot of a bullish impact on the “king of the altcoins,” which didn’t maintain above the $1,600 degree up to now day. This lack of ability of the Ethereum worth to mount a convincing restoration emphasizes the token’s struggles in current months.

Is The Value Backside In For ETH?

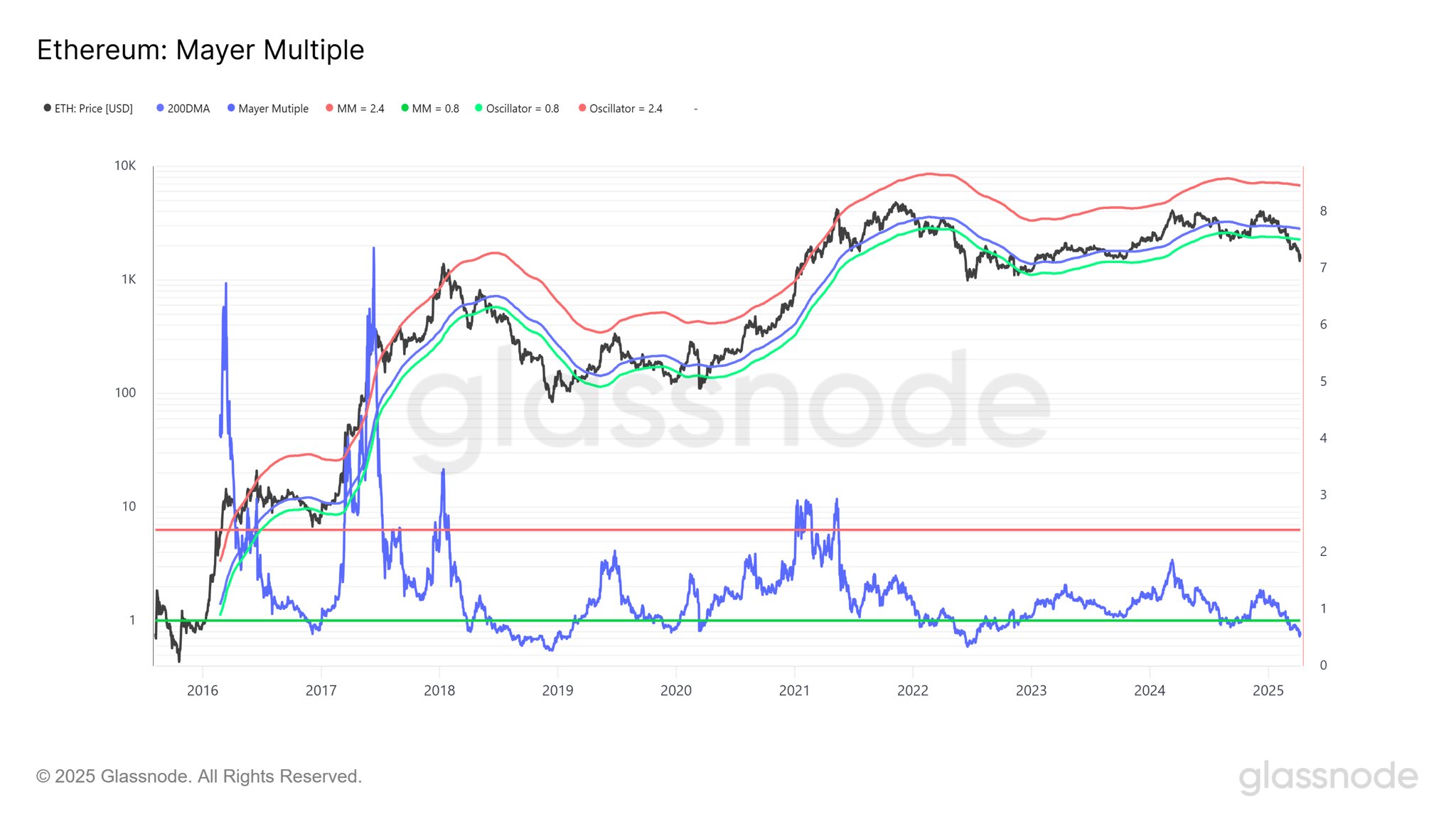

Crypto analyst with the pseudonym Cryptollica shared contemporary on-chain perception in a submit on the X platform, suggesting that the worth of Ethereum could possibly be at a pivotal level of bullish reversal. This projection is predicated on the Mayer A number of indicator, which measures the ratio between an asset worth and its 200-day transferring common (MA).

The 200-day MA represents the long-term common worth of an asset; and the Mayer A number of estimates the space of the asset’s precise worth from this common worth to find out overbought and oversold circumstances. The metric signifies an overheating market situation and a possible worth high when its worth is above the two.4 mark.

On the flip aspect, a Mayer A number of worth under 0.8 alerts an oversold situation and that the asset’s worth may need hit a backside. In the end, the metric is used to find out macro bull or bear his when analyzing cyclical worth modifications.

Supply: @cryptollica on X

In accordance with the Glassnode chart shared by Cryptollica, the Ethereum Mayer A number of lately slipped beneath the 0.8 mark. This means that the worth of ETH is likely to be bottoming out, with a possible bullish reversal on the horizon.

Furthermore, the final time the Mayer A number of indicator fell to this low in 2022, the worth of Ethereum rebounded to above the $4,000 mark — the worth excessive within the present cycle. If historical past repeats itself, the second-largest cryptocurrency might embark on one other journey to $4,000 — an over 150% rally from the present worth level — over the approaching months.

Ethereum Value At A Look

As of this writing, the worth of ETH stands at round $1,550, reflecting a mere 1% leap up to now 24 hours. Regardless of the marginally bettering market sentiment, the altcoin’s efficiency on the weekly timeframe has remained virtually the identical. In accordance with CoinGecko information, the Ethereum worth is down by almost 15% up to now seven days.

The worth of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.