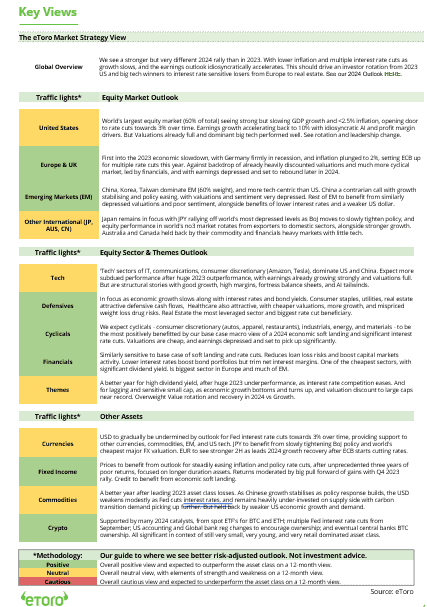

President Trump’s ‘America First’ strategy is shaking up international markets, however the UK inventory market isn’t flinching. Positive, there have been a number of wobbles up to now ten days however the FTSE 100 and FTSE All-Share have stayed resilient. So, what’s driving the latest efficiency, and might it sustain? Let’s dig in.

The UK market is defying sceptics:

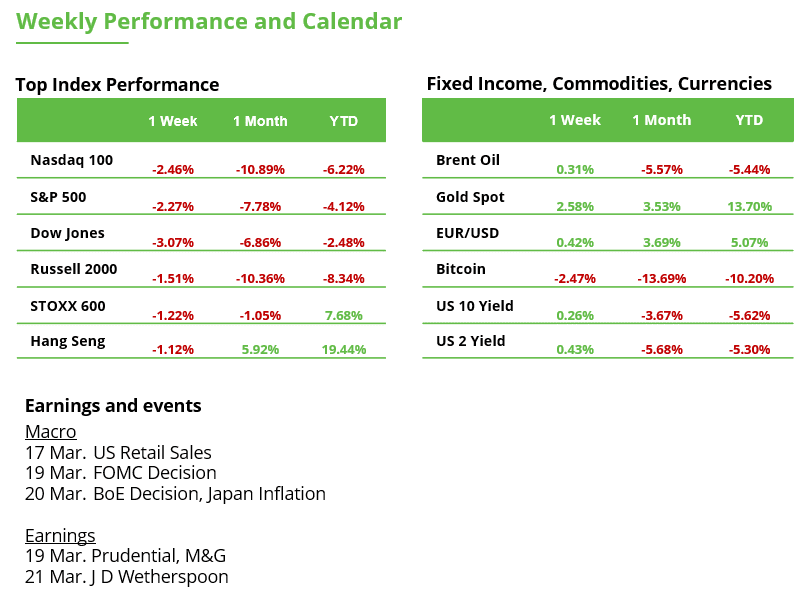

The FTSE 100 is up 6.6% YTD, beating the S&P 500 (-3.9%) and defying years of underperformance.

The Euro Stoxx 50 (+10.7%) is even stronger, as international traders rotate into worth shares and away from overpriced US mega-cap tech.

In the meantime, the FTSE 250 (UK-focused shares) isn’t enjoying alongside, caught in mid-cap limbo because the UK economic system struggles. However for those who’re a long-term investor, a few of its unloved shares is perhaps hidden gems ready to shine.

FTSE 100 loves its “outdated economic system” shares:

Banks, oil, and mining shares are holding agency – due to excessive charges, dear crude, and value-hunting traders.

Lloyds and Commonplace Chartered popped as traders piled into financials, whereas BP and Shell stayed robust, shrugging off vitality worth swings.

Not-so-hot sectors, now:

Client shares are struggling. Price-of-living pressures imply UK consumers aren’t splurging on luxurious sneakers.

Actual property took a success. Greater-for-longer charges = robust instances for property shares. Savills a notable case and not too long ago dropped after failing to current a transparent turnaround plan.

Shares within the highlight:

NatWest fell because the UK authorities offered extra shares. Traders don’t love “pressured” promoting, however this can be a step towards full privatization.

Assura (healthcare property enterprise) jumped on takeover buzz. Personal fairness loves low cost UK belongings – count on extra M&A strikes.

Gold miners shined as gold hit an all-time excessive. Tariff fears + safe-haven demand = traders speeding into valuable metals.

The macro setup is essential – watch the BoE.

The Financial institution of England meets on March 20. Will they maintain charges at 4.5% or trace at cuts? Inflation ticked as much as 3%, which might delay fee cuts.

If the BoE eases later in 2025, rate-sensitive shares (actual property, shopper) might rebound.

Bottomline: Worth Play or Worth Lure?

Low cost, however for a way lengthy?

The FTSE 100 trades at ~12x ahead earnings – beneath its long-term common (14x) and cheaper than each the S&P 500 (21x) and Europe (15x). Whereas it is probably not a deep cut price, its relative low cost suggests room for a re-rating as international traders take discover.

Personal fairness and international traders are already snapping up undervalued UK belongings.

Dividends nonetheless rule.

The FTSE 100’s 3.8% dividend yield dwarfs the S&P 500’s 1.4% – providing regular earnings even when progress takes time.

Endurance pays.

Warren Buffett’s warning: Markets wrestle once they overlook the basics—earnings have traditionally grown ~7% per 12 months, on common. When markets overshoot this tempo, they’re basically borrowing returns from the long run. The US has front-loaded years of beneficial properties, whereas the UK has quietly caught to its long-term tempo. That will make UK a greater risk-reward guess for long-term traders.

Tariffs as a Boomerang? Trump’s Commerce Conflict Weighs on U.S. Company Earnings

Issues are rising, however panic stays absent: Extra S&P 500 firms are mentioning “tariffs” of their earnings calls than at any time within the final 10 years. This highlights how a lot commerce uncertainties threaten company earnings and market stability. On the identical time, the variety of firms mentioning “recession” has dropped to its lowest degree in over 5 years, signaling that fears of an financial downturn stay low.

Tariff uncertainty clouds the outlook: S&P 500 firms are anticipated to report 7.3% YoY earnings progress in Q1 2025 (see chart), a pointy revision down from 11.6% projected on the finish of 2024. Income progress is estimated at 4.3% YoY. Trump and uncertainty over new tariffs are weighing on expectations, however the market has already partially priced in these dangers. Tariffs alone received’t crash the economic system, however they may speed up the slowdown within the U.S.

4 sectors hit hardest: The 4 sectors with the very best mentions of “tariffs” in This autumn earnings calls—Supplies, Industrials, Client Discretionary, and Client Staples—are additionally those which have seen the most important cuts in earnings expectations for Q1 2025. This means that tariffs will not be only a speaking level however are instantly impacting company earnings.

Earnings progress doesn’t at all times imply inventory beneficial properties: Eight of the eleven S&P 500 sectors are anticipated to report earnings progress in Q1 2025, led by Well being Care and Data Expertise. Nonetheless, greater earnings don’t mechanically translate to rising inventory costs—valuations and market tendencies play an important position. Whereas Well being Care has gained 4.5% YTD, Data Expertise is down 10.0%, reflecting a market shift towards defensive and cyclical sectors. Well being Care, Vitality, Utilities and Actual Property have been the strongest performers this 12 months.

Bottomline: Whether or not the four-week dropping streak is an overreaction or if the correction continues will develop into clear within the coming days. Traditionally, corrections happen virtually yearly, typically creating new alternatives. Nonetheless, traders stay at nighttime relating to Trump’s commerce insurance policies and are in search of readability. Let’s see whether or not the Fed can calm the markets considerably on Wednesday – or set off new turbulence.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.