The most effective crypto copy buying and selling platforms to make use of in 2025 are Binance, MEXC, Bybit, PrimeXBT, eToro, OKX, and Coinbase. These exchanges and brokers permit merchants, particularly rookies, to study and earn earnings by copying the trades of skilled merchants.

Totally different crypto copy buying and selling platforms supply completely different options and buying and selling merchandise, so to resolve on one of the best copy buying and selling platforms, we reviewed varied crypto exchanges and brokers and in contrast them primarily based on their charges, person interface, commerce execution pace, safety, and accessibility.

On this article, we’ll cowl the seven finest crypto copy buying and selling exchanges, what’s copy buying and selling in crypto? What are one of the best copy buying and selling platforms to make use of? And what are the varieties of crypto copy buying and selling platforms?

Moreover, we’ll present you ways to decide on a crypto copy buying and selling platform, find out how to begin crypto copy buying and selling, how to decide on one of the best crypto merchants to comply with, and reply the query: Is crypto copy buying and selling worthwhile? However earlier than we proceed, here’s a comparability of one of the best crypto copy buying and selling platforms in 2025, utilizing their charges, supported markets, and key options.

Copy Buying and selling FeesCommissionSupported CryptocurrenciesBinance0.10% maker/taker10%400+MEXC0.00% maker and 0.05% taker10%2,700+Bybit0.10% maker/taker10 – 15%650+PrimeXBT0.05% per commerce.

1% month-to-month administration charge

20%40+OKX0.08% maker charge and 0.1% taker charge.8-10%350CoinbaseBeginning at $0.99–240

1. Binance

Binance is a centralized crypto change providing merchants an intensive choice of services for brand new and skilled merchants, together with copy buying and selling instruments. Binance Copy Buying and selling is a characteristic that enables customers to robotically replicate the trades of skilled merchants, making it simpler for newcomers to take part within the cryptocurrency market.

Binance Copy Buying and selling professionals are:

Helps 100+ Spot Buying and selling Pairs and 100+ USD-M Futures Contracts: Binance helps over 100 tradable pairs, permitting copy merchants to pick the pairs they wish to commerce. Excessive Liquidity: Binance has excessive liquidity, permitting quicker execution of trades at extra secure costs. Merchants can enter or exit positions rapidly with minimal slippage.A number of Buying and selling Choices for Copy Merchants: Binance presents varied buying and selling choices, together with futures and spot buying and selling. Merchants can resolve whether or not to repeat merely purchase and promote orders on the spot market or commerce with leverage.

Binance Copy Buying and selling cons are:

Restricted Availability: Whereas Binance presents its services to merchants in over 100 nations, some copy buying and selling merchandise could also be restricted in some areas.Small Quantity Trades Might Be Costly: Binance doesn’t cost further charges for copy trades; nevertheless, for small quantity merchants, the usual value of 0.1% and 10% revenue share provided to skilled merchants may minimize into earnings.

Copy Buying and selling Charges on Binance:

Binance doesn’t cost copy merchants further charges. Nonetheless, lead merchants earn a ten% revenue share and a ten% fee on charges from their followers. You’ll be able to make investments a minimal of 10 USDT in copy buying and selling, however it could possibly go as excessive as 10,000 USDT.

Key Options of Binance Copy Buying and selling:

Spot and Futures Copy Buying and selling: The change permits customers to robotically replicate the trades of skilled merchants in spot and futures markets. Merchants can amplify their place with leverage within the futures market or go for spot buying and selling, which is extra simple.Select Your Leverage: Binance merchants can select their desired leverage when copying trades. You’ll be able to mirror the grasp dealer’s leverage or accept a hard and fast leverage starting from 1x to 10x.

2. MEXC

MEXC is a high-performance buying and selling engine that teams grasp merchants into varied classes to assist copy merchants select who to repeat from primarily based on their buying and selling targets. You’ll be able to choose from the top-performing merchants primarily based on general rating, highest ROI (return on funding), highest PNL (revenue and loss), most followers, and new lead merchants.

MEXC Copy Buying and selling professionals are:

Huge Collection of Merchants: MEXC has many profitable merchants that customers can comply with. The change additionally makes it straightforward for brand new merchants to resolve who to comply with via their detailed grouping {of professional} merchants.Customizable Preferences: When following an skilled dealer to open a place, you possibly can set parameters on your trades primarily based in your danger tolerance degree, such because the copy commerce mode, margin, and order placement methodology.Pre-vetted Lead Merchants: MEXC fastidiously critiques and approves all lead merchants to make sure they’re skilled and have spectacular buying and selling portfolios.

MEXC Copy Buying and selling cons are:

Lack of Social Buying and selling Group: MEXC change doesn’t have a social group the place traders can ask questions, be a part of discussions, and share insights, concepts, or buying and selling methods.Not Obtainable for US Merchants: MEXC doesn’t supply copy buying and selling companies to merchants in the USA.

Copy Buying and selling Charges on MEXC

MEXC fees copy merchants common buying and selling charges. It is without doubt one of the prime zero-fee crypto exchanges, with maker charges beginning at 0.00% for makers and 0.05% for takers.

Key Options of MEXC Copy Buying and selling:

Copy Commerce Customers Can Take part in Futures M-Day: The buying and selling quantity of Copy Commerce customers is counted for Futures M-Day, and customers can get the corresponding variety of tickets primarily based on this quantity. The extra quantity you generate via copy buying and selling, the extra tickets you earn, rising your possibilities of profitable rewards within the Futures M-Day occasion.Auto Margin Mode: Followers can now activate auto margin addition when enhancing their Copy Commerce orders. This characteristic helps scale back liquidation danger by robotically including margin when wanted. Earlier than enabling it, be sure to totally perceive how automated buying and selling with this characteristic works.

3. ByBit

Bybit is the primary crypto change to supply copy buying and selling for gold and FX pairs. The Copy Buying and selling Gold & FX characteristic permits customers to copy skilled merchants’ methods immediately inside their MetaTrader 5 (MT5) accounts, utilizing USDT as collateral.

Bybit Copy Buying and selling professionals are:

New Consumer Bonus: Bybit presents new copy commerce customers a duplicate buying and selling voucher to get better as much as 100 USDT on their first copy commerce loss.Consumer-Pleasant Interface: Bybit’s MT5 platform for Gold and FX pairs presents an easy-to-use interface with options and instruments to assist merchants of all ranges revenue from copy buying and selling.Merchants Can Select Their Copy Mode: Merchants can customise their copy mode and arrange their settings by mirroring the grasp dealer’s funding methods, altering the funding quantity, deciding on gadgets to repeat, or setting different settings.

Bybit Copy Buying and selling cons are:

Revenue Sharing is Unpredictable: Whereas the revenue for Copy Buying and selling Basic for grasp merchants is between 10% and 15%, the revenue for Gold and FX pairs could be unpredictable since they’re calculated otherwise.Not Obtainable for US Merchants: Bybit doesn’t supply its merchandise and replica buying and selling companies to merchants in the USA.

Copy Buying and selling Charges on Bybit

The buying and selling and funding charges are the identical as these utilized when buying and selling on Bybit’s Derivatives platform. No additional charges shall be charged.

Alternatively, the charges for Copy Commerce Gold & FX accounts are charged per lot and range relying on the kind of asset you might be buying and selling: FX and Gold – $6 per lot, Market Indices – $3 per lot.

Key Options of Bybit Copy Buying and selling

Bybit Copy Buying and selling Basic: Earlier than Bybit launched copy buying and selling for Gold, FX, and indices pairs, it provided and nonetheless presents derivatives buying and selling via the Copy Buying and selling Basic interface. Merchants can use both of those settings when copying trades on Basic: SyncMaster, parameters setting, and different settings. When SyncMaster is on, merchants mirror the methods of the grasp dealer with out modifying any settings. For parameter settings, you possibly can change the funding quantity and the account funds from which it will likely be taken. You’ll be able to choose what to repeat, equivalent to USDT perpetual trades or Buying and selling Bot.Gold & FX Copy Buying and selling: Bybit launched a brand new product, Copy Commerce Gold & FX, for customers to commerce Gold, FX pairs, and market indices. This product permits copy merchants to revenue from established and liquid gold and FX markets along with all the same old advantages of copy buying and selling. To hitch, you could arrange an MT5 Copy Commerce Gold & FX Account on Bybit. This account simplifies the complete copy buying and selling course of by providing superior choices for thorough market evaluation, together with automated buying and selling and 90+ technical indicators.

4. PrimeXBT

PrimeXBT is a multi-asset cryptocurrency buying and selling platform providing copy buying and selling, futures buying and selling, and contract for-difference (CFD) buying and selling for shares indices, foreign exchange, commodities, and extra. The PrimeXBT copy buying and selling product additionally options membership plans, which give subscribers with further advantages, together with elevated revenue share, lowered buying and selling charges, and far more.

PrimeXBT Copy Buying and selling professionals are:

Demo Account: PrimeXBT presents demo accounts with simulated buying and selling environments for merchants to apply varied buying and selling methods and enhance their buying and selling skills earlier than investing cash.Excessive Liquidity: The change has excessive liquidity, which permits copy merchants to open and shut positions with minimal slippage and reap the benefits of risky markets and different market situations.Various Markets: Not like different crypto exchanges that focus on crypto futures contracts solely, PrimeXBT presents copy buying and selling throughout varied markets, together with foreign exchange, cryptocurrencies, inventory indices, and commodities.

PrimeXBT Copy Buying and selling cons are:

Restricted Buying and selling Choices: PrimeXBT doesn’t assist spot, margin buying and selling, choices, or social buying and selling. So, contemplate alternate options if you’re in search of spot copy buying and selling platforms.May Not Be Appropriate for Freshmen: Whereas the aim is for brand new customers to repeat profitable merchants’ trades, the change may not be the best choice for merchants new to buying and selling CFDs, together with shares, indices, FX, and commodities.

Copy Buying and selling Charges on PrimeXBT

PrimeXBT fees a profit-sharing charge of as much as 20%, which is increased than different exchanges. Moreover, commonplace cryptocurrency buying and selling charges of 0.05% per commerce are charged. Nonetheless, the excessive profit-sharing charge might deter some customers.

Key Options of PrimeXBT Copy Buying and selling

Predictable Charges: PrimeXBT fees a flat 1% month-to-month administration charge primarily based on the whole copied capital, no matter revenue or loss. So, when you allocate $5,000 to copied trades, you’ll pay $50 monthly, no matter revenue or loss.Slender Spreads: PrimeXBT maintains low spreads, decreasing prices for frequent merchants.Partnership With Covesting: Although the change gives derivatives buying and selling and margin copy buying and selling, it additionally companions with Covesting, a social and replica buying and selling platform that enables customers to repeat commerce immediately on the change.

5. eToro

eToro is without doubt one of the finest buying and selling platforms that gives a variety of monetary devices for copy buying and selling, together with shares, ETFs, cryptocurrencies, commodities, and foreign exchange. It’s also a social buying and selling platform the place customers can share insights, change concepts, ask questions, be a part of discussions, and extra.

eToro Copy Buying and selling professionals are:

Consumer pleasant Interface: eToro has a person pleasant interface, making it appropriate for brand new and skilled merchants. As well as, while you copy a dealer, your portfolio is structured equally to theirs, together with the proportion of belongings and any ongoing trades.Respected Dealer with Pre-vetted Merchants: Each grasp dealer on eToro has a profile with an actual photograph. If you click on on a dealer’s profile, you possibly can see their title and think about posts. Merchants have a weblog part the place they share market information, and also you work together with their posts, similar to on conventional social networks.Various Belongings: eToro helps varied asset courses, together with shares, foreign exchange, indices, and cryptocurrencies.

eToro Copy Buying and selling cons are:

Inactivity Price: eToro fees a $10 month-to-month inactivity charge after one 12 months.Excessive Charges: The dealer has increased charges in comparison with another platforms.Restricted Customization: You’ll be able to copy as much as 100 merchants concurrently, however eToro presents restricted customization choices.

Copy Buying and selling Charges on eToro

eToro fees no further charges for copy buying and selling. Lead merchants positions replicated through eToro’s proprietary CopyTrader incur the identical swap charges and spreads as common trades. Nonetheless, merchants should deposit no less than $200 to get began, with a minimal quantity of $1 per single copied place.

Key Options of eToro Copy Buying and selling

Demo Account: For merchants who wish to strive eToro’s CopyTrader characteristic earlier than investing their cash, the change gives a demo account loaded with $100,000 in digital cash. Merchants can use this simulated buying and selling surroundings to apply, take a look at their methods, and sharpen their buying and selling abilities to keep away from dropping cash quickly.Instructional Sources: eToro presents tons of articles, video tutorials, and different sources for merchants to study extra about copy buying and selling and selecting a dealer that matches their buying and selling targets.Social Buying and selling Group: The dealer additionally has a big group of merchants and traders (20+ million) that new merchants can join with, share concepts, and study from different skilled traders.

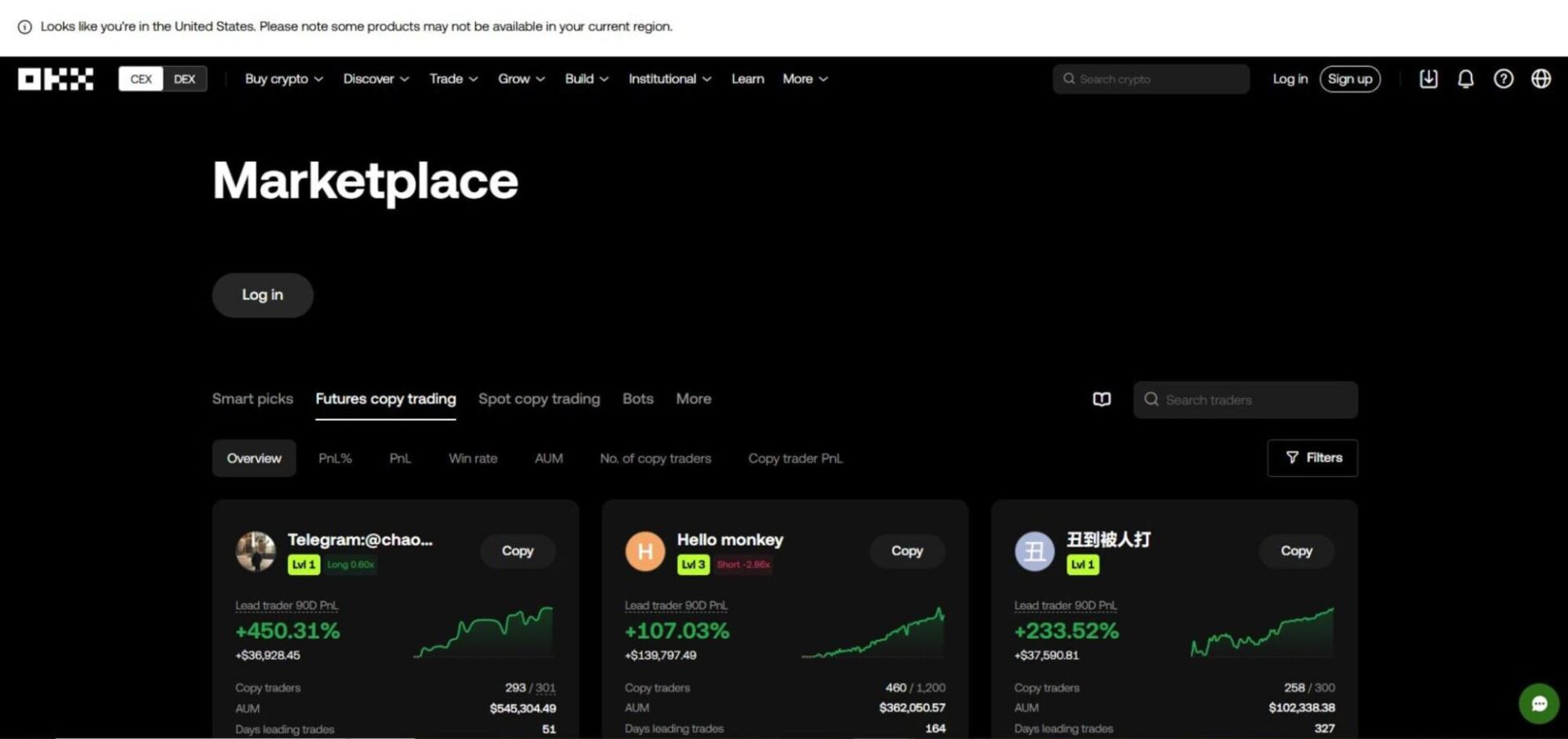

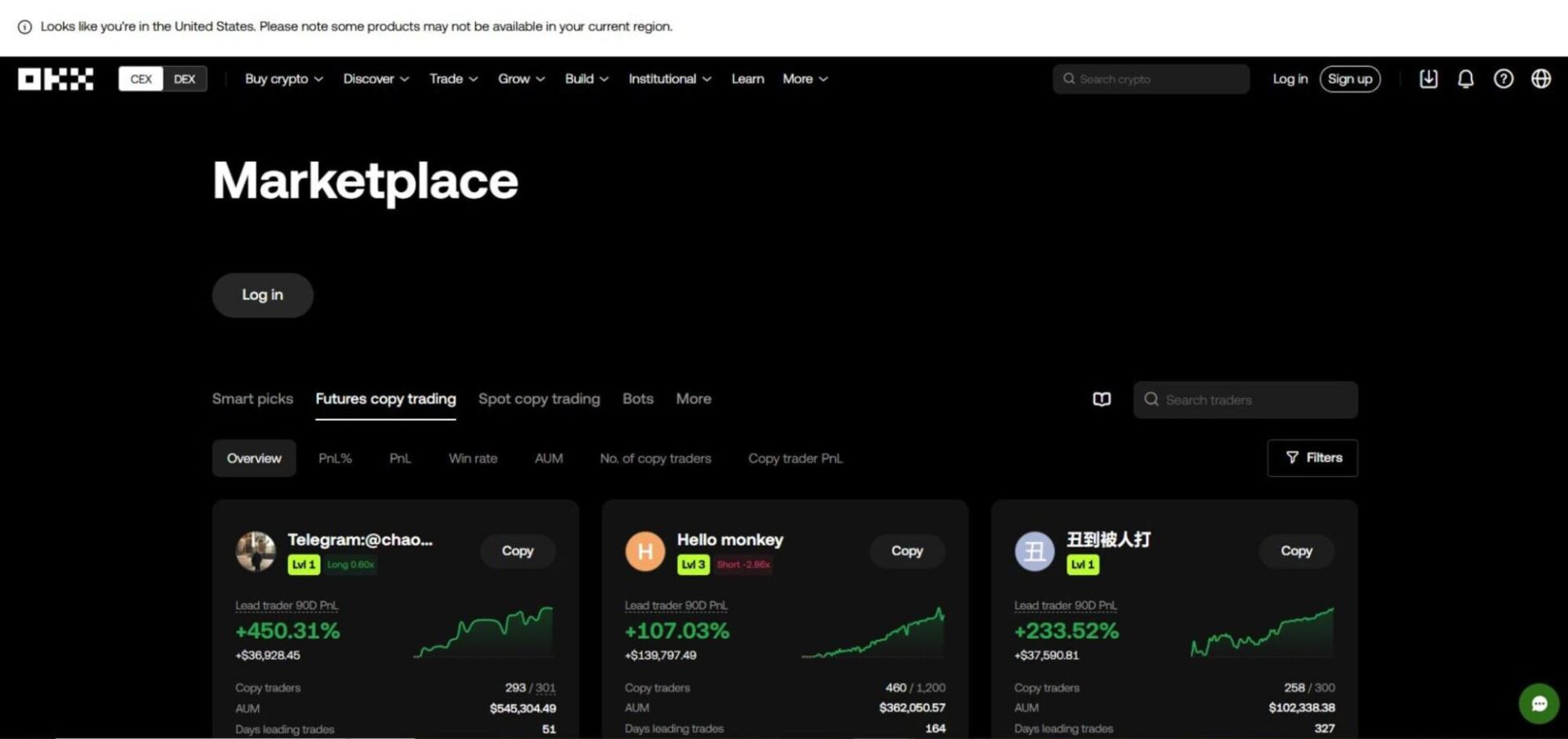

6. OKX

OKX is a cryptocurrency change that gives a user-friendly copy buying and selling platform the place customers can choose and replicate the trades of skilled traders. With OKX copy buying and selling, you possibly can analyze the previous efficiency of merchants, assess their danger ranges, and study and replica commerce throughout a number of buying and selling pairs.

OKX Copy Buying and selling professionals are:

Complete Statistics of Lead Merchants: OKX gives detailed insights into the efficiency of prime merchants, permitting customers to research their success charges, historic earnings, danger ranges, and crypto buying and selling methods.OKX presents 114 pairs for copy merchants to discover.24/7 Buyer Assist: OKX presents 24/7 assist, and so they have an open-door coverage of listening to their merchants’ options and suggestions.

OKX Copy Buying and selling cons are:

Not out there to merchants within the US, Bulgaria, Singapore, Bolivia, Malaysia, Malta, Canada, and Hong KongCopiers can solely replicate as much as 10 trades in Open/Shut Place mode.

Copy Buying and selling Charges on OKX:

Copy buying and selling charges on OKX are the identical because the common charges on your buying and selling tier. No different transaction charges are charged, however you’ll pay an 8-10% revenue share.

Key Options of OKX Copy Buying and selling:

Sensible Sync: The Sensible Sync robotically copies the lead merchants positions, leverage, and margin to your out there funds.Spot and Futures Copy Buying and selling: OKX permits you to robotically replicate the trades of skilled merchants in spot and futures markets. You’ll be able to amplify your place with leverage within the futures market or merely purchase and promote on the spot market.Customized Copy: For those who don’t wish to use Sensible Sync, you possibly can customise your commerce parameters throughout leverage and place measurement per commerce.

7. Coinbase

Coinbase is a cryptocurrency platform that gives customers among the finest and most user-friendly copy buying and selling crypto companies. The change permits merchants to copy the methods of extra skilled merchants and earn earnings with no need intensive market data via Copycat Finance.

Coinbase Copy Buying and selling professionals are:

Simple to Use: The clear and user-friendly interface permits rookies and skilled merchants to purchase and promote crypto belongings and replica the trades of skilled merchants.Sources: Entry a variety of instructional sources, serving to customers study cryptocurrencies and rewarding them with crypto.

Coinbase Copy Buying and selling cons are:

Low Leverage: It presents low leverage in comparison with different crypto futures exchanges on this checklist.Excessive Charges: Coinbase’s charges are usually increased in comparison with some rivals, particularly for small transactionsCoinbase doesn’t supply copy buying and selling immediately.

Copy Buying and selling Charges on Coinbase:

Range primarily based on transaction measurement and cost methodology. For instance, transactions beneath $10 incur a $0.99 charge, whereas these between $10 and $25 value $1.49. These charges might go increased as your transaction measurement will increase.

Key Options of Coinbase Copy Buying and selling:

Coinbase Earn: Coinbase presents studying instruments that assist customers perceive the basics of the crypto. The change rewards merchants with cryptocurrencies for finishing instructional modules. This characteristic makes Coinbase a great crypto buying and selling platform and an important useful resource for private progress within the crypto area.Strong Safety Options: The change implements sturdy security measures, together with two-factor authentication and chilly storage for 98% of person funds. As well as, Coinbase is extremely compliant, making its companies out there to merchants in varied nations, together with the USA.

What’s Copy Buying and selling in Crypto?

Copy buying and selling in crypto is a method that enables a dealer to robotically or manually replicate one other dealer’s positions. This instrument is ideal for rookies, merchants who shouldn’t have time to provoke their trades from the bottom up, and skilled merchants looking for to discover different merchandise like indices, commodities, FX, gold, and crypto.

Copy buying and selling platforms can help you select between hundreds of skilled merchants and comply with them, and their trades shall be synced to yours, and it’ll start to run on autopilot. Relying in your platform, you would mirror the a number of merchants’ precise strikes or make customized adjustments to how a lot cash you wish to make investments, leverage for futures buying and selling, and place measurement.

What Are the Greatest Crypto Copy Buying and selling Platforms to Use?

The most effective crypto copy buying and selling platforms are Binance, MEXC, Bybit, PrimeXBT, eToro, OKX, and Coinbase. When you comply with a dealer and replica them, each commerce they execute shall be mirrored in your account in actual time. When the lead dealer closes a commerce, it additionally closes for the follower.

Since a lead dealer’s methods have a lot influence on whether or not you acquire revenue or lose your capital, it’s important to do your personal analysis as a result of every platform has its distinctive options, advantages, copy commerce merchandise, and modes it helps.

What Are the Forms of Crypto Copy Buying and selling Platforms?

The varieties of crypto copy buying and selling platforms are broker-integrated copy buying and selling platforms, third-party copy buying and selling platforms, and social buying and selling platforms. Here’s a detailed overview of how every of those copy buying and selling platform varieties works.

1. Dealer-Built-in Copy Buying and selling Platforms

A broker-integrated copy buying and selling platform permits merchants, particularly rookies or these with restricted time, to robotically replicate the trades of extra skilled merchants inside a dealer’s surroundings. For instance, let’s say you enroll with a dealer that gives built-in copy buying and selling, equivalent to eToro.

As a substitute of manually analyzing the markets, putting trades, and managing danger, you possibly can browse a listing of skilled merchants on eToro and choose and replica the trades of a number of merchants that align along with your targets.

2. Third-Social gathering Copy Buying and selling Platforms

Third-party copy buying and selling platforms additionally permit merchants to repeat the trades of skilled traders, however as a substitute of being immediately built-in into an change infrastructure, it operates as an unbiased service that connects a number of brokers and crypto exchanges. An instance of a third-party copy buying and selling platform is Copycat Finance, a DeFi-based platform that copies the buying and selling portfolios of skilled merchants.

3. Social Buying and selling Platforms

Social buying and selling platforms take copy buying and selling a step additional by utilizing options that permit customers to work together, share insights, and focus on methods with different merchants. So, as a substitute of passively copying trades, customers can have interaction with professional merchants, ask questions, and change market concepts.

One good instance of a dealer that doubles as a social buying and selling platform is eToro. eToro presents social buying and selling options the place customers can comply with a number of merchants, learn their market analyses, and even focus on ongoing trades with different group members. The thought is to create an interactive area the place merchants can study from one another slightly than merely copy trades.

Find out how to Select a Crypto Copy Buying and selling Platform?

To decide on a crypto copy buying and selling platform, contemplate the platform’s copy buying and selling charges, person interface & commerce execution pace, safety, and accessibility.

Copy Buying and selling Charges

Understanding how a lot an change fees for transaction charges and the way a lot you might be prepared to pay is important. Examine the prices of various crypto copy buying and selling platforms to make sure you can commerce with low charges. Some platforms cost aggressive buying and selling charges and supply skilled merchants 10% – 15% of their earnings, whereas others take as much as 25%.

So, make sure you totally perceive the platform’s charge construction, revenue sharing, unfold charge, and month-to-month fees, if there are any. It’s advisable to additionally evaluate the prices of a number of exchanges, and a great place to begin could be this complete checklist of the finest zero charge crypto exchanges.

Consumer Interface and Commerce Execution Pace

You’ll be managing a number of trades directly, and although the trades you copy are automated, you’ll need to handle your portfolio and discover different merchandise on the platform you select. So, search for platforms with easy interfaces designed to cater to rookies and skilled merchants alike.

A clean person interface is without doubt one of the first indicators of how briskly you possibly can execute trades. However moreover the interface, select a platform that gives high-speed execution, guaranteeing you make knowledgeable buying and selling selections and by no means miss out on buying and selling alternatives as a result of sluggish efficiency.

Safety

When copying trades, you need your funds and knowledge to be secure and safe. Search for crypto exchanges that implement sturdy safety measures like chilly pockets storage, two issue authentication, sturdy encryption, insurance coverage funds, and different safety measures. If you’re involved about sharing your data, you possibly can go for no-KYC exchanges like MEXC. Learn this MEXC evaluate to learn the way to commerce with out KYC.

Accessibility

Crypto copy buying and selling platforms face regulatory points in lots of nations. Nonetheless, they’re additionally capable of present companies in plenty of nations. So, search for platforms that supply copy buying and selling companies to merchants in your location, in addition to net interfaces and cell apps for buying and selling to make sure you have a trouble free buying and selling expertise.

Find out how to Begin Crypto Copy Buying and selling?

Here’s a step-by-step information on find out how to begin crypto copy buying and selling:

Select Copy Buying and selling Crypto Platform: Choose a crypto copy buying and selling software program that matches your buying and selling targets. Look out for the abovementioned components and make sure the change has every little thing you want.Set Up Your Account: Go to the platform’s web site or obtain their cell app and register by offering the mandatory particulars, together with a referral code. For those who don’t have one, try this crypto sign-up bonus article to get promo codes for varied copy buying and selling platforms and safe as much as $30,000 in sign-up bonuses, relying on the change.

Some crypto exchanges supply customers entry to numerous buying and selling options with out requiring id verification, whereas others implement strict KYC insurance policies. For those who favor to keep up privateness whereas buying and selling, try this compilation of the finest no KYC crypto exchanges. Nonetheless, if you’re comfy with KYC, you possibly can select any change that aligns along with your wants.

Deposit Funds: Fund your account utilizing the platform’s accepted cost strategies, equivalent to direct crypto deposits, financial institution transfers, or debit/bank cards, contemplating the comfort and transaction charges of every choice.Choose a Dealer to Copy: The vast majority of copy buying and selling platforms fee lead merchants primarily based on their expertise, revenue and loss inside a particular interval, and different components. So, analyze varied merchants’ efficiency, danger ranges, and buying and selling methods, and select somebody who aligns along with your targets.Set Your Copy Buying and selling Parameters: Point out how a lot capital to allocate to copying the dealer and set stop-loss orders, leverage limits, and take-profit ranges to handle danger. You’ll be able to mirror the dealer’s methods when you don’t have intensive market data.

When you execute the commerce, evaluate the efficiency of your investments and alter your settings or chosen dealer as wanted primarily based on market adjustments.

Find out how to Select the Greatest Crypto Merchants to Comply with?

To decide on one of the best crypto merchants to comply with, contemplate their consistency, buying and selling methods, profitability, danger rating, win charges, and even how they impart with their followers.

Buying and selling Fashion: Examine whether or not they favor day buying and selling, swing buying and selling, or long-term buying and selling and guarantee their buying and selling types align with what you want in a grasp dealer. As well as, take a look at the merchandise they commerce (cryptocurrencies, shares, indices, gold, FX, or commodities) and select the dealer that matches your targets.Consistency: Despite the fact that previous success doesn’t decide how effectively they commerce you copy will go, a constant buying and selling historical past over an prolonged interval will enable you to predict the out of your funding.Profitability (ROI): Examine their historic return on funding. You wish to revenue out of your funding, so it’s only proper to choose a dealer that will help you obtain that.Danger Rating: Decide your danger tolerance degree and choose a dealer who matches that. As a rule of thumb, a decrease danger ranking signifies extra secure buying and selling.Communication: Good merchants usually share their thought processes, methods, and market analyses. This transparency can assist you perceive their buying and selling selections.

These metrics will not be an assurance that your commerce shall be worthwhile, contemplating how unpredictable the crypto market could be. Nonetheless, they’re a great way to find out merchants who could make your trades worthwhile.

Is crypto copy buying and selling worthwhile?

Sure, crypto copy buying and selling is worthwhile. Nonetheless, it relies on the dealer you copy and whether or not that dealer has predicted market actions accurately. Except for that, the crypto market is extremely risky, and even merchants with constant profitability can typically lose. There are different methods to make free cash on crypto exchanges, particularly for brand new merchants.

You need to use promo codes throughout registration and earn enroll bonuses, thriller containers, and different financial rewards. As an example, if you’re utilizing MEXC or Binance for copy buying and selling, you should utilize this MEXC referral code and rise up 8,000 USDT or Binance referral code and earn as much as $100 in enroll bonus.