Bitcoin has proven a continuation to its crash over the last 24 hours. Right here’s what on-chain information says relating to whether or not a backside is shut or not.

Bitcoin NVT Golden Cross Is Now In Oversold Territory

As identified by an analyst in a CryptoQuant Quicktake publish, the Bitcoin NVT Golden Cross has witnessed a pointy decline just lately. The “Community Worth to Transactions (NVT) Ratio” refers to an on-chain indicator that measures the ratio between the market cap of Bitcoin and its transaction quantity.

When the worth of this metric is larger than 1, it means the worth of the asset (that’s, the market cap) is excessive in comparison with its skill to transact cash (the transaction quantity). Such a development can recommend BTC is overvalued.

Then again, the indicator being beneath the zero mark can indicate the cryptocurrency could also be due for a rebound to the upside as its quantity is excessive relative to its market cap.

Within the context of the present dialogue, the NVT Ratio itself isn’t of curiosity, however slightly a modified type of it often known as the NVT Golden Cross. This indicator principally compares the short-term development of the NVT Ratio in opposition to its long-term one to seek out whether or not it’s near a prime or backside.

For monitoring these tendencies, the metric makes use of the 10-day and 30-day shifting averages (MAs) of the NVT Ratio, respectively. Now, right here is the chart shared by the quant that exhibits the development within the Bitcoin NVT Golden Cross over the past couple of years:

The worth of the indicator appears to have plunged in latest days | Supply: CryptoQuant

Traditionally, there have been two zones which have held significance for the Bitcoin NVT Golden Cross. The primary of those is located above 2.2 (highlighted in crimson) and is the place the tops within the metric have typically occurred. These peaks are typically alerts of overvaluation for the cryptocurrency, so bearish motion can most likely comply with them.

Equally, the second zone, which takes place beneath -1.6 (inexperienced), is the place bottoms happen within the NVT Golden Cross. The indicator dipping into this zone has typically confirmed to be a bullish signal for the asset.

From the chart, it’s seen that the Bitcoin NVT Golden Cross has just lately seen a pointy decline because of the crash that BTC’s worth has witnessed. The metric is now contained in the bottoming zone, which suggests the coin could also be beginning to change into oversold.

To this point, the indicator’s worth has dropped to -2.4, which continues to be greater than the opposite detrimental spikes that the analyst has marked within the graph. Thus, whereas BTC could also be nearing a backside, it may nonetheless take an extra drop earlier than it’s really in.

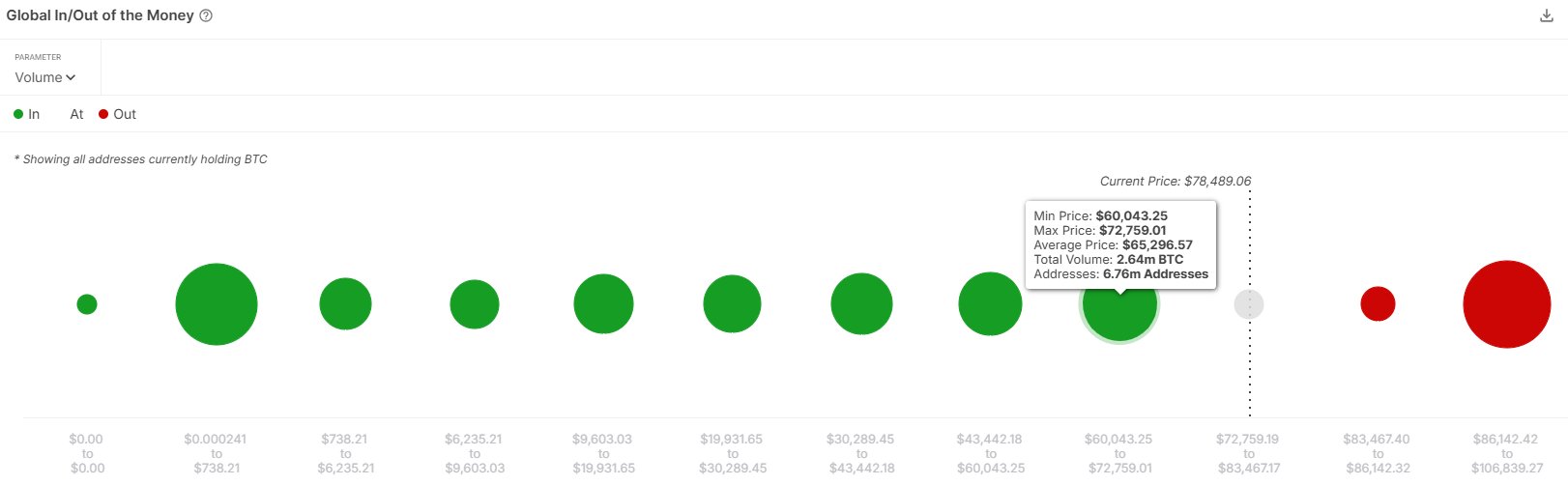

By way of on-chain help, the market intelligence platform IntoTheBlock has defined that the following related one is current beneath $72,000. As such, if BTC’s decline continues, it’s potential that the asset could discover a minimum of momentary reduction round this mark.

The associated fee foundation distribution of the BTC addresses throughout the assorted worth ranges | Supply: IntoTheBlock on X

BTC Value

Following the newest leg of the decline in the course of the previous day, Bitcoin has seen its worth drop to the $81,600 mark.

Appears to be like like the worth of the coin has been sliding down just lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com